Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD - keep track of external factors that can cause cross fundamental winds

US Dollar - "Finally, it is always wise to keep tabs on the general quality of risk trends. Though the correlation to equities, volatility levels and other traditional measures of ‘risk’ have waned; they would be quickly restored by a jolt of concerted panic or greed that shot through the market. A purge of speculative excess is necessary for the capital markets. It is just a matter of time and motivation. When the unwind occurs, capital will seek the security of US liquidity and regulations".

USDJPY - "It’s shaping up to be a fairly important week for the Dollar versus the Yen, and any major surprises could finally be enough to force the USD/JPY out of its narrow trading range".

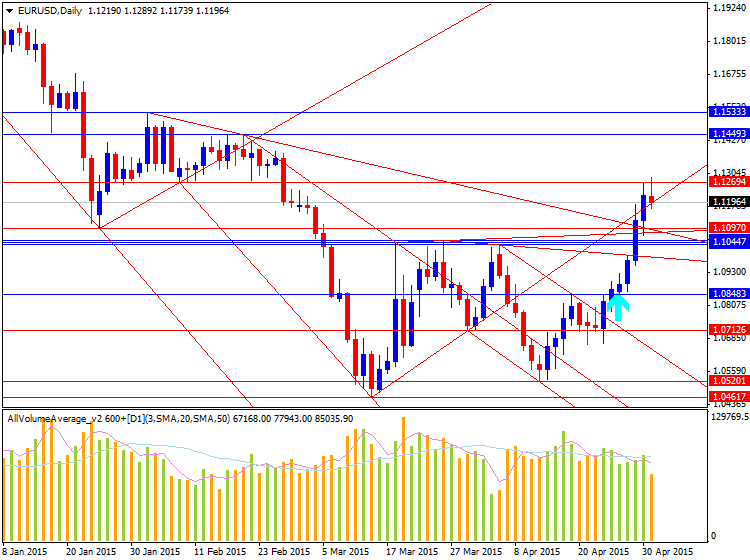

GBPUSD - "Nevertheless, the failed attempt to test the February high (1.5551) may keep GBP/USD capped going into the first full-week of May, and the failure to retain the bullish structure from April certainly raises the risk of seeing a further decline going into the election. In turn, former resistance around the 1.5000 handle will come on the radar as the pound-dollar searches for near-term support".

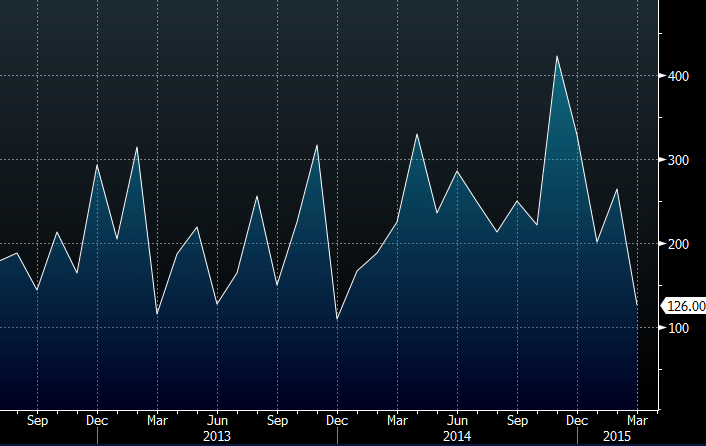

AUDUSD - "Traders’ priced-in expectations reflected in OIS rates put the probability of a 25bps RBA cut at the May meeting at 73 percent. This is nearly identical to the 75 percent probability of easing that the markets foresaw ahead of April’s sit-down, when Governor Glenn Stevens and company opted to remain on hold. That marked a six-year low for AUDUSD and saw prices rise as much as 7.2 percent over subsequent weeks. Choosing to keep rates steady this time around may trigger a similar response".

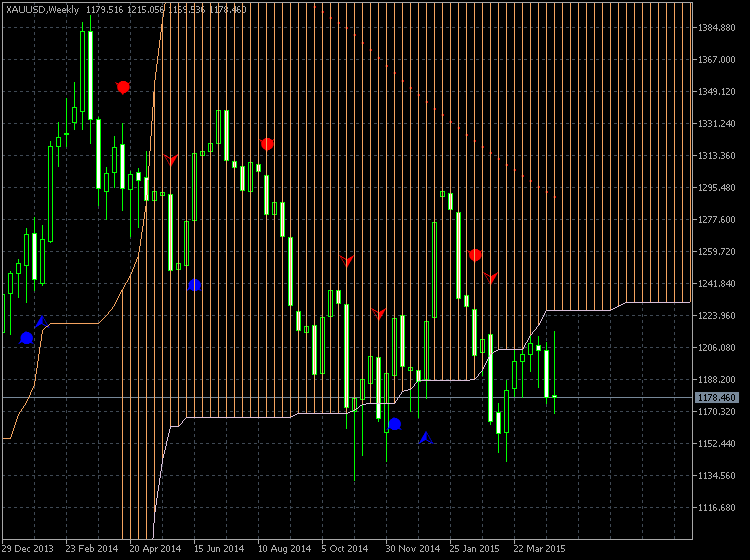

GOLD - "We’ll maintain a neutral stance heading into the monthly open / NFPs with a broader bearish outlook back in play below this week’s high / ML resistance. Interim support is seen at the confluence of the 100% Fibonacci extension and the lower median-line parallel of the decline of the April highs. A break lower targets objectives at 1150/51 & the early stretch low at 1142".