Technical analyst: S&P 500 will not hit new highs in 2015

According to technical analyst

and chief market technician at MKM Partners Jonathan Krinsky, you should drop any hopes for new highs in the stock market this year.

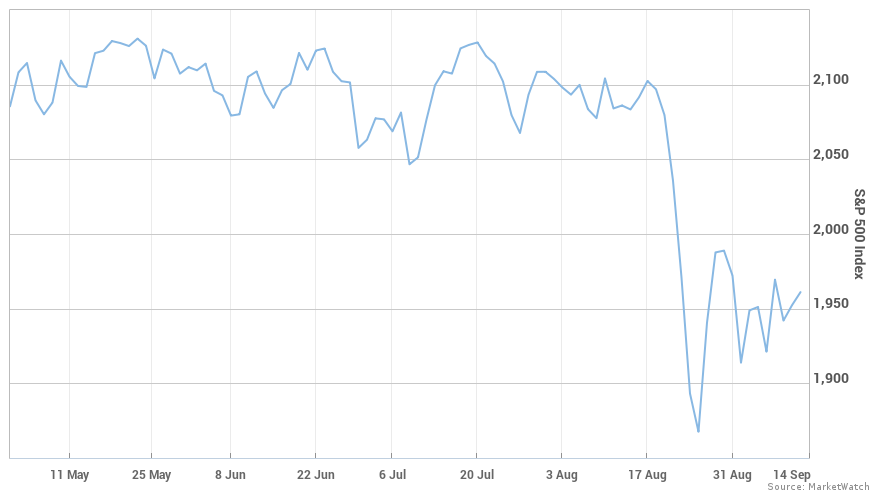

He makes such a conclusion after looking at how the S&P 500 has behaved historically after falling at least 10% from a peak.

The 10% slide is often described as a

“correction,” and the S&P recorded one last month as the benchmark tumbled more than 10% below its May record close.

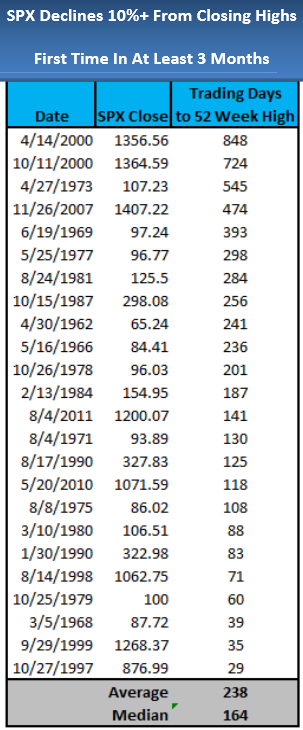

Krinsky said in a note "Don't Expect New Highs This Year" that there have been at least 24 times when the gauge passed through at least 10% correction for the first time in at least three months.

“On average, it took nearly 12 months to reach a new 52-week high, while the median recovery time was over eight months. All of this suggests that while a low may have already been created, making new highs this year would be unusual from a historical standpoint.”

Krinsky also says that “even if we are in a bottoming process, the odds of the SPX making a new high this year are less than 25% based on historical precedence.”

The analyst notes that his organization is aware that the

consensus view is “we are in a bottoming process, and the bull market is

still very much intact,” but the reality is that nobody knows for sure.

Below is a table from MKM’s Krinsky demonstrating the number of days that it is taken the S&P score a new high after a 10% correction. His data go back to the 1960s.