Human Traders vs AI Trading Bots: Who Really Has the Edge?

So, who truly has the edge — humans or AI? The answer may surprise you.

Where AI Dominates

AI and algorithmic trading systems have clear strengths:

-

Speed & Execution: Trades are placed faster than any human can react.

-

Data Processing: Thousands of instruments can be monitored simultaneously.

-

Consistency: AI sticks to its rules without fear, greed, or hesitation.

-

Repetitive Strategies: Arbitrage, scalping, and statistical models are handled flawlessly.

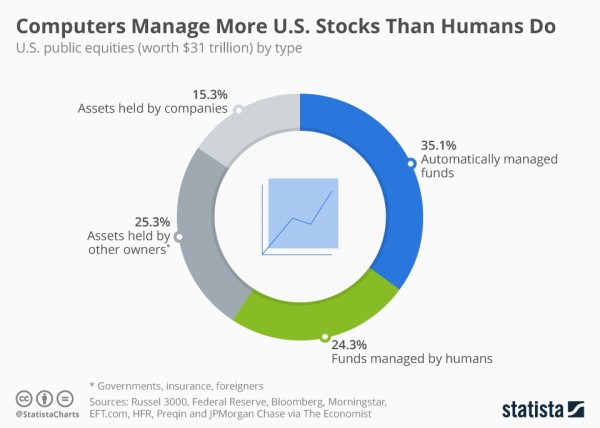

💡 Fact: Studies show that AI executes over 70% of U.S. equity trading volume in some sectors. That’s proof of its dominance in structured, liquid markets.

For high-frequency and repeatable strategies, AI is clearly the superior performer.

Where Humans Still Shine

Despite AI’s speed, humans outperform when:

-

Markets react to sudden events – like geopolitical developments or economic shocks.

-

Qualitative insights matter – news interpretation, sentiment, and context are crucial.

-

Creative strategy development – humans innovate for conditions AI has never seen.

-

Liquidity traps and manipulation – spotting anomalies that may fool AI systems.

Example: During a recent gold spike, AI executed multiple trades perfectly, but a human trader avoided an early stop-out by interpreting sudden market sentiment changes — preventing losses that the AI could not anticipate.

The Real Advantage: Human + AI

It’s not Humans vs AI — it’s Humans + AI. Combining the two maximizes strengths while minimizing weaknesses:

-

AI: handles execution, speed, and disciplined risk management.

-

Humans: provide strategy, judgment, and adapt to unexpected conditions.

This approach ensures better consistency, reduced emotional mistakes, and the ability to capitalize on opportunities AI alone may miss.

Key Takeaways for Traders

-

Leverage AI as a tool, not a replacement. It’s perfect for execution and analytics.

-

Human judgment is irreplaceable for context-driven decisions and market anomalies.

-

Combine AI with your trading strategy to maximize performance and reduce risk.

-

Stay disciplined — whether you trade manually or with AI assistance.

Final Thoughts

Markets are driven by more than numbers — they’re about fear, greed, liquidity, and human behavior. Until AI can fully replicate this complexity, skilled human traders will remain essential.

The future of trading isn’t Humans vs AI — it’s Humans + AI.

Daily Market Updates For real-time updates on Gold and other major pairs, make sure to follow my daily analysis channel here: https://www.mql5.com/en/channels/structured_fx_trades

💬 Your turn: How do you combine AI with human insight in your trading? Comment below and share your experience!