Morgan Stanley made some fundamental/technical outlook for this week related to USD, EUR, JPY, GBP and AUD. It is about some fundamental news events coming and the strategies to be used for trading.

"USD: Bullish.

In an environment of fading risk appetite and high uncertainty due to

China and Greece, we believe USD will be a relative outperformer. Oil

prices are also on a downward trend, which could boost USD as well. The

market has pushed back the timing of the first Fed hike significantly,

creating room for upside moves if US data does surprise on the strong

side. We will watch the upcoming retail sales and CPI prints.

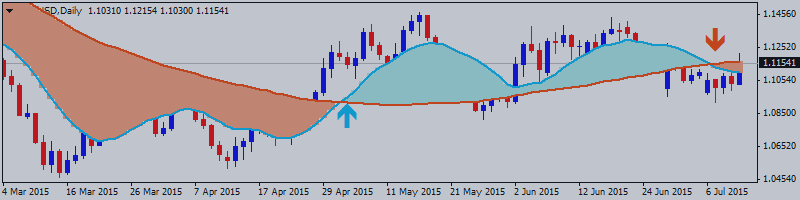

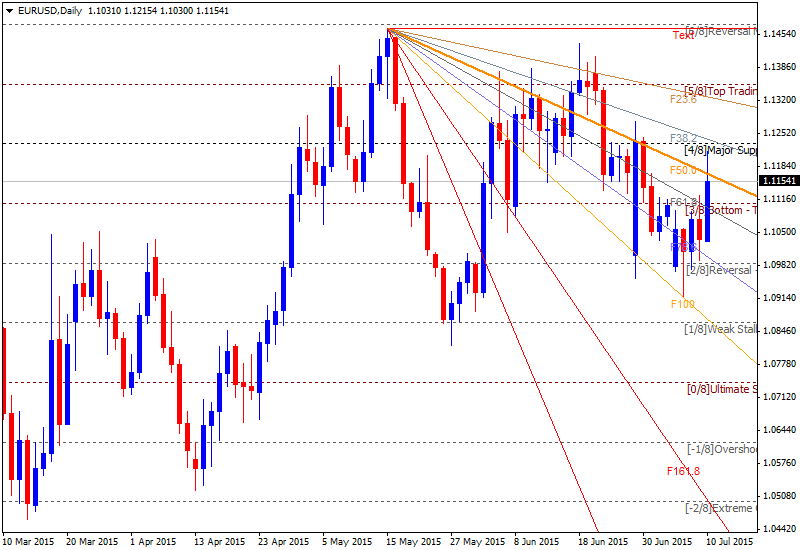

We believe that with or without a Greek deal, EUR is likely to weaken. Should Greece sign a deal, the market will return to funding in EUR, weighing on the currency. On the other hand, if a Grexit develops, this will force markets to price a higher risk premium of exit into all European assets, as this is a risk that cannot be hedged out. This will weigh on EUR as well. All eyes will be on the upcoming ECB meeting.

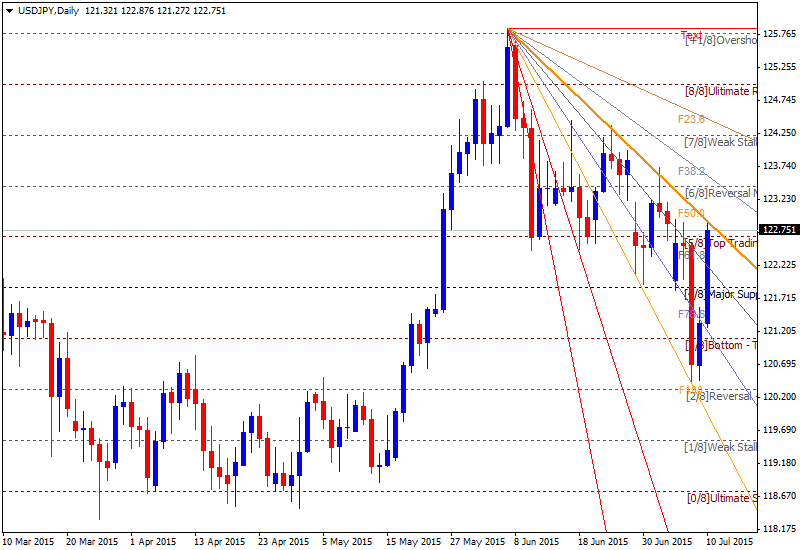

JPY: Bullish.

JPY is likely to remain an outperformer over the coming week.

Uncertainty surrounding Greece and China remain high, which should

support safe haven flows and repatriation by Japanese investors.

Demographics also should support JPY going forward. As the population

ages, pension funds will need to liquidate foreign assets in order to

pay out. Finally, Japan’s balance of payments has turned positive, also

boosting JPY.

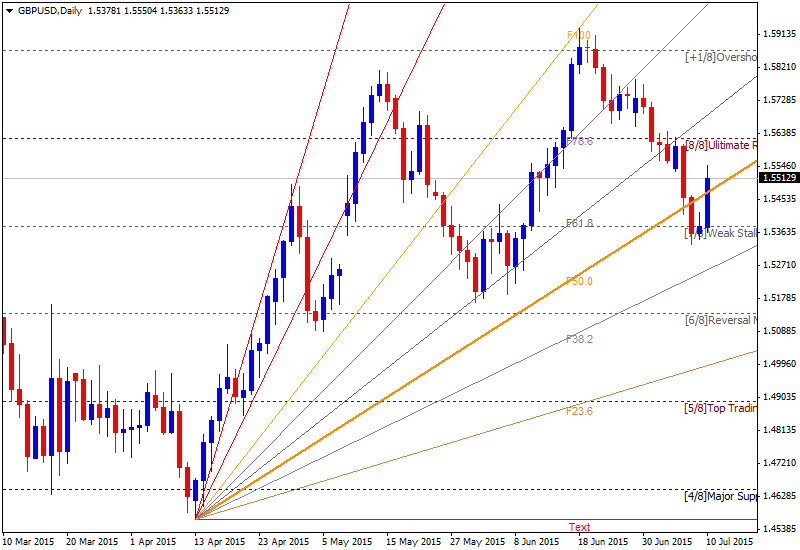

GBP: Neutral.

We believe that GBP will strengthen to its peak in the coming months

with short-term performance driven by rate expectations in anticipation

of the first vote for a rate hike in August. The Budget announced this

week supports this view pointing to potential upside risks to inflation

in the near term so we will be watching the CPI. However, front loaded

fiscal tightening indicates growth headwinds and GBP strength coming

under pressure in the medium term.

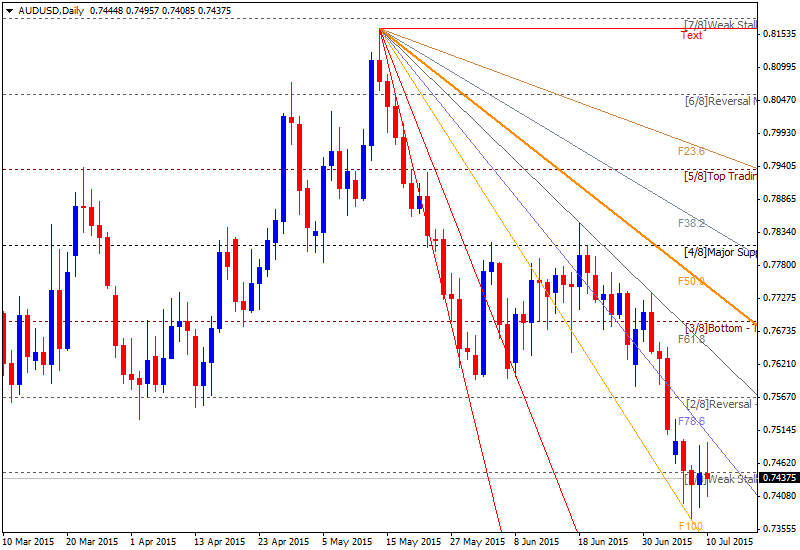

AUD: Bearish.

AUD is doubly hit by concerns about China growth, both by the direct

impact via trade linkages, and the indirect commodity impact. Indeed,

iron ore prices have fallen significantly this month, and it is no

surprise AUD was the underperformer in the G10 currencies over the past

week. Uncertainty in Greece could also weigh on AUD, should it have a

larger impact on global risk appetite."