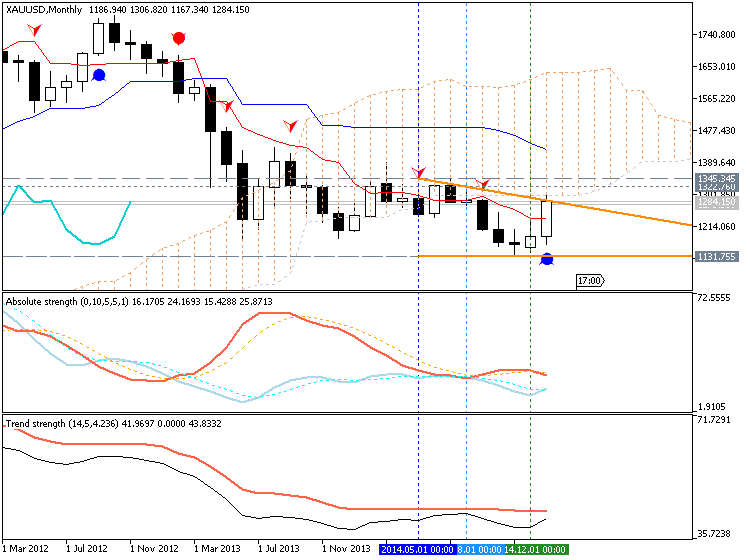

GOLD Technical Analysis 2015, 22.02 - 01.03: Bullish Breakout or Bullish Ranging with 1306.82 Key Resistance

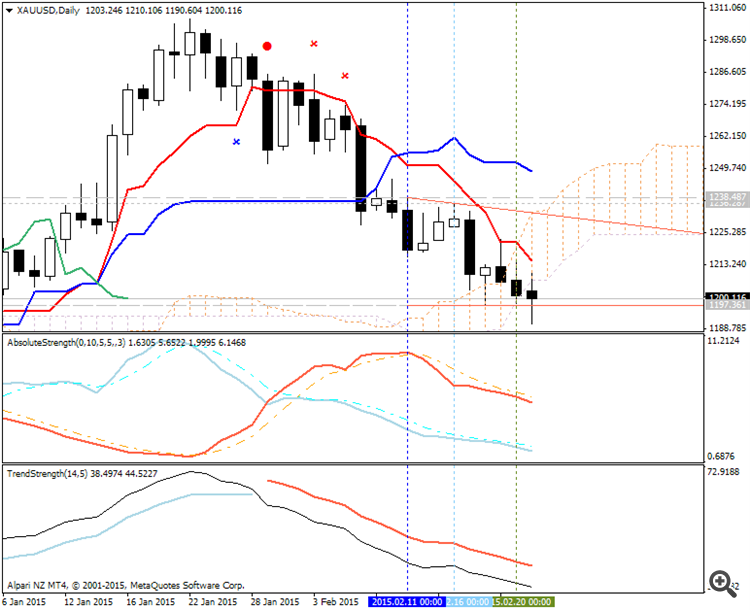

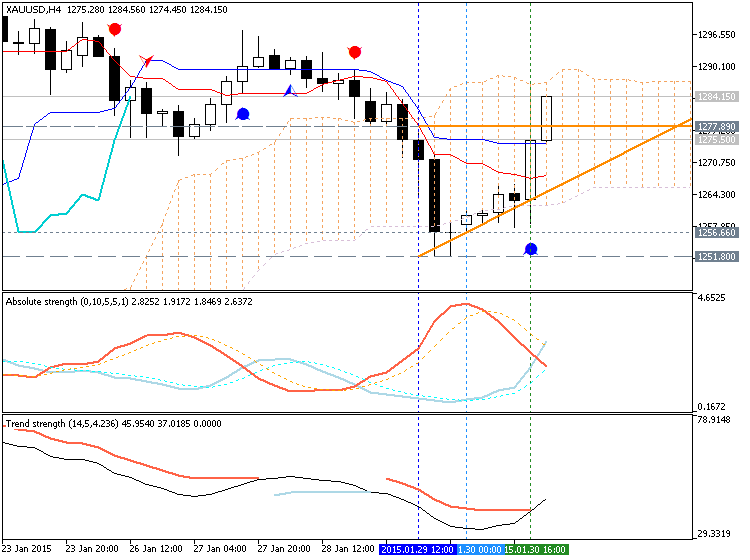

H4 price is inside Ichimoku cloud/kumo with the following condition:

- The price is located inside kumo below Senkou Span A line which is indicating the bearish condition with the secondary ranging

- Chinkou Span line is crossing the price from below to above on open H4 bar for possible breakout to reversal of the price movement from primary bearish to the primary bullish

- Nearest support levels are 1256.66 and 1251.80

- Nearest resistance levels are 1277.89 (H4)

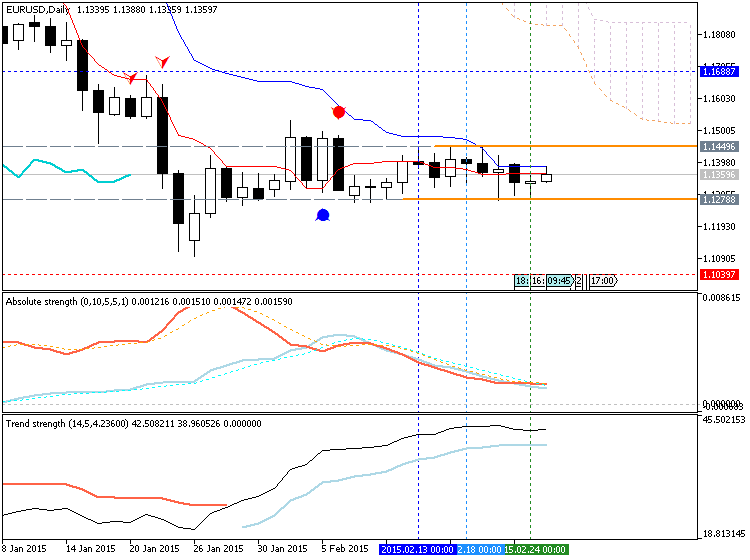

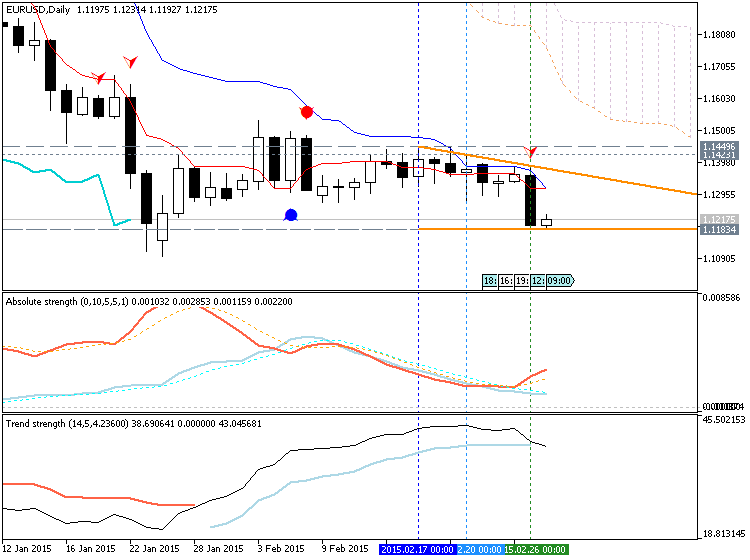

D1 price is on primary bullish with the correction which was started in the end of January this year:

- The price is located above Ichimoku cloud/kumo for primary bullish

- Chinkou Span line is located too far for any near future possible breakout or breakdown on D1 timeframe

- Nearest support levels are 1251.80

- Nearest resistance levels are 1302.63 and 1306.82

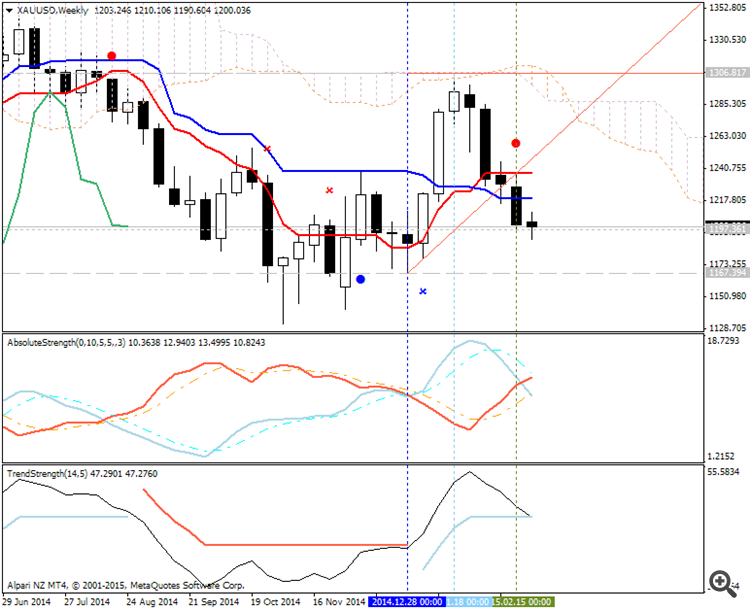

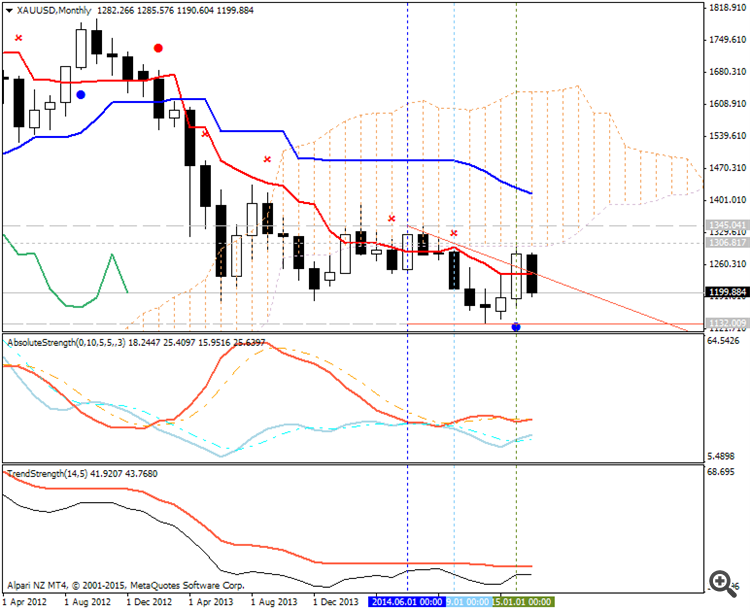

W1 price

is on bearish with secondary rally started in the beginning of January

this year; Chinkou Span line is located to be close to the price for

good possible breakout to reversal of the price movement from bearush to

the bullish market condition

MN price is on bearish market condition with market rally started on open monthly bar

If D1 price will break 1251.80 support level on close bar - we may see good secondary correction inside the primary bullish

If D1 price will break 1306.82 resistance level so the bulliosh trend will be continuing

If not so it will be bullish ranging between 1251.80 and 1306.82 levels

- Recommendation for long: watch D1 price to break 1306.82 for possible buy trade

- Recommendation

to go short: watch D1 price to break 1251.80 support level for possible sell trade

- Trading Summary: bullish

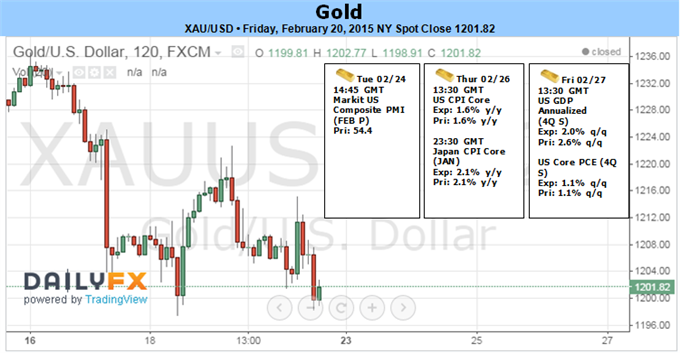

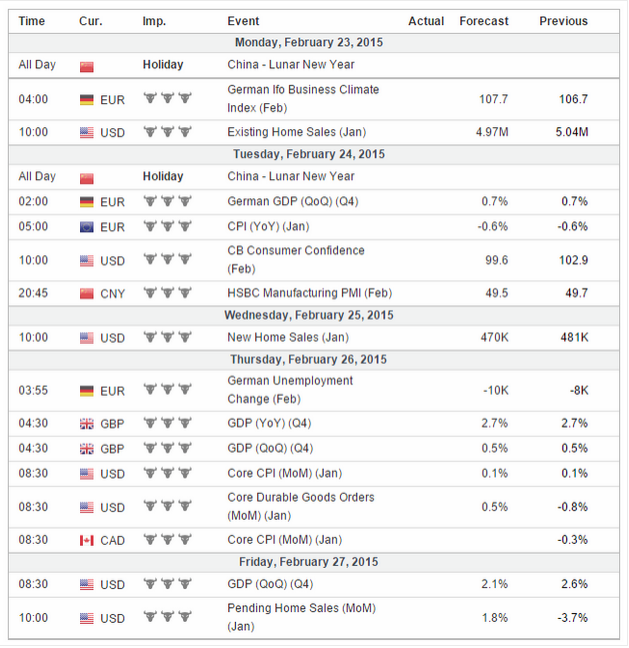

UPCOMING EVENTS (high/medium impacted news events which may be affected on XAUUSD price movement for this coming week)

2015-02-24 14:45 GMT (or 16:45 MQ MT5 time) | [USD - Services PMI]

2015-02-24 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Consumer Confidence]

2015-02-24 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2015-02-25 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2015-02-26 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]

2015-02-26 23:30 GMT (or 01:30 MQ MT5 time) | [JPY - CPI]

2015-02-27 13:30 GMT (or 15:50 MQ MT5 time) | [USD - GDP]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on XAUUSD price movement| Resistance | Support |

|---|---|

| 1306.82 (D1) | 1251.80 (D1) |

| 1306.82 (W1) | 1167.34 (W1) |

| 1345.34 (MN1) | 1131.75 (MN1) |

SUMMARY : bullish

TREND : ranging