Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, AUDUSD, NZDUSD and GOLD

US Dollar - "Aside from the FOMC decision, the US docket has an array of indicators set for release. The top two listings are the 3Q GDP release due Thursday and PCE deflator on Friday. Growth for the world’s largest economy can equially dictate rate expectations and investor sentiment. The PCE is the central bank’s preferred inflation indicator. It’s impact will be dictated by how the Fed decision plays out. Outside its own docket, it will be important to further watch the listings of the United State’s largest counterparts. The BoJ rate decision, Eurozone inflation figures, UK GDP, Chinese plenum and RBNZ rate decision are high-profile event risks that can continue to work the indirect fundamental leverage for the Greenback."

GBPUSD - "The technical outlook for GBP/USD remains tilted to the downside as the rebound from the monthly low (1.5106) fails to spur a test of the September high (1.5658), with the pair marking multiple failed attempts to close above the 100-Day SMA (1.5490). The lack of momentum to hold above the 1.5500 handle ahead of the last week of October may highlight a near-term topping process in the exchange rate especially as the Relative Strength Index (RSI) largely preserves the bearish formation from back in May."

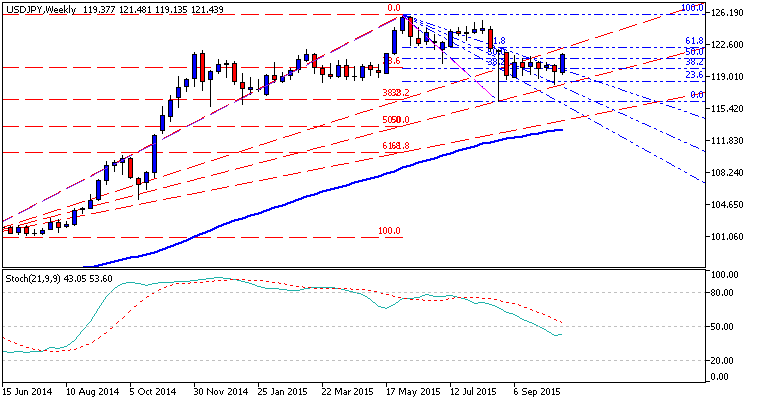

USDJPY - "Traders should keep an eye on Japanese Consumer Price Index inflation figures due the day before the Bank of Japan decision as any surprises could easily reshape the odds of fresh monetary policy action. There is comparatively little data to shift sentiment ahead of the Fed, but traders should use caution ahead of what promises to be a big week for the USD/JPY."

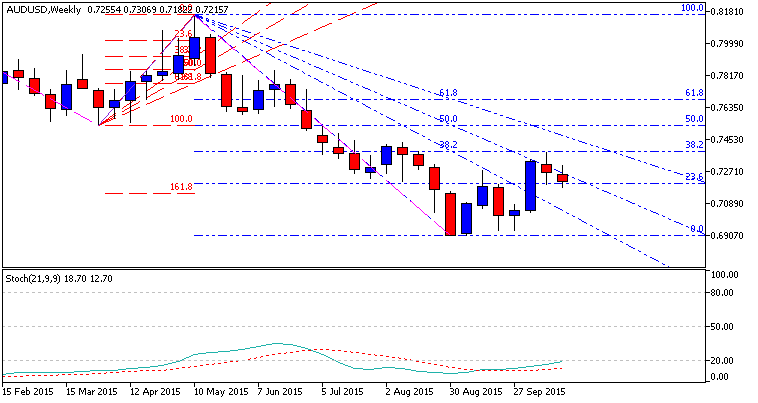

AUDUSD - "Hawkish commentary will clash with market expectations and force a readjustment, probably weighing on risk appetite and punishing the sentiment-sensitive Australian unit. A dovish lean is likely to yield the opposite result, though follow-on momentum may be capped considering this would amount to convergence with an already priced-in outlook."

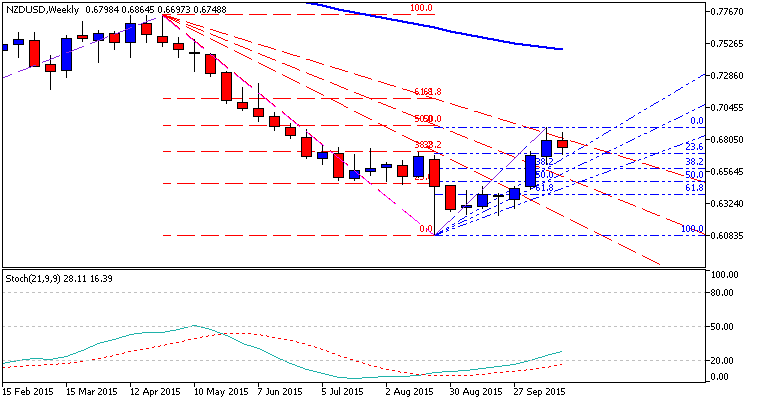

NZDUSD - "For now, the fundamental forecast in NZD/USD is neutral; and this could change to bearish with an overly-dovish tone from the RBNZ or another big move down in Chinese/Asian markets."

GOLD - "Gold reversed off the 52-week moving average at 1180 early this week with a subsequent three-day decline testing ascending slope support on Friday at ~1163. Key weekly support stands just lower at the 1151/55 region (medium-term bullish invalidation) – a break below would shift the focus lower in gold targeting confluence support down towards 1132. Topside targets are unchanged at 1189 with a key resistance confluence seen higher at 1197/98. Note that the daily momentum signature is also approaching a longer-term support trigger off the August low – look for a reaction at that mark to offer guidance heading into FOMC."