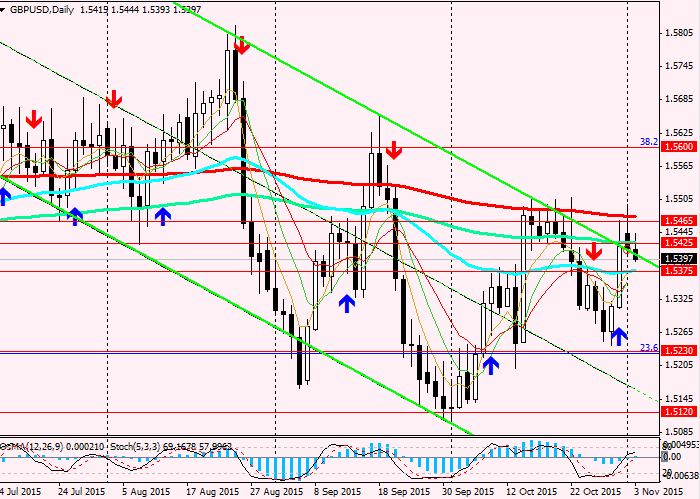

GBP / USD: in the right place at the right time. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

Released yesterday, the business activity index of purchasing managers (PMI) in the manufacturing sector by Markit Economics in the UK in October, was higher than forecast (55.5 instead of the 51.3 forecast and 51.5 in September). Good PMI data will strengthen the GBP / USD pair in one hour 60 points, but later growth potential dried up, and the pair closed the trading day in negative territory. Down a couple of deployed positive data from the US. Despite the fact that the PMI index for the US manufacturing in October fell to 50.1 from 50.2 in September, its lowest since May 2013, the data indicate increased activity, albeit at a slower than expected pace.

With the opening of the trading day the GBP / USD pair is trading within a narrow range.

The pressure on the couple now have weak data on the level of business activity in the UK construction sector 58.8, in line with expectations, and against 59.9 in September.

On Thursday scheduled the release of important data for the UK. At 12:30 (GMT + 3) the quarterly report of the Bank of England on inflation, at 14:00 - the planned volume of asset purchases and interest rate decision in the UK (the forecast - unchanged at 0.5%), and 15: 45 prospects with the explanation of monetary policy will make the Bank of England Governor Mark Carney. He knows how to find the words that have a strong influence on the movement of the pound. Therefore, caution must be exercised in making trading decisions at this time in view of increased volatility.

Further, market participants' attention will shift on Friday, when the 16:30 (GMT + 3) there are data on the state of the labor market (Non-Farm PayRolls) in October.

Released on Friday the US data (the level of consumer spending in the US in September rose by 0.1% compared with the previous month (forecast 0.2%), while the price index for personal consumption expenditures (PCE) in September decreased to 0, 1% compared with August (forecast 0.2%) and grew by only 0.2% per year) and yesterday's weak PMI data for the US manufacturing for October, point to a slowdown in the US economy in the 3rd quarter.

If NFP Friday will also be worse than forecast (180 000 new jobs), the probability of a rate hike in the US this year, much lower. The dollar will be under pressure throughout the market.

See also review and trading recommendations for the pair EUR/USD!