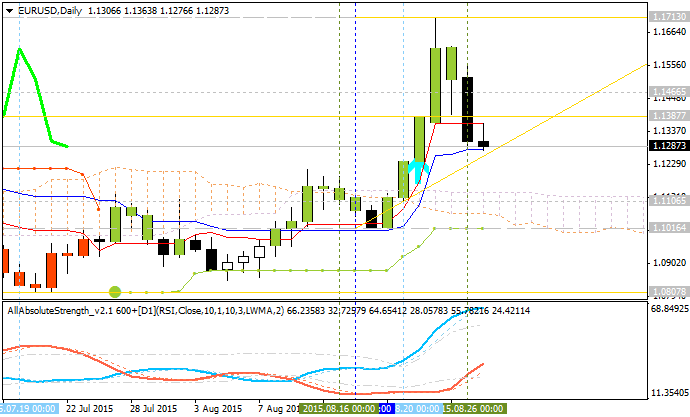

Societe Generale is suggesting to make a short with stop loss aroud 1.14 for example: "Chart-watchers saw the 1.1370-1.1385 as support, with the next major

resistance at 1.20 on long-term charts. Now that we’re back below

there’s a real risk that we drift into the old range, which I may as well describe as 1.08-1.14," SocGen's Kit Juckes stated.

Let's describe the technical situation about EUR/USD concerning the levels.

EUR/USD: daily correction started. This pair is started with secondary correction within the range of 1.1713 resistance with 1.1016 as the bearish target located below Ichimoku cloud in the bearish area of the chart. Price crossed 1.1387 support from above to below for the bearish trend to be continuing. Chinkou Span line is located above the price and showing the correction by direction. There are two variations of the price movement for today:

- bullish trend will be continuing by breaking 1.1713 resistance;

- price will be reversed to the bearish by crossing 1.1016 support.

| Resistance | Support |

|---|---|

| 1.1713 | 1.1016 |

| N/A | N/A |

I foresee the ranging bearish condition within 1.17/1.10 levels with 1.10 as the good target at week-end.