First, a few words regarding our forecast for last week:

- for the EUR/USD pair, the forecast was fulfilled by exactly 50%. As promised, at the start of the week the pair strived to the top border of the corridor, which was set by the maxima of March and April. However, after that, instead of rebounding and going downwards, the pair rushed further upwards and reached the horizon of February;

- much more obedient was the GBP/USD pair, which, after growing for the first few days of the week, near the end, as predicted, rapidly rolled downwards and finished the five days on the same level as it had started;

- for USD/JPY we foretold a continuation of the sideways trend with a rise to the zone of 120.80÷122.00, which is what happened with 100% accuracy. The pair’s sideways movement with a maximum of 120.28 is clearly seen on the graphs H4 and D1;

- but for USD/CHF, the forecast of the analysts turned out to be, on the contrary, 100% inaccurate. It was presumed that the pair would mirror the movements of EUR/USD, which is what it actually did. Precisely because of this it went not upwards but downwards, reaching, following EUR/USD, the level of February.

***

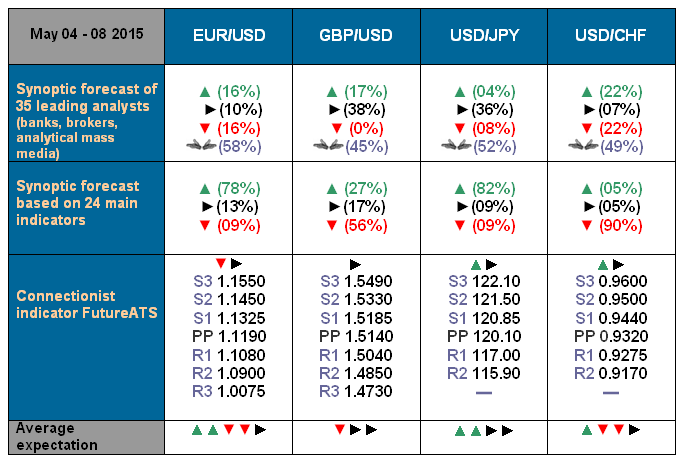

Now about the forecast for the coming week. Generalising the opinions of 35 analysts from world leading banks and broker companies collected in a table as well as forecasts based on different methods of technical and graphical analysis, it can be suggested that:

- the EUR/USD pair will be in a sideways trend with fluctuations in the zone of 1.1100÷1.1430, although it is not excluded that the pair can fall to the 1.0800 mark, returning to the minimum of last week;

- for the GBP/USD pair the majority of analysts also are of the opinion that there will be a sideways trend in the boundaries from 1.5000 to 1.5300. This forecast is supported by the discordance in the indicators;

- for USD/JPY, as last week, most of the analysts and 82% of the indicators presume that the pair will strive to gain a foothold in the zone of 120.00÷122.00, while the maximum for the coming five days is said to be the height of 121.50. On the other hand, 8% of analysts foretell a sharp rebound downwards and a fall to the level of 117.00;

- and, finally, the last pair of our review – USD/CHF, which, most probably, will like last week follow in the wake of EUR/USD. So if the latter strives downwards, the USD/CHF, mirroring its “older sister”, will go upwards to the level of 0.9500. At the same time, if you calculate the mean maximum and minimum based on all the forecasts, the pair should finish the next week exactly on the same mark as it had started on, i.e. on 0.9335.

Roman Butko, NordFX & Sergey Ershov