Tuesday:

- Eurozone ZEW Economic Sentiment (Aug.). Forecast: 41.3, Previous 48.1

- German ZEW Economic Sentiment (Aug.). Forecast: 18.2, Previous: 27.1

Wednesday:

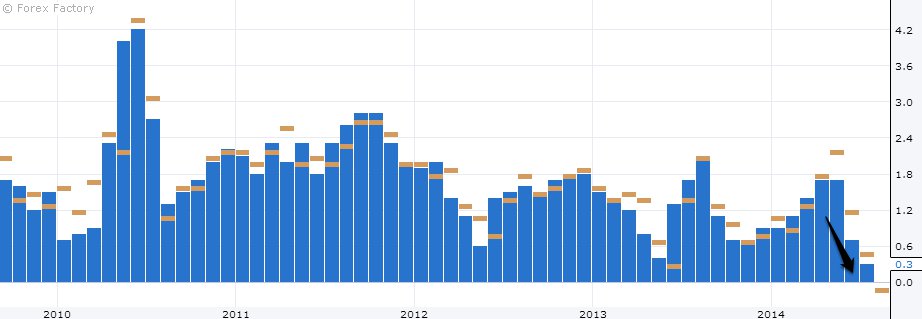

- UK Claimant Count Change (July). Forecast: -29.7K, Previous -36.3K

- Unemployment Rate (June). Forecast: 6.4%, Previous: 6.5%

- Average Earnings Index 3m/y (June). Forecast: -0.1%, Previous 0.3%

- UK jobs data will be key. The claimant count change is expected to decline as a slower rate, but this should not be so alarming. The unemployment rate is expected to edge lower, but that is not much to write home about. However, the earnings index, seen to have shrank in the 3 months to June compared to the same period in 2013, could reaffirm the BoE’s concern of the lack of wage growth. The lack of wage growth is something that will likely keep the rate hike from happening in 2014. Note in the historic chart above, that the previous 3 readings have missed forecast (the orange marks).

- BoE’s quarterly Inflation Report will have even more significant implication to monetary policy. The bank president, Mark Carney will hold a press conference. *Make sure to watch it or at least watch the markets reaction to this presser. Again, it will be interesting to see where the BoE sees inflation, especially wage inflation, and how this effects its interest-rate-hike time-line.

Thursday:

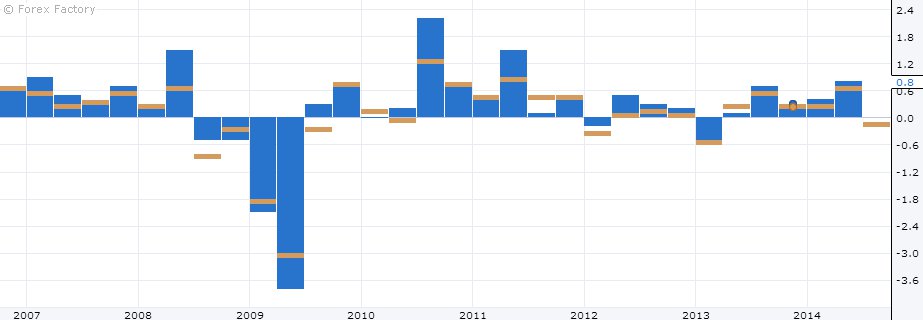

- German Prelim GDP q/q (Q2). Forecast: -0.1%, Previous: 0.8%

- Eurozone Final CPI y/y (July). Forecast: 0.4%, Previous: 0.4%

- The preliminary estimate of German’s GDP growth in the second quarter is expected to be around -0.1%, after a 0.8% print for Q1. A reading below 0 would be in-line with recent soft data, credit crunch issues, and geopolitical tensions that have plagued the Eurozone. It would add to the theory that the ECB should implement more stimulus measures soon.

- US Jobless Claims. Forecast: 307K, Previous 289K

Friday:

- UK GDP q/q (Q2), second estimate. Forecast 0.8%, 1st Estimate: 0.8%.

UK GDP data should confirm growth of 0.8% in the second quarter. This would be the strongest quarter to quarter growth rate since Q3 of 2012, and reflects a recovery on track in 2014. However, we know this already, and the BoE is looking for growth to translate to an increase in wages, which then can in turn provide the domestic demand that cna help sustain the recovery track.

- CAN Manufacturing Sales m/m (June). Forecast: 0.5%, Previous: 1.6%

The Canadian economy has been leveling off somewhat, and a reduced growth in manufacturing sales in June would confirm the recent “flatness” in the Canadian economy.

- US PPI m/m (July). Forecast: 0.1%, Previous. 0.4%

- US Empire State Manufacturing Index (August): Forecast: 20.3, Previous: 25.6

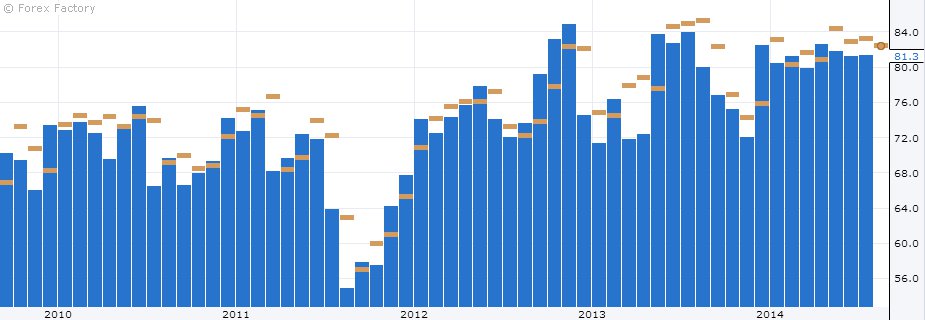

- Prelim UM Consumer Sentiment (Aug). Forecast: 82.7, Previous: 81.3