GOLD Price Action Analysis - bearish breakdown with YR S1 Pivot to be broken

22 July 2015, 03:11

0

1 284

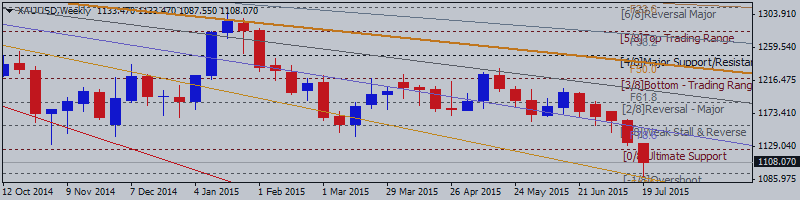

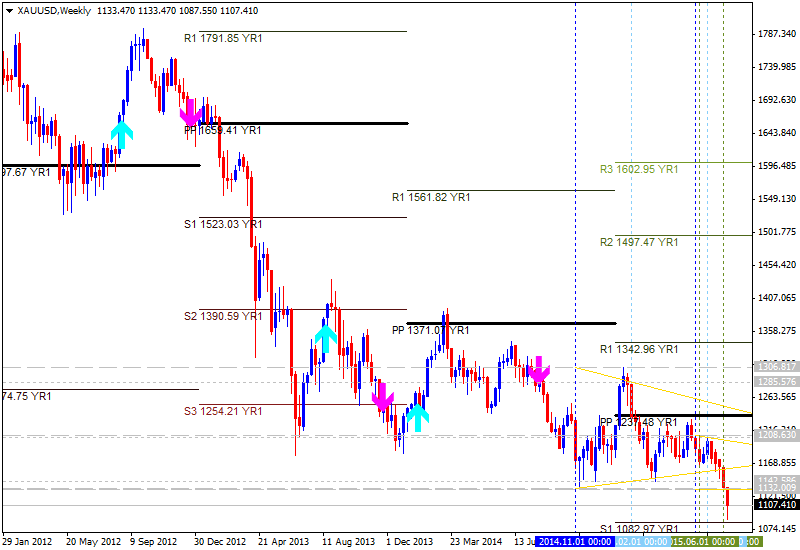

W1 price is located between Yearly Pivot level at 1237.48 and S1 Pivot at 1082.97:

- The price is on bearish market condition for ranging between Central Pivot level at 1237.48 and S1 Pivot level at 1082.97;

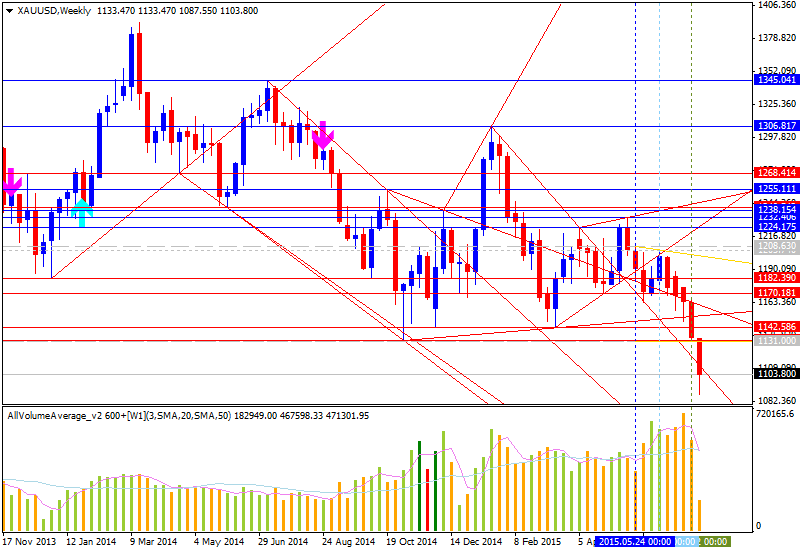

- The price broke triangle pattern on close weekly bars for the bearish trend to be continuing;

- If weekly

price will break S1 Pivot level at 1082.97

from above to below so the primary bearish market condition will be

continuing; if price will break PP YR1 at 1237.48 from

below to above so we can see the reversal of the price movement to the

primary bullish condition; otherwise the price will

be ranging within yearly Central Pivot and yearly S1 Pivot;

- “XAU/USD fell to a 5-year low. With the S&P 500 just off all-time highs and the Federal Reserve supposedly contemplating a move to policy normalization (taper tantrum was almost two years ago now) it is not that surprising to see gold doing what is doing”;

- “Under $1000 an ounce XAU/USD starts to look attractive again, but arguably XAU/EUR and XAU/JPY are much more important instruments to watch”;

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| XAU/USD | 1082.97 | 1237.48 | 1342.96 |

Trend:

- W1 - bearish

- MN1 - bearish