Technical Pattern Analysis for US Dollar, S&P 500, Gold and Crude Oil - Price jumps most in 2 months following Dark Cloud Cover pattern

US DOLLAR TECHNICAL ANALYSIS

Prices paused to digest gains,

snapping a four-day winning streak. Near-term resistance is at 12066,

the 14.6% Fibonacci expansion, with a break above that on a daily

closing basis exposing the 12149-77 zone (23.6% level, March 13 high).

S&P 500 TECHNICAL ANALYSIS

Prices moved lower as expected

after putting in a bearish Evening Star candlestick pattern. A daily

close below the March 12low at 2040.10 exposes the 38.2% Fibonacci

retracement at 2004.60. Alternatively, a reversal above the 14.6% Fib

expansion at 2084.00 targets the 2111.00-19.40 area (23.6% threshold,

February 25 high).

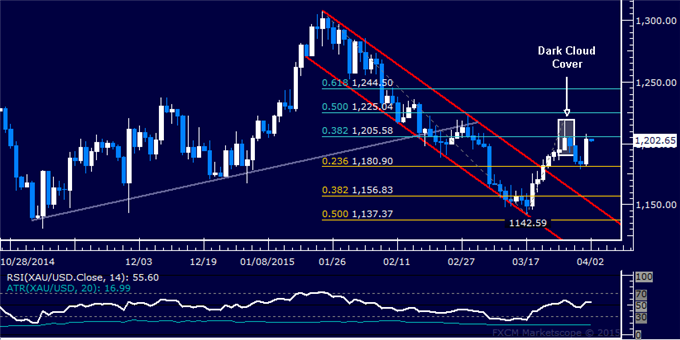

GOLD TECHNICAL ANALYSIS

Prices recoiled sharply higher after

declining as expected following the appearance of a bearish Dark Cloud

Cover candlestick pattern. A daily close above the 38.2% Fibonacci

retracement at 1205.58 exposes the 50% level at 1225.04. Alternatively, a

push below the 23.6% Fib expansion at 1180.90 targets the 38.2%

threshold at 1156.83.

CRUDE OIL TECHNICAL ANALYSIS

Prices continue to tread water

below the $60/barrel figure. A close above the March 26 high at 59.75

exposes the February 17 top at 62.98. Alternatively, a push below the

14.6% Fibonacci expansion at 52.76 targets the 23.6% level at 46.47.