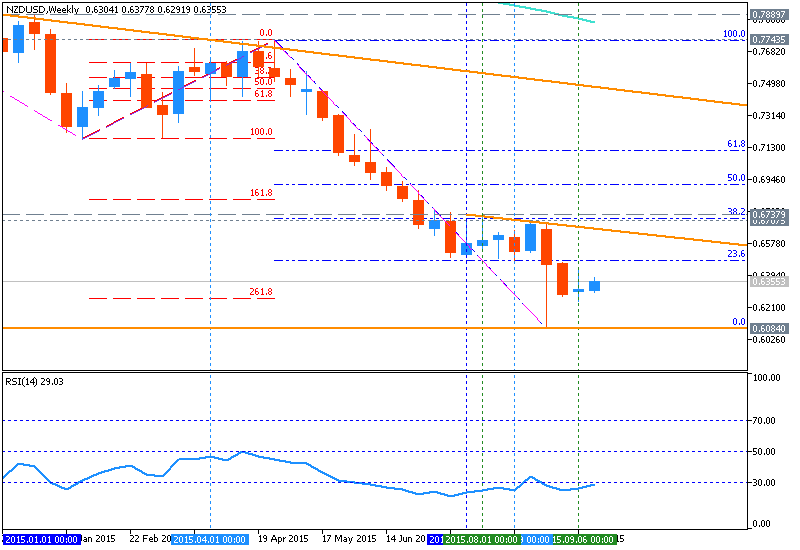

NZDUSD Price Action Analysis - descending triangle pattern to be crossed for breakdown

18 September 2015, 06:11

0

1 197

W1 price is located below 200 period SMA and 100 period SMA for the primary bearish with secondary ranging between Fibo support level at 0.6084 and 38.2% Fibo resistance level at 0.6737:

- The price is ranging between Fibo support at 0.6084 and 23.6% Fibo resistance at 0.6475;

- Descending triangle pattern was formed for the price to be broken from above to below for the bearish trend to be continuing;

- If weekly price will break 0.7552 support

level so the primary bearish will be cintinuing, otherwise the price will be ranging within the familiar levels;

- "The New Zealand Dollar continues to oscillate in a well-defined

rangeabove the 0.62 figure against its US namesake. The dominant trend

continues to look decidedly bearish, painting the current standstill as

digestion preceding the resumption of downward momentum."

- "Near-term support is in the 0.6219-44 area, marked by the 38.2% Fibonacci expansion and the September 7 low. A break below this barrier on a daily closing basis opens the door for a test of the 50% level at 0.6069. Alternatively, a move above the 23.6% Fib at 0.6406 clears the way for a challenge of the 0.6497-0.6521 zone, bracketed by the July 16 low and the 14.6% expansion."

Trend:

- W1 - ranging bearish