Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - followed by the 38.2% Fibonacci expansion at 70.57 for oil

Prices turned sharply lower, producing the largest decline in close to three months. A daily close below the 23.6% Fibonacci retracement at 11918 exposes the 38.2% level at 11841.

S&P 500 TECHNICAL ANALYSIS

Prices remain in consolidation mode. A break below trend line support at 2107.80 exposes the 38.2% Fibonacci retracement at 2100.00.

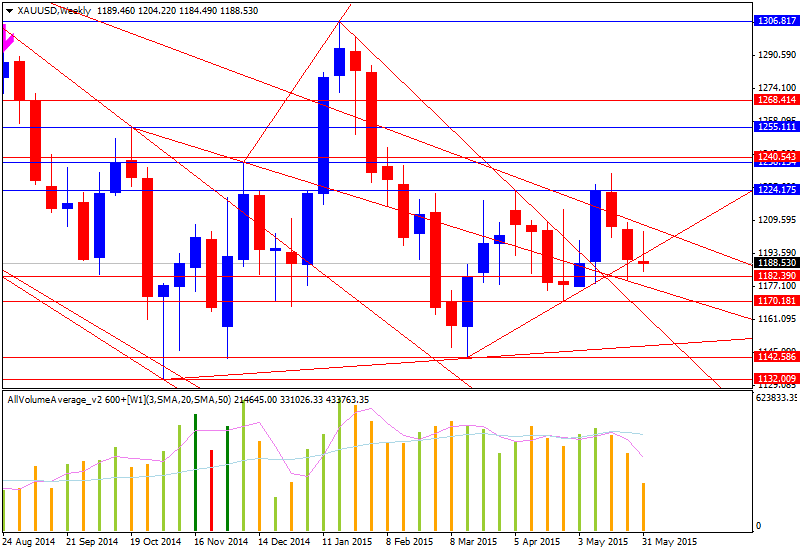

GOLD TECHNICAL ANALYSIS

Prices are digesting

losses after claiming a foothold below the $1200/oz figure anew. A close

below range support at 1178.09 exposes the 38.2% Fibonacci expansion at

1169.31. Alternatively, a rebound above the 23.6% level at 1193.38

targets trend line support-turned-resistance at 1203.33.

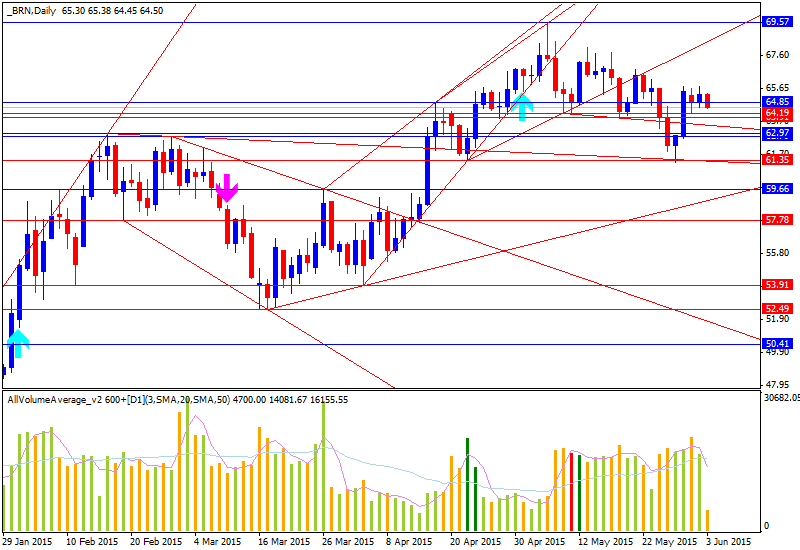

CRUDE OIL TECHNICAL ANALYSIS

Prices rebounded from

support guiding the up move from lows set in mid-January. A push above

downward-sloping resistance at 65.77 exposes the May 6 high at 69.60,

followed by the 38.2% Fibonacci expansion at 70.57. Alternatively, a

move below trend line support at 61.81 targets the 38.2% Fib retracement

at 60.27.