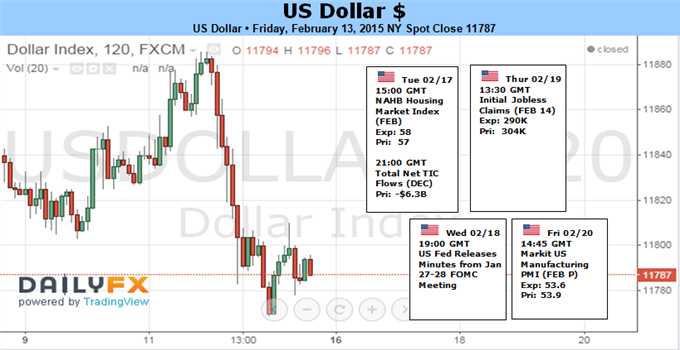

US Dollar - "We are not expecting a change to the ECB’s flight plan for its new QE program launching next month. Instead, the world’s second most prolific reserve currency will be stirred by the burgeoning concerns about the region’s stability as negotiations over Greece’s bailout terms grind on. Since the anti-austerity Syriza-led coaltion took over the government last month, little to know progress has been made towards compromise. With meaningful deadlines coming due, if the pressure eases back, a relief rally for EURUSD could produce a strong Dollar downdraft."

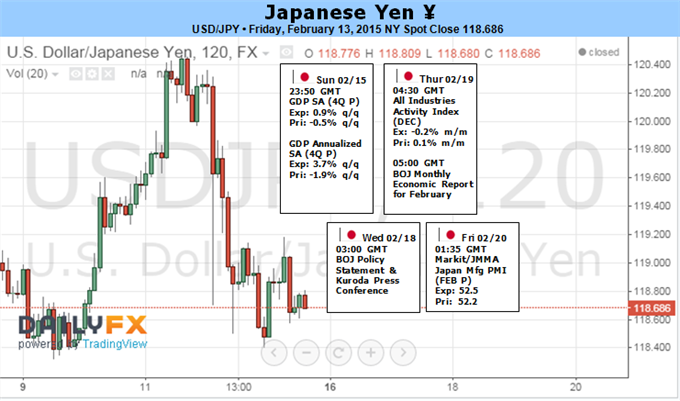

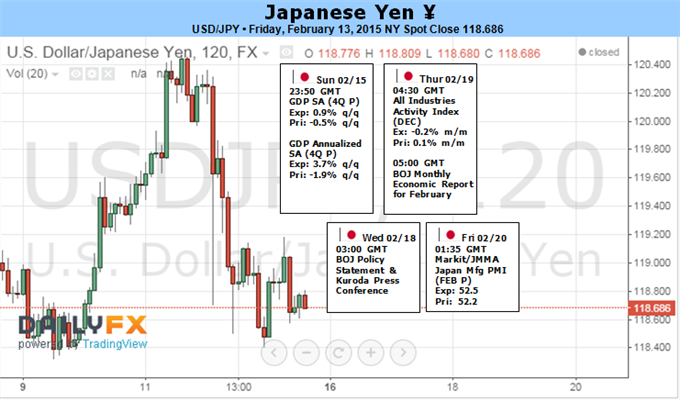

USDJPY - "Despite the pickup in risk sentiment, USD/JPY may continue to give back the rebound from 116.86 and work its way back towards the monthly low after failing to push above the January high (120.73). As a result, we will continue to watch support/resistance in the week ahead, and may need a major fundamental catalyst to establish a new near-term trend in USD/JPY as a wedge/triangle pattern continues to take shape."

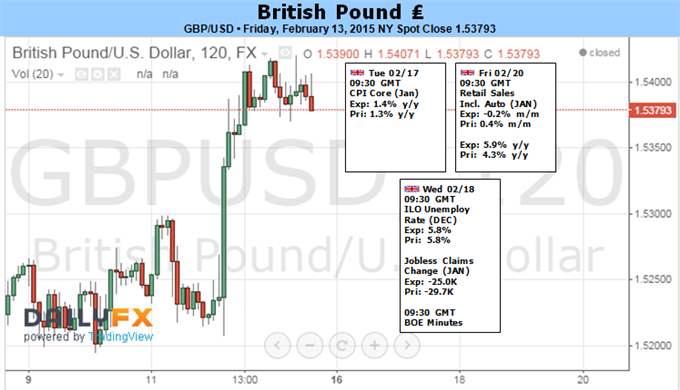

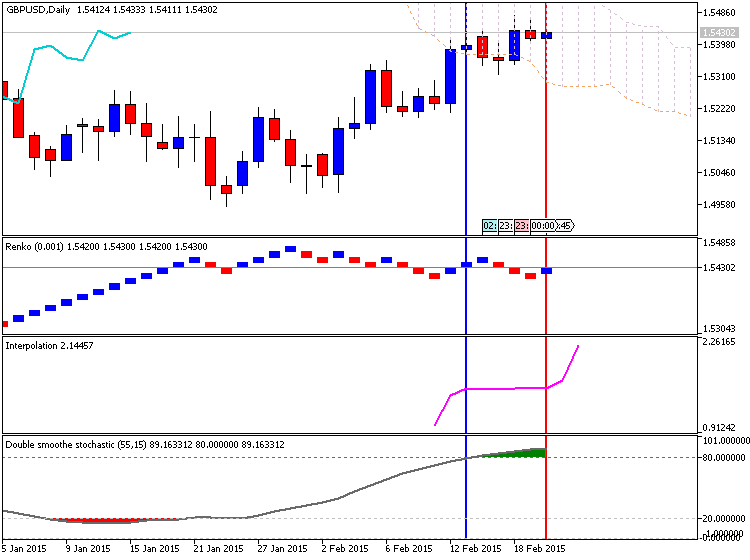

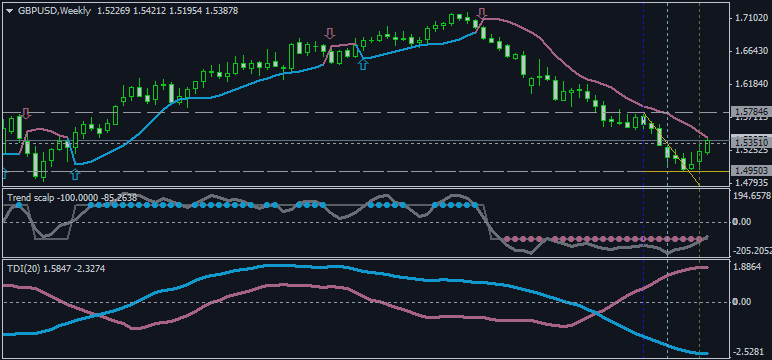

GBPUSD - "The coming week features a potentially formative bit of event risk as January’s CPI figures cross the wires. The headline year-on-year inflation rate is expected to drop to 0.4 percent, the lowest since at least 1989, but Mr Carney’s sanguine posture on this front will likely dilute the figures’ potency. Instead, all eyes will be focused on the core CPI print – a reading that excludes the influence of volatile items the BOE has opted to dismiss – which is expected to rise for a second month to 1.4 percent. UK price growth data has broadly tended to underperform relative to consensus forecasts over the past two years. If that trend continues and a soft core reading emerges, Sterling may retreat as rate hike expectations cool anew."