Gold dropped 2.4% Monday as upbeat economic data spurred fresh expectations that the Fed was on track to raise short-term interest rates later in the year. Some commodity strategists say that's has driven selling among funds skeptical the yellow metal will recover and continue its decade-long rally which ended in 2011.

Higher borrowing costs curb the appeal of commodities in general and gold in particular because the metal doesn’t pay interest or give returns like assets including bonds and equities.

“This kind of sharp drop during

early Asian hours is a strong indication that a big fund is selling

their holdings of gold,” commented Gnanasekar Thiagarajan, director of

Commtrendz Risk Management.

“Any increase in U.S. interest rates should further strengthen the dollar, prompting more fund outflows from commodities, metals and emerging-market assets,” Vattana Vongseenin, the chief executive officer of Phillip Asset Management Co. in Bangkok, said to Bloomberg.

Gold futures in New York traded 2.4 percent lower at $1,107.93 an ounce after dropping as much as 4.6 percent at about 9:30 a.m., losing more than $50. Spot bullion lost as much as 4.2 percent.

"It was down to speculation here, someone taking advantage of the low liquidity environment," Victor Thianpiriya, commodity strategist at ANZ, told CNBC. "Around 5 tonnes of gold was sold on the Shanghai Gold Exchange within the space of two minutes between 09:29 and 09:30. The daily volume last week was about 25 tonnes," he noted.

"It clearly wasn't driven by fundamentals, because the U.S. dollar didn't move at that time," Thianpiriya added.

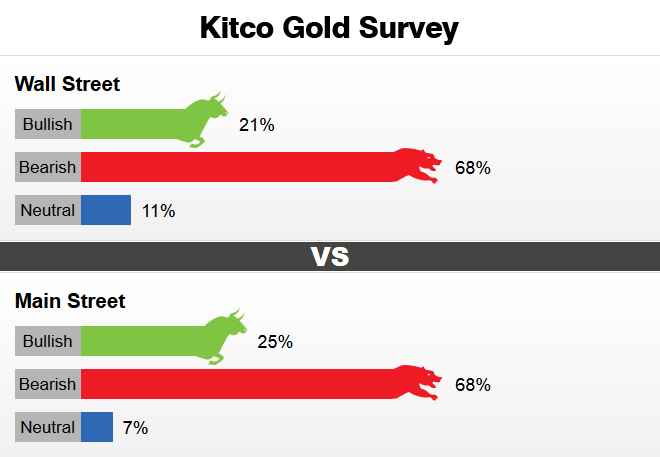

According to Kitco News "Main Street vs Wall Street" survey this week, out of 364 participants, 247, or 68%, expect to see lower gold prices next week; 90 participants, or 25%, see higher gold prices; and 27 people, or 7%, are neutral.

The majority of analysts appear to agree that gold prices will move

lower in the short-term.

Out of 33 market experts contacted, 19

responded, of which four, or 21%, said they are bullish on gold next

week. At the same time, 13 professionals, or 68%, said they are

bearish, and two people, or 11%, are neutral on gold.

Market

participants include bullion dealers, investment banks, futures traders

and technical-chart analysts, says Kitco News.