EURUSD Threatens Bearish RSI Momentum Despite Dovish ECB Draghi; GBPUSD Continues to Underperform

24 March 2015, 12:11

1

688

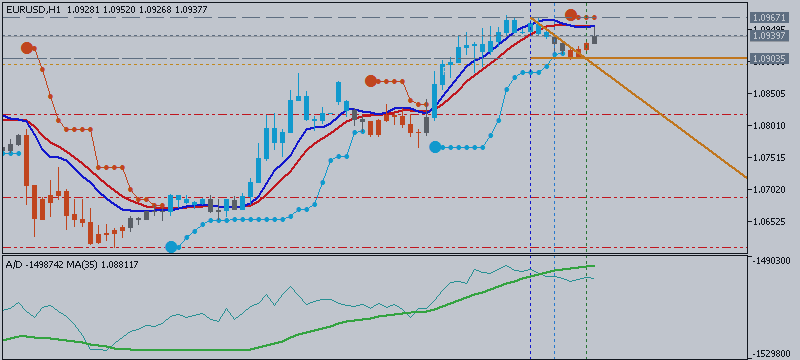

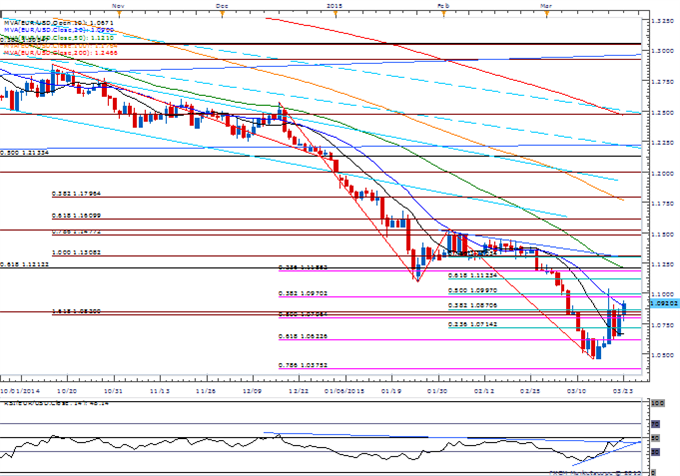

- Even though European Central Bank (ECB) President Mario Draghi continues to endorse a dovish tone for monetary policy, EUR/USD may face a larger correction as the Relative Strength Index (RSI) breaks out of the bearish trend.

- Euro remains at risk of facing additional headwinds especially as Greece struggles to reach an agreement, while policymakers favor a weaker exchange rate.

- Despite the push higher, Speculative Sentiment Index (SSI) shows retail crowd remains net-short EUR/USD, with the ratio sliding to -2.00.

GBP/USD Continues to Underperform; U.K. Inflation to Slow Further.

- Despite the bullish RSI momentum, failure to push & close above the 1.5000 handle may continue to produce range-bound prices in GBP/USD.

- However, a further slowdown in the headline & core U.K. CPI may spark a further decline in the sterling as the Bank of England (BoE) remains in no rush to normalize monetary policy.

- Will stay flat on GBP/USD amid the string of closing price above 1.4700-10 (78.6% expansion).