Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD and GOLD

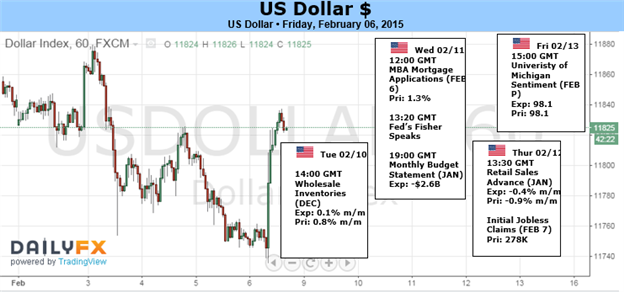

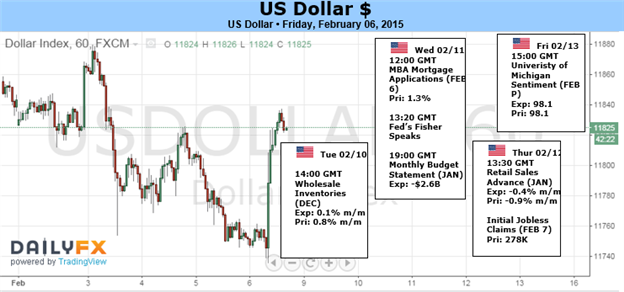

US Dollar - The Dollar’s most promising fundamental backer heading into the new trading week is a worsening of global confiditions that can hasten the demand for liquidity. This is especially true of the Euro where Greece’s debt standoff has found the country with one less important liquidity line and an accelerated time line issued by an unaccommodating European community. Another possible source of strength for the reserve currency is further fallout from global stimulus. We’ve already seen Switzerland’s central bank falter under the ECB’s efforts, and many others were already struggling before that. Cracks in the façade of complacency can quickly expose more systemic issues – such as asset bubbles.

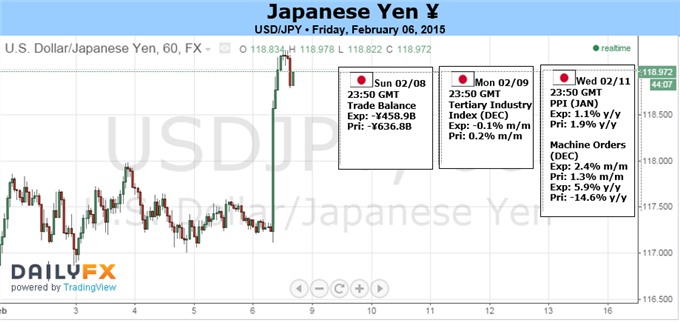

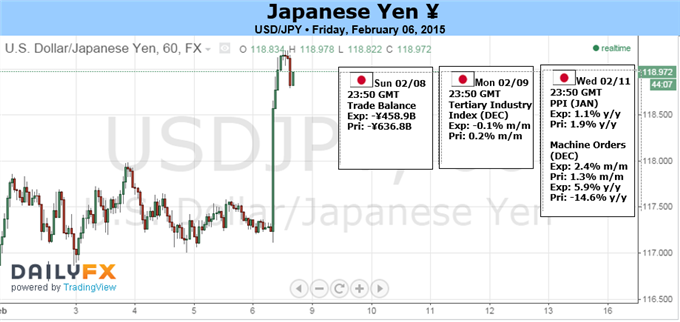

USDJPY - It far looks as though it will be a quiet week for the Japanese Yen. And despite its substantial post-NFPs rally, the USDJPY remains in a broad consolidative range dating back to December highs. Only a break of significant resistance near January’s peak of ¥121 and eventually 8-year highs near ¥122 would change that.

British Pound - On balance, this suggests the British Pound may be disproportionately more sensitive to a hawkish surprise in the central bank’s rhetoric than a dovish one. The currency may not suffer too badly if the markets’ unwinding of rate hike bets is validated. If policymakers firmly remind investors that the BOE does not intend to join the increasingly wide-spread lurch toward stimulus expansion and maintain the next policy change will be to reduce accommodation, the UK unit may rise.

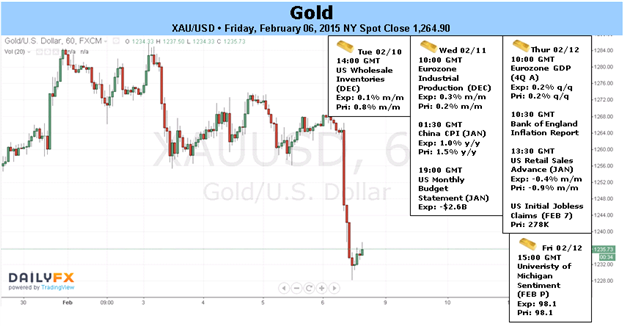

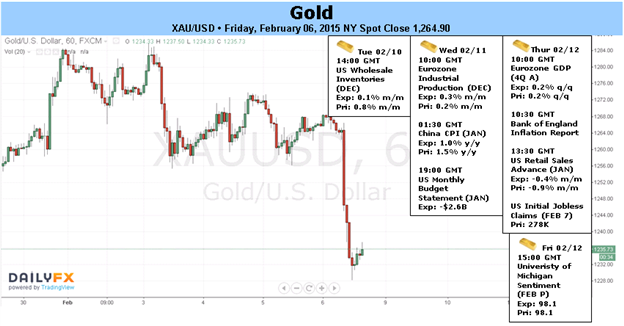

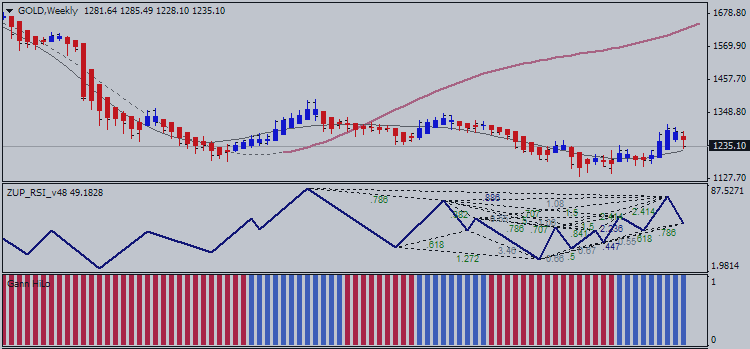

Gold - From a technical standpoint gold broke below the 200-day moving average on Friday for the first time since January 15th with the decline taking prices into the lower median line parallel of a pitchfork formation dating back to the November low. This trendline also converges on a median line off the July 2013 highs and could offer some near-term support. We’ll reserve this threshold as our medium-term bullish invalidation level with a break below targeting support objectives at $1206 & $1197. That’s said, shorts are at risk here with interim resistance seen at $1248/52 and $1268. We’ll be looking for a low early next week with our basic near-term focus higher while within the confines of the November median-line structure.