Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD - second worst week for the even-weighted measure in 12 months

US Dollar - "Moderated rate expectations reinforced by tepid data, but it’s capability as a fundamental driver is diminished considering the time frame yields imply and the persistent buoyancy of the Dollar – a rate hike may come later but it is still a hike among QE programs. Sentiment may simply tip out of favor for the Greenback and pull it lower, but the most effective means would by through key event risk to focus the selling effort. For the coming week’s docket, there is limited high-profile event risk to hit all traders’ radars. And, marking a meaningful distraction, there are very high profile events in the following week (FOMC decision and GDP amongst others)".

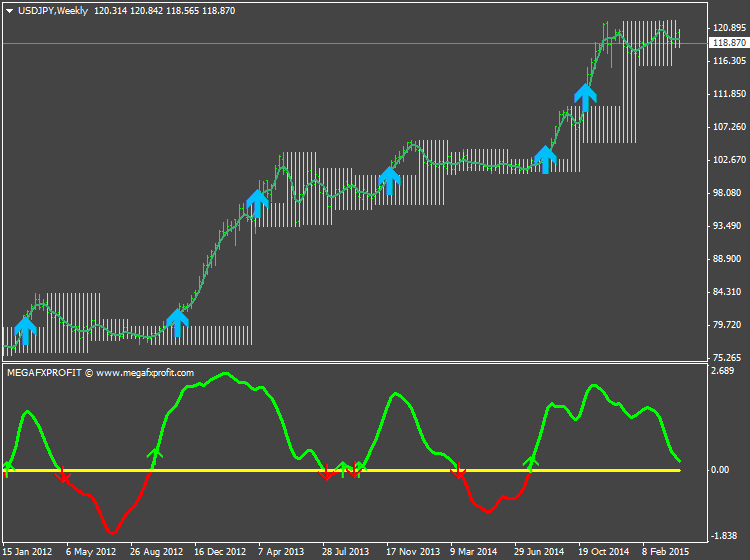

USDJPY - "With Japan expected to post a trade surplus for the first time since June 2012, prospects for a stronger recovery in 2015 may encourage the Bank of Japan (BoJ) to retain a wait-and-see approach at the April 30 interest rate decision as Governor Haruhiko Kuroda remains confident in achieving the 2% inflation target over the policy horizon. In turn, Japanese officials may continue scale back their verbal intervention on the local currency, and the bearish sentiment surrounding the Yen may continue to diminish over the near to medium-term as the central bank turns increasingly upbeat on the economy".

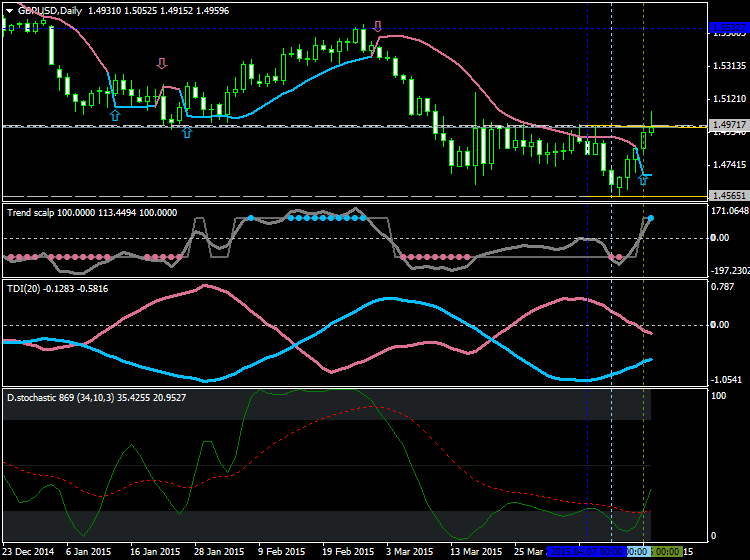

GBPUSD - "The critical point remains that political uncertainty surrounding UK elections on May 7 have hurt the British Pound against major counterparts. Derivatives markets show that GBP/USD volatility prices/expectations trade near multi-year highs given clear indecision in UK electoral poll figures. Ultimately, however, fears over post-election political disarray may be overdone. And indeed further improvements in economic data and interest rate expectations could fuel a larger British Pound recovery versus the US Dollar and other major FX counterparts".

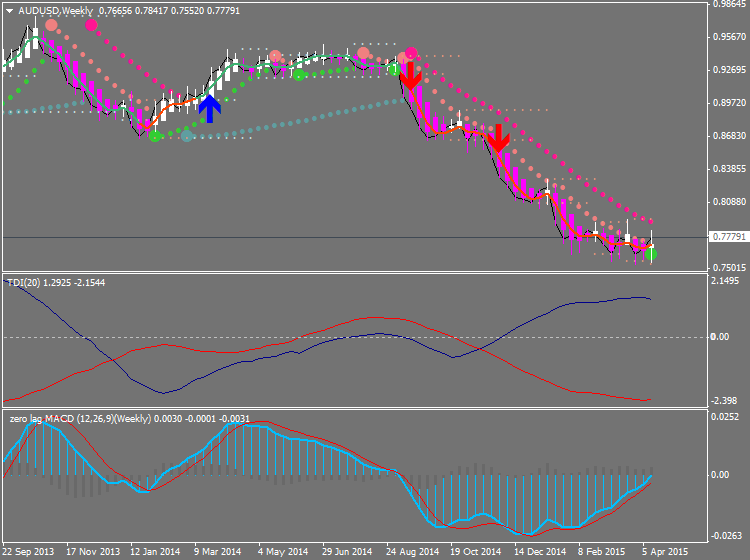

AUDUSD - "Chinese news-flow represents another significant inflection point. The Aussie overlooked dismal industrial production figures from the East Asian giant last week, with the release seemingly overshadowed by a concurrently published first-quarter GDP report that printed in line with forecasts. The week ahead will bring a timelier measure of the business cycle in Australia’s top export market via the flash estimate of April’s HSBC Manufacturing PMI measure. Accelerated contraction in factory-sector activity is expected, which may cap the Aussie’s upside potential".

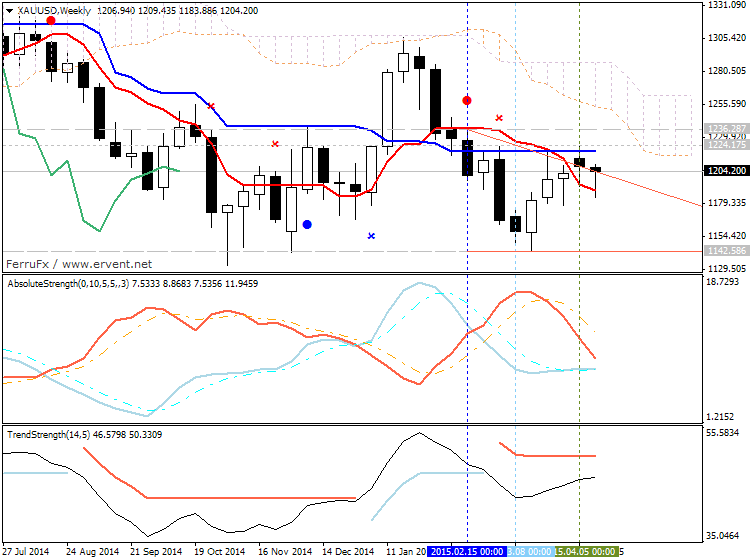

GOLD - "From a technical standpoint, the near-term outlook remains clouded as the monthly range continues to compress. Key support rests at 1173/77 and we will reserve this threshold as our medium-term bullish invalidation level. Interim resistance is eyed at 1214 (April high day close) backed by the 50% retracement of the 2014 range / 200-day moving average at 1225/29. Key resistance stands at 1245/48 with a breach above targeting objectives into 1300. That said, we’ll be looking for a break of the monthly opening range to validate our near-term bias with the broader outlook weighted to the topside while above 1173".