It should be a top priority to determine the appropriate chart for your trading.

Reference a specific date range to begin your analytics

Finalize your execution by moving to a shorter term timeframe

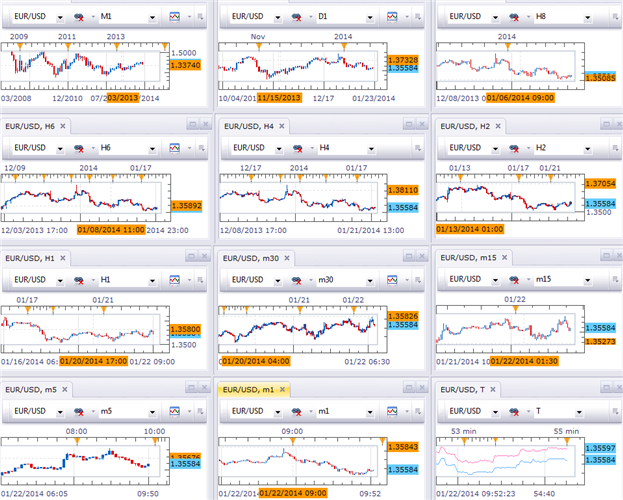

One of the most frequent concerns voiced by new Forex scalpers is how to identify which timeframe and charts to use in their analysis. This question is often addressed after selecting a currency pair for scalping, and makes sense because the possibilities are almost limitless. The image below includes 12 different time frame charts for the EURUSD. If all of these possibilities seem overwhelming, don’t worry you’re not alone.

To help simplify this process today we will look at charts for scalping, and how to identify the appropriate timeframe for our selected strategy.

A Frame of Reference

Whether you are a position trader or scalper it is always good to begin

your charting with a frame of reference. A frame of reference is

specifically looking at how much data is displayed on your chart. This

reference is designed for scalpers to find the short term trend while

identifying key levels of support and resistance. Think of it this way,

scalpers looking for 10 pip gains would be ill advised to begin

looking at multi-year graphs on a daily chart to begin their analysis.

So what reference point and what timeframe charts should a scalper use?

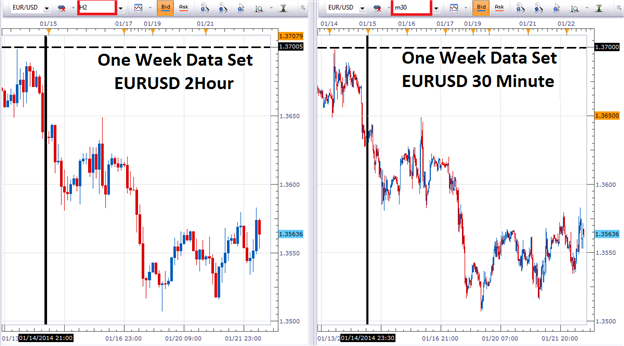

Below we can see two EURUSD charts, both looking at one weeks’ worth of data. Notice how we can easily identify the trend on both graphs? Once this frame is selected, the time frame chosen simply denotes the number of bars displayed for the period selected. I find that a 30minute is a great place to begin, while traders wanting fewer bars may opt for a 2Hour or 1Hour selection.

The Execution Chart

Now that you have narrowed down the trend, it’s time to consider an

execution chart. This graph should be the final chart that you use in

accordance to your scalping trading plan. While this chart may be the

reference chart mentioned above, more often than not, scalpers prefer

moving into shorter time frames at this point. This can aid in

identifying intraday trading opportunities, and is most commonly called

multi time frame analysis.

The final question you must ask yourself as a scalper is how many

positions you wish to take in one day. While this answer will vary from

trader to trader, normally in my experience the answer tends to fall

in the 1 to 5 trade range. If you are looking to take 1-2 positions a

day, I would recommend starting off with a 30 or 15 min chart. Traders

looking for 3-5 positions a day can begin by looking for entries on a

5minute graph. Finally traders looking for 5 or more trades may be best

served by consulting a 1 minute graph.

Of course everything is customizable when it comes to trading! My final

recommendation is to find what works for you. Below is an example of a

trade taken today, based off of a 5 minute strategy.