Scalpers seek to profit from small market movements, taking advantage of a ticker tape that never stands still during the market day. For years this fast-fingered crowd relied on Level II bid/ask screens to locate buy and sell signals, reading supply and demand imbalances away from the NBBO (National Best Bid and Offer). They would buy when demand set up on the bid side or sell when supply set up on the ask side, booking a profit or loss minutes later as soon as balanced conditions returned to the spread.

That methodology works less reliably in our modern electronic markets for three reasons. First, the order book emptied out permanently after the 2010 flash crash because deep standing orders were targeted for destruction on that chaotic day, forcing fund managers to hold them off-market or execute them in secondary venues. Second, high speed (frequency) trading (HFT) now dominates intraday transactions, generating wildly fluctuating data that undermines market depth interpretation. Finally, the majority of trades now take place away from the exchanges in dark pools that don’t report in real time.

Scalpers can meet the challenge of this lightning fast era with three technical indicators custom-tuned for scalping and other short-term opportunities. The signals used by these real-time tools are similar to those used for longer-term market strategies, but are instead applied to 2-minute charts. They work best when strongly trending or strongly range-bound action controls the intraday tape, but poorly during periods of conflict or confusion. You’ll know those conditions are in place when getting whipsawed into losses at a greater pace than is usually present on your typical profit and loss curve.

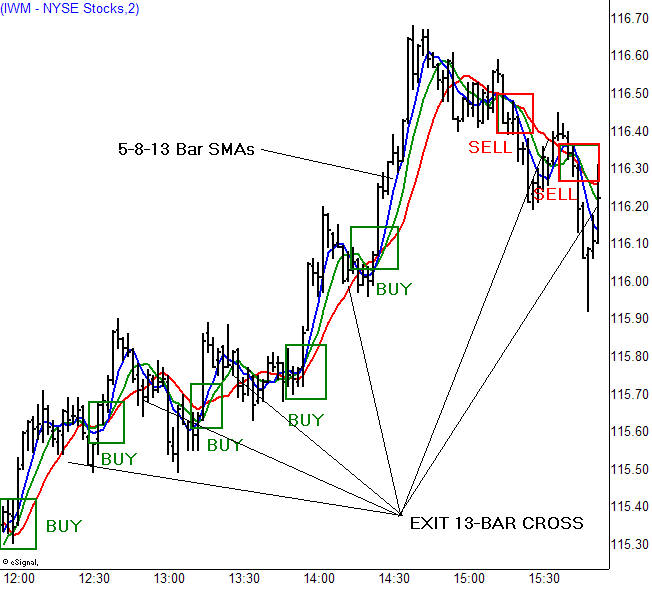

Moving Average Ribbon Entry Strategy

Place a 5-8-13 SMA combination on the 2-minute chart to identify strong trends that can be bought or sold short on counterswings, as well as to get warning of impending trend changes that are inevitable in a typical market day. This scalp trading strategy is easy to master. The 5-8-13 ribbon will align, pointing higher or lower, during strong trends that keep price glued to the 5 or 8-bar SMA. Penetrations into the 13-bar SMA signal waning momentum that favors a range or reversal. The ribbon flattens out during these range swings and price may crisscross the ribbon frequently. The scalper then watches for realignment, with ribbons turning higher or lower and spreading out, showing more space between each line. This tiny pattern triggers the buy or sell short signal.

Relative Strength/Weakness Exit Strategy

How does the scalper know when to take profits or cut losses? 5-3-3 Stochastics and a 13-bar, 3- standard deviation (SD) Bollinger Band used in combination with ribbon signals on 2-minute charts work well in actively traded markets, like index funds, Dow components and for other widely held issues like Apple. The best ribbon trades set up when Stochastics turn higher from the oversold level or lower from the overbought level. Likewise, an immediate exit is required when the indicator crosses and rolls against your position after a profitable thrust.

Time that exit more precisely by watching band interaction with price. Take profit into band penetrations because they predict the trend will slow or reverse and scalping strategies can’t afford to stick around through retracements of any sort. Also take a timely exit if a price thrust fails to reach the band but Stochastics rolls over, telling you to get out. Once you’re comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower to 2SD to account for daily changes in volatility. Better yet, superimpose the additional bands over your current chart so that you get a broader variety of signals.