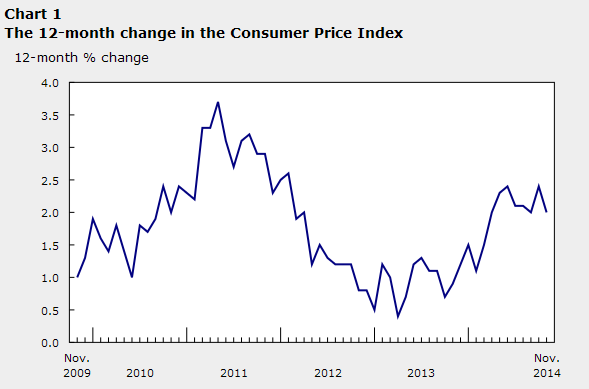

Trading News Events: Canada Consumer Price Index (CPI) - To Hold Above 2% Target for Eighth Consecutive Month

What’s Expected:

Why Is This Event Important:

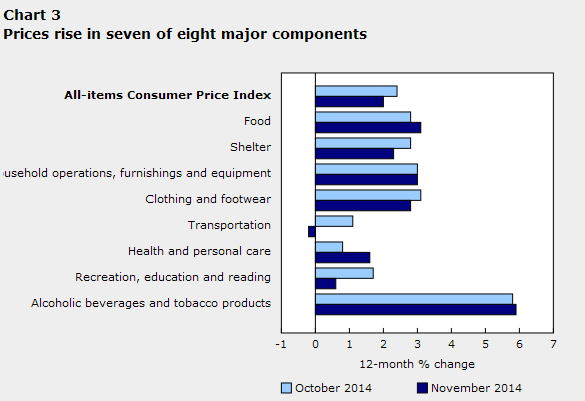

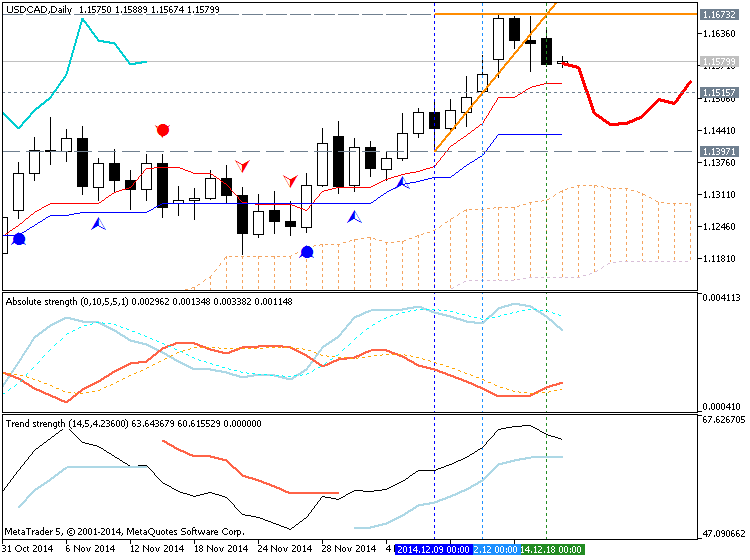

However, another uptick in the core rate of inflation may heighten the

appeal of the loonie as sticky price growth undermines the BoC’s scope

to retain the current policy, and Governor Stephen Poloz may sound

increasingly hawkish in 2015 as the central bank head highlights the

broadening recovery in the Canadian economy.

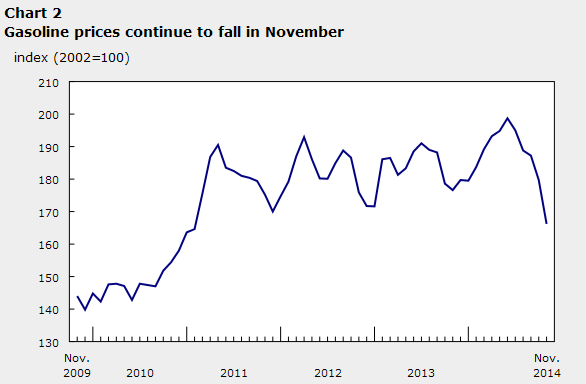

However, the pickup in economic activity along with the expansion in

private sector consumption may produce a stronger-than-expected

inflation report, and sticky price pressures may generate a near-term

pullback in USD/CAD as it fuels bets for a BoC rate hike.

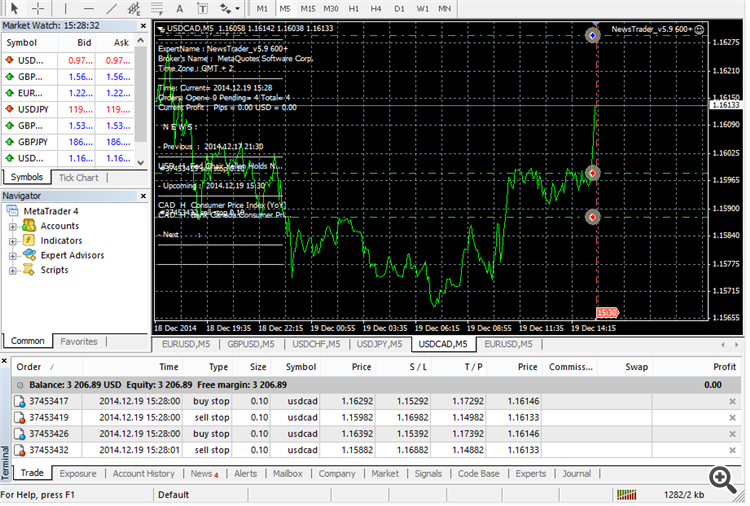

How To Trade This Event Risk

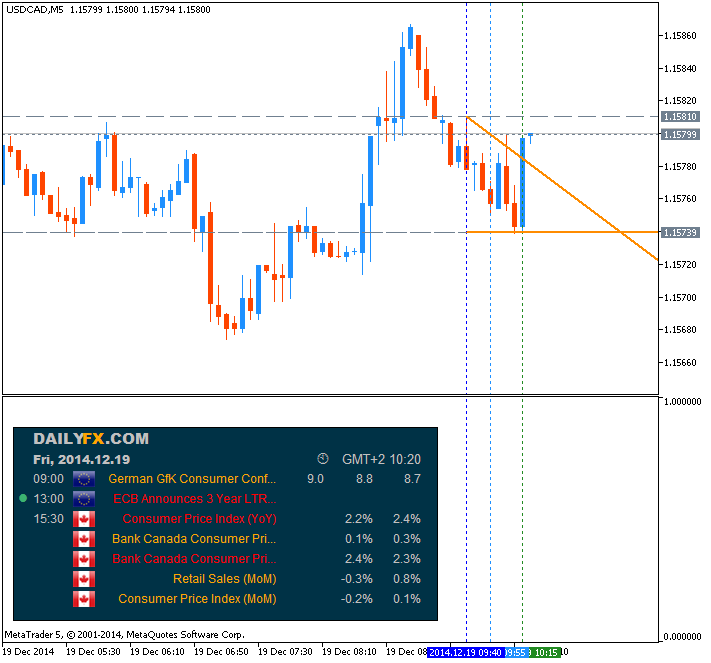

Bearish CAD Trade: Headline & Core Inflation Miss Market Forecast

- Need green, five-minute candle following a dismal CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

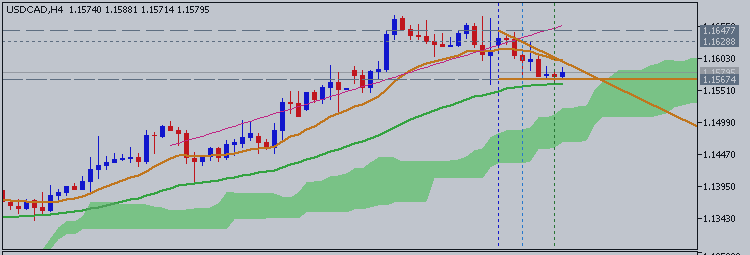

USD/CAD Daily Chart

- USD/CAD may have carved a near-term top in December as the RSI quickly turns around from overbought territory.

- Interim Resistance: 1.1700 pivot to 1.1715 (100% expansion)

- Interim Support: 1.1470 (50% expansion) to 1.1480 (38.2% expansion)

| Period | Data Released | Survey | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| OCT 2014 |

11/21/2014 12:30 GMT | 2.1% | 2.4% | -27 | -29 |