Don't take too much comfort that China's stock meltdown didn't trigger broader panic. There's still plenty of Chinese debt to worry about.

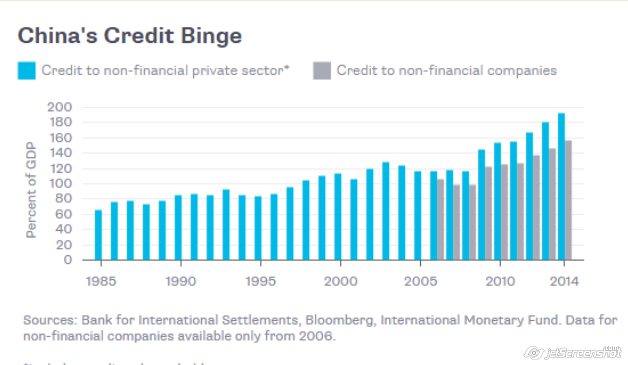

To maintain the country's decelerating growth rate at a politically acceptable level, officials have allowed financial institutions to keep pumping credit into the economy. This has made China one of the most indebted developing nations: As of December, the combined debts of households and non-financial corporations -- with the latter accounting for the majority of the total -- stood at 192 percent of gross domestic product, up from 118 percent before the 2008 financial crisis (and that doesn’t include as much as $4 trillion in local-government debt). Here's how that looks:

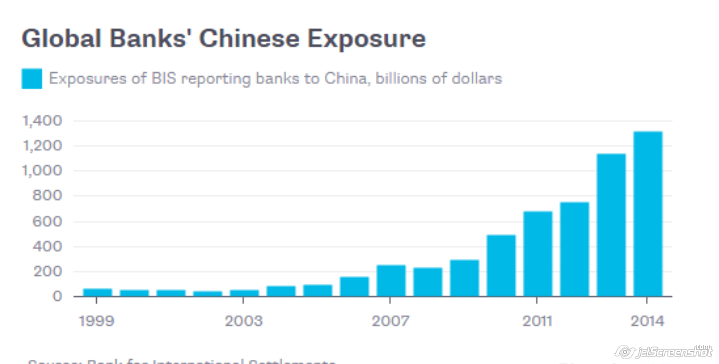

Much of China's lending has gone to building excess manufacturing capacity and to speculative real estate investment. It's hard to know how many of those loans will go bad or which financial institutions will suffer the most. To a large extent, China can absorb losses by recapitalizing state-owned banks that run into trouble. Nonetheless, banks outside China are increasingly exposed: As of December, total foreign bank exposure to the country's government, banks and companies stood at $1.3 trillion, according to the Bank for International Settlements. That's down a bit from September, but still more than five times the pre-crisis level. Here’s a chart:

A Chinese bust could play out in several ways. It could be a long period

of stagnation with a banking system paralyzed by bad loans, like Japan

in the 1990s. Or if losses crystallized at a global systemically

important bank, it could be more sudden and financially destabilizing.

Or both. Whatever happened last week, it's too early to call. https://www.mql5.com/en/signals/111434