- How to calculate leverage in trading account

- The concept of notional value

- How much leverage we can use

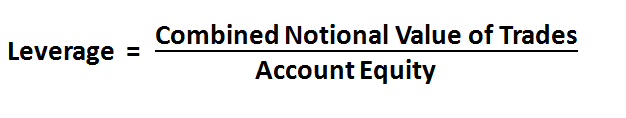

How to Calculate Leverage

Leverage is one of the simplest concepts of trading that most traders misunderstand. The definition of leverage is controlling trades that have a greater value than the amount deposited into our account. So if we have $50,000 worth of trades and we have $10,000 deposited into our account, we are using 5x effective leverage ($50,000 / $10,000 = 5).

So if we have a 40k EURUSD trade, it is a 40,000 Euro or $53,520 trade size (40,000 x 1.3380 = $53,520). 1.3380 equaling the current EURUSD exchange rate. If we have a 25k GBPJPY trade, it is a 25,000 British Pounds or $42,150 (25,000 x 1.6860). 1.6860 equaling the current GBPUSD exchange rate. Once all of our positions have been converted to their notional value in US Dollar terms, we then add the values for each trade altogether and divide them by our account’s equity. The result will be how much leverage we are using.

How Much Leverage Can We Use?

So now that we know how much leverage we are effectively using in our

accounts, how much leverage should we use? The Forex market is very

generous with its available leverage. In the United States, traders can

use up to 50:1 leverage, in the UK, 200:1 leverage, and in some parts of

the world, as much as 400:1 leverage can be used! But we don’t want to

use leverage just because we can; we need to analyze how much leverage

we should use just like we would analyze a trading strategy before we

use it.

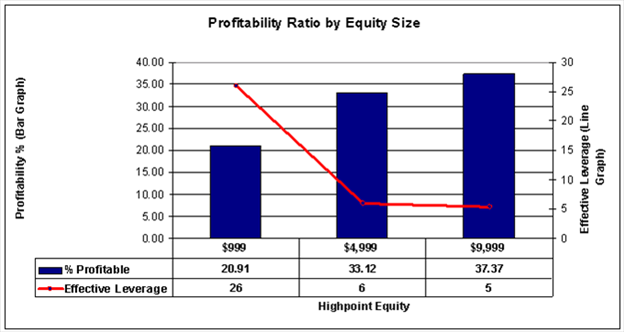

The chart above shows that of accounts using 26 times effective

leverage, only 21% of those accounts were profitable. For accounts using

6 times effective leverage, 33% of those accounts were profitable. And

for the final group of accounts that used 5 times effective leverage,

37% of those account were profitable. So we can clearly see that the

amount of leverage used is inversely correlated to the likelihood of

being profitable. The less leveraged we used, the more likely we were to

being profitable.

Lightly Leveraged

Using leverage in the Forex market is common, but many traders ignore

how much leverage is actually being used. We now know how easy it is to

calculate leverage using notional value and the maximum amount of

leverage we can use at any given time (10x).