CRUDE OIL Price Action Analysis - triangle pattern to be crossed to breakdown

9 July 2015, 15:11

0

1 031

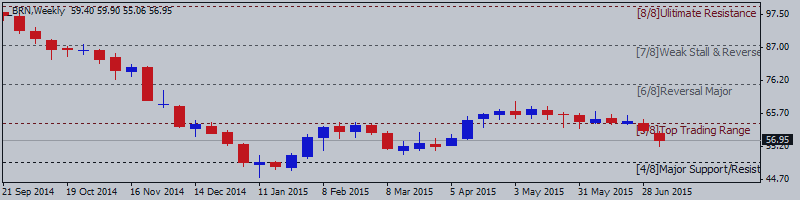

W1 price is located below 200 period SMA and below 100 period SMA for the primary bearish with secondary ranging between 45.17 support level and 69.57 resistance level:

- Triangle pattern was crossed by the price together with 60.08 support level from above to below for the bearish to be continuing;

- The price is ranging between 45.17 and 69.57 levels;

- If weekly price will break 45.17 support level so the primary bearish will be continuing, if weekly price will break 69.57 resistance level - we may see the secondary market rally as a local uptrend within the primary bearish market condition. If not - the price will be ranging within the familiar levels;

- the value to reversal to the total bullish is 90.50;

- “Prices are digesting losses after issuing the largest daily decline in over seven months. A break below the 61.8% Fibonacci retracement at 54.50 exposes the 76.4% level at 50.94.”

Trend:

- D1 - bearish breakdown

- W1 - ranging bearish

- MN1 - ranging bearish