The principal week of August brings critical information readings that are certain to get the notification of Federal Reserve authorities. The Fed's July 29 arrangement articulation set a few rules for the financial information will influence strategy producers. Here's the way five things from the week may fit in with Fed considering. https://www.mql5.com/en/signals/120434#!tab=history

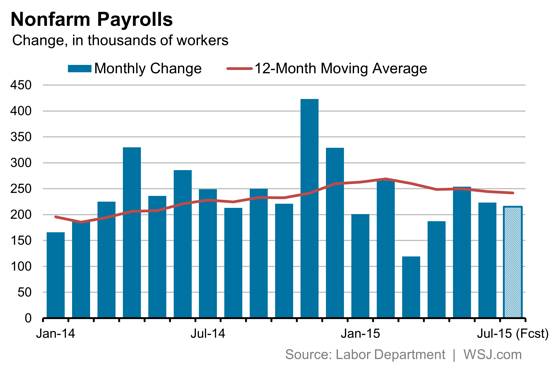

1 A Modest Gain Expected in July Payrolls

Friday's job report is the greatest Fed-related thing of the

week. In its July explanation, the Fed noticed, "The work business sector

kept on enhancing," and that the bank expected further progressed.

Financial specialists studied by The Wall Street Journal expect the economy

included another 215,000 in July, proceeding with a pattern of humble increases

seen so far this year. In the event that forecasters are correct, the pace of

employing ought to keep the Fed on track for a September rate rise.

2 No Breakout Expected in Wage Growth

Then again, Fed director Janet Yellen regularly specifies

stagnant pay development as a pointer that the work markets still have a lot of

slack in them—regardless of that the official unemployment rate is relied upon

to remain at 5.3% in July. Business analysts had trusted the July occupations

report would show normal hourly profit is breaking out of the 2% yearly groove

seen subsequent to 2010. However, a different provide details regarding job

costs, likewise done by Labor, demonstrated remuneration was level in the

second quarter. That shortcoming tosses frosty water on the pay quickening

thought.

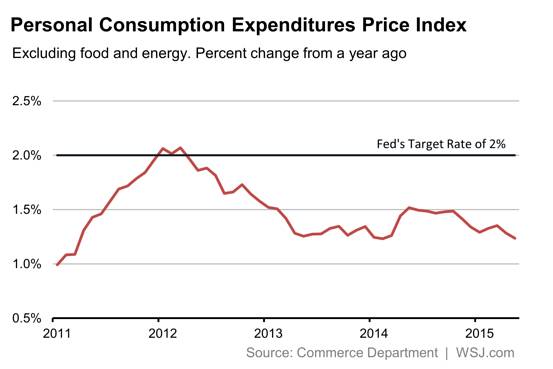

3 New Reading on Fed's Inflation Fav

The Fed is additionally worried about the to a great degree

low pace of swelling. On Monday, the Commerce Department discharges purchaser

wage and spending information. Inside of that report will be a Fed swelling top

choice: the value list for individual utilization uses barring nourishment and

vitality. Financial experts expect this center June PCE file expanded only

0.1%, or just 1.2% over the previous year. The absence of valuing force is one

reason a few business analysts and bond financial specialists think the Fed

could hold off in September.

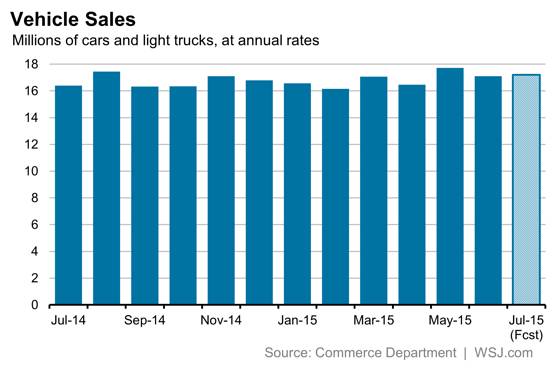

4 Car Sales Still Cruising Along?

The Fed articulation additionally noted "development in

family unit spending has been moderate." Even with modest fuel, customers

have not been in a spending mind-set—aside from concerning new autos.

Automakers write about vehicle deals Monday and financial specialists expect

new autos and light trucks sold at a yearly rate near to June's 17.1 million. A

normal drop in deals—say to underneath 16.5 million—could bring up issues about

buyers' ability to push the economy forward, as the Fed now anticipates.

5 Factory Reports Bring Export News

Monday additionally brings two reviews on processing plant action, one by Markit and an all the more broadly took after report by the Institute for Supply Management. The Fed is worried about the issues tormenting global economies and how those inconveniences are falling back on U.S. makers. Both plant reports will offer understanding into U.S. fare request. As indicated by the ISM information, producers have been attempting to gin up new remote requests th https://www.mql5.com/en/signals/120434#!tab=history