Trading News Events: U.S. Gross Domestic Product (GDP) - Slowest Pace of Growth Since the Contraction in 1Q 2014

A marked downward revision in the U.S. growth rate may generate a

short-term rebound in EUR/USD should the preliminary 4Q Gross Domestic

Product (GDP) report dampen bets for a mid-2015 Fed rate hike.

What’s Expected:

Why Is This Event Important:

Despite bets for higher borrowing-costs, further weakness in the core

Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for

inflation, may push Chair Janet Yellen to endorse a wait-and-see

approach and further delay the normalization cycle as the central bank

struggles to achieve the 2% target for price growth.

Nevertheless, the uptick in private wages paired with the ongoing

improvement in the labor market may foster a better-than-expected GDP

report, and bets for a stronger recovery may heighten the bullish

sentiment surrounding the U.S. dollar as the Fed remains on course to

remove the zero-interest rate policy (ZIRP) over the near to

medium-term.

How To Trade This Event Risk

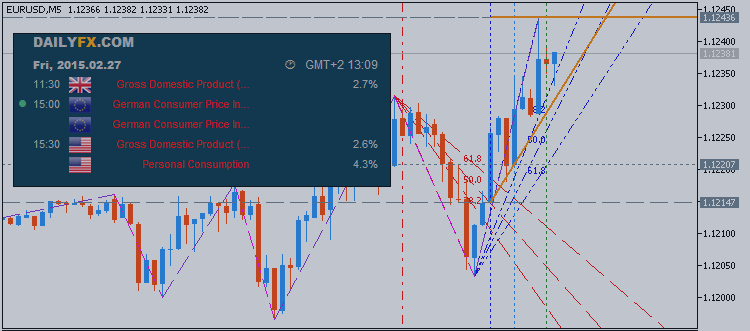

Bearish USD Trade: Growth Rate Narrows to 2.0% or Lower

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD

- If market reaction favors a short dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in reverse

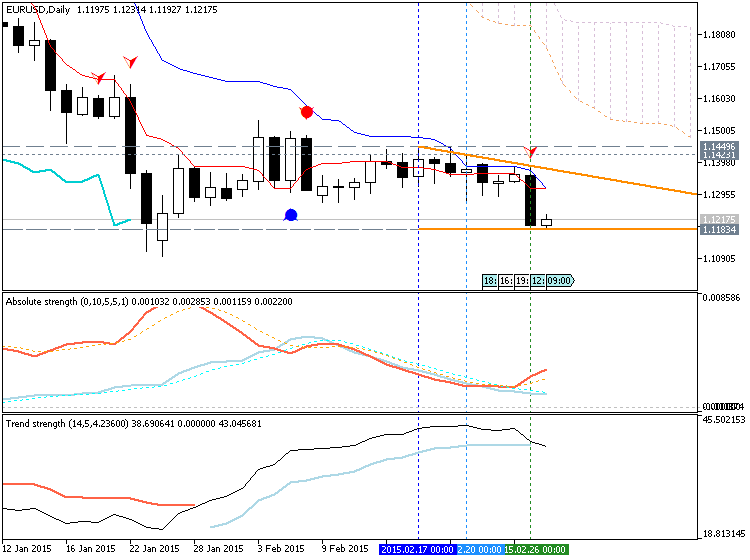

EUR/USD Daily Chart

- Break of the triangle/wedge formation favors a continuation of the bearish trend and the approach to ‘sell-bounces’ in EUR/USD.

- Interim Resistance: 1.1440 (23.6% retracement) to 1.1470 (78.6% expansion)

- Interim Support: 1.1185 (23.6% expansion) to 1.1210 (61.8% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| 3Q P 2014 |

11/25/2014 13:30 GMT | 3.3% | 3.9% | +1 | +47 |