The euro started trade on Friday higher against most of its peers but could struggle to extend gains if U.S. employment data due later in the day re-energise dollar bulls.

Investors were forced to trim bearish positions in the common currency overnight after the European Central Bank (ECB) disappointed some by not immediately expanding its stimulus program.

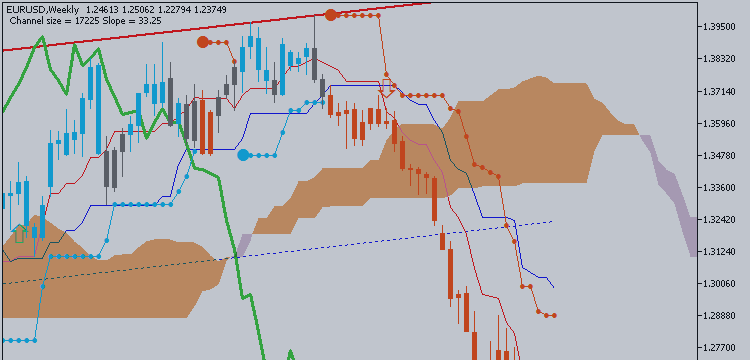

As a result, the euro jumped to $1.2457 from a two-year trough around $1.2279. It has since steadied at $1.2380. It climbed towards a six-year peak of 149.12 yen set on Nov. 20, rising as far as 148.95 before losing a bit of steam to last fetch 148.27 yen.

If there was one reason tempering a more aggressive squeeze in short euro positions, it would have been ECB President Mario Draghi's promise to decide early next year whether to take further action to revive the euro zone economy.

Importantly, Draghi also signaled that he would not allow opposition from Germany or anyone else to stop it.

"Taking on board likely further falls in headline HICP, Draghi's comments give succor to the idea that further policy moves are coming at the next couple of meetings," said Gavin Friend, senior markets strategist at National Australia Bank.