If ECB did anything last week, it was...get people buy champagne to celebrate the EURUSD at parity. Let's see.

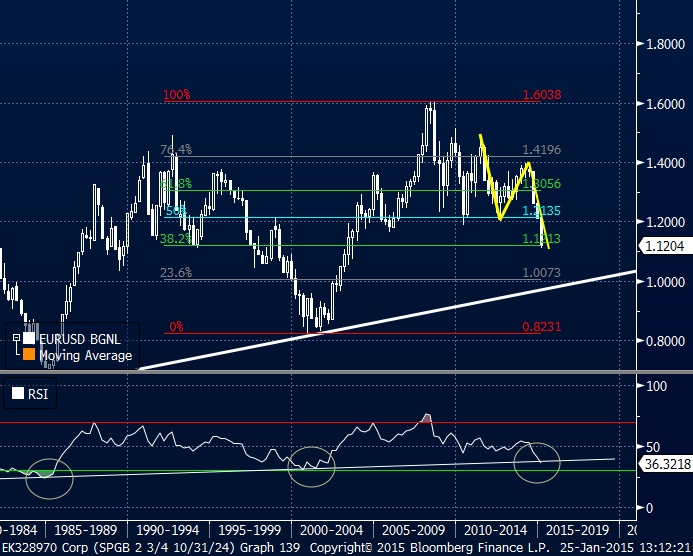

Figure 1. Zooming out

Technically the EURUSD looks at a very important juncture, the 1.12 level is a big thing. If it holds, bounce to 1.21 likely. In case it doesn't…well, parity is the next stop then, quick (months) and dirty (volatile). Actually, just looking at the chart above you get a déjà vu feeling – similar pattern as in the previous mega cycle.

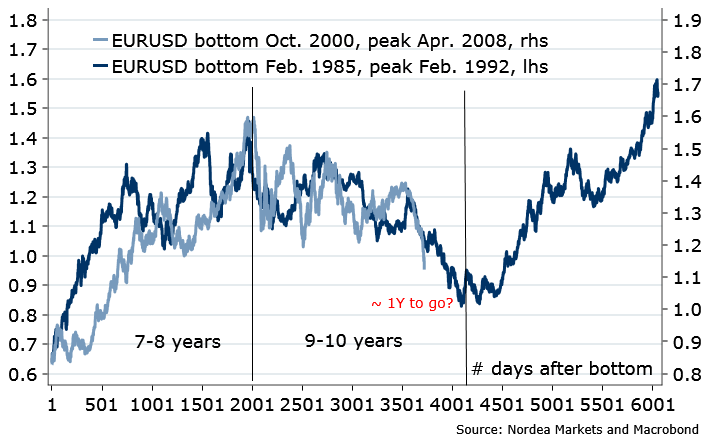

Figure 2. Something something...similar (they say)

Fundamentally, they say, it is the Fed tightening prospects driving the USD... but. A full Fed funds hike has been priced out since December. And, once again, look at the major two Fed funds hiking cycles in ’94 and ’04 (yes, every 10-year...or 11 now): the USD rose before the hike, and fell back after.

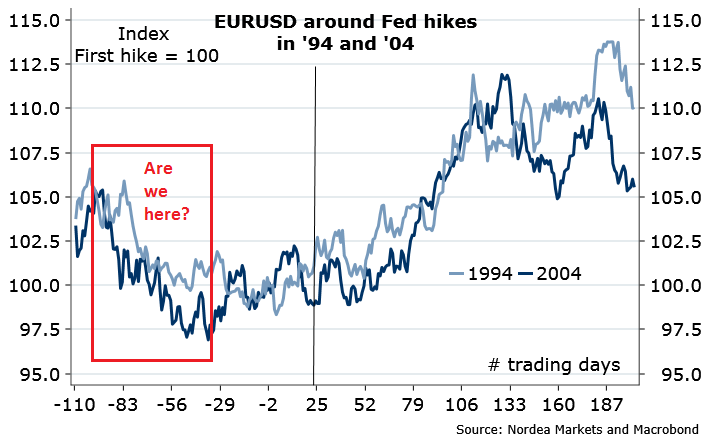

Figure 3. Will it be different this time?

Are we getting Fed funds hike this summer? Our economists say, yes we (still) can. The FOMC meeting this week should signal they are staying cool with what’s happened (recent speeches suggest so). Timing of the first lift-off could be hinted by this week’s key data point, Friday’s US employment cost index, which has been somewhat more in line with leading indicators than the payrolls’ hourly earnings data.

As for the EUR side this week, a deflationary print on Friday. The consensus expects arond -0.5% y/y, so does the market prices, and then pricing goes... -0.6% to -0.7 until October. But negative inflation actually helps the currency (boosting real rates). And ECB has used all the bullets for now anyway. If history is a guide we should at least get a bounce in EURUSD this week (post QE announcement), also the rates (Bund yield 0.36%, just about right! Not).

With ECB’s QEphoria, prospects of further expansion from the BoJ, more cuts from those who still have what to cut (Markets), AND first signals of global growth outlook improving (me)…difficult not to fancy some “high yielding” EMs like ZAR, TRY (6M forward “carry” around 3%), let alone RUB (8.5%...really?).

Which reminds me of… “When the wind is strong enough, even turkeys can fly”