The other 10 top market minds from whom you must learn successful money strategies.

Here is the continuation of the list published earlier today:

11. Friedrich Engels

1820-95

Industrialist, political theorist

Indispensible Wisdom: Profit from cheap labor

Influenced by: Georg Wilhelm Friedrich Hegel

Bestseller: The Condition of the Working Class in England (1844)

Money Quote: "The proletarians have nothing to lose but their chains."

Fundamentals: Engels was born rich--the heir to a cotton fortune--and he loved the good life: champagne, foxhunting, late-night soirees--all while delivering a withering critique of capitalism. He coauthored The Communist Manifesto with Karl Marx in 1848 and financially supported him--to no one's surprise, he was bad with money--while Marx wrote his magnum opus, Das Kapital.

Invest like Engels: At the heart of Engels' theories: Capitalists profit by "exploiting" workers. It's hard to argue with that. Investing in businesses with low labor costs remains a sound way of making money. Two blue chips: McDonald's, which yields 3%, and Wal-Mart, with a 2.5% dividend yield.

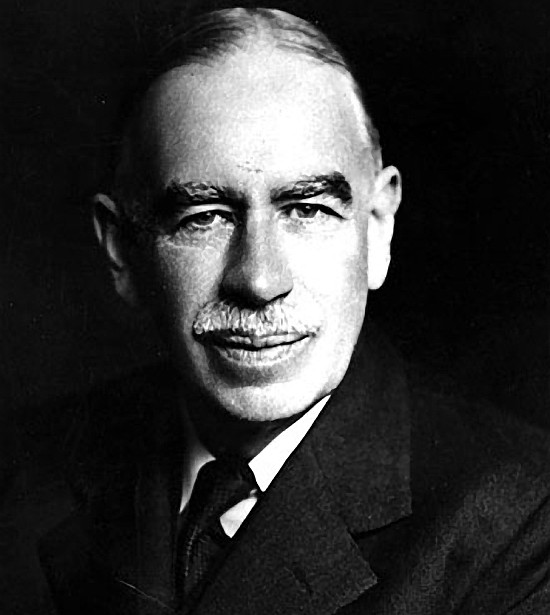

12. John Maynard Keynes

1883-1946

Economist

Indispensible Wisdom: Invest, don't speculate

Bestseller: The Economic Consequences of the Peace (1919)

Money Quote: "Investing is an activity of forecasting the yield over the life of the asset; speculation is the activity of forecasting the psychology of the market."

Fundamentals: Although Keynes is known for pioneering macroeconomic theory, he was also a great investor. Throughout the 1920s he was an avid speculator, gambling on currencies and commodities. Later he moved into stocks, eschewing the "animal spirits" of an irrational market for companies with good long-term prospects. Despite being nearly wiped out three times (1920, 1929, 1937), he achieved a 16% annualized return between 1922 and 1946.

Invest Like Keynes: Buy well-managed companies that pay a solid dividend, like those found in Vanguard's Dividend Appreciation Index Fund.

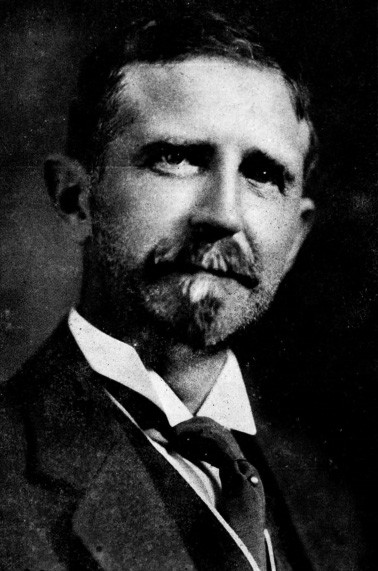

13. Roger Babson

1875-1967

Founder, Babson Statistical Organization

Indispensible Wisdom: Diversification, caution and no margin debt

Influenced By: Sir Isaac Newton

Crystal Ball Cred: In September 1929 warned investors of an impending crash

Money Quote: "More people should learn to tell their dollars where to go instead of asking them where they went."

Fundamentals: The eventual founder of Babson College was educated as an engineer at MIT but taught himself statistical analysis while recuperating from tuberculosis. He bought a typewriter, developed a market index based on Newton's law of action and reaction (lower prices must follow higher prices and vice versa) and attracted 30,000 newsletter subscribers.

Invest Like Babson: Buy PowerShares' FTSE RAFI 1000 Index ETF or FTSE RAFI All World 3000. Both are broadly diversified in stocks that have a lower price-to-book value and high cash flow and pay a dividend.

14. Thomas Rowe Price Jr.

1898–1983

Founder, T. Rowe Price & Associates

Indispensable Wisdom: Growth stocks for the long run

Money Quote: “[Most big fortunes result] from investing in a growing business and staying with it through thick and thin.”

Lasting Innovation: Price hated selling stocks on commission, so when he launched his own firm in 1937 he charged a fee based on assets managed, a radical concept at the time that is now industry standard.

Fundamentals: Price sought out stocks with earnings and dividends rising faster than inflation and economic growth. Some stocks are better than others, he reasoned, despite the prevailing view that stocks fluctuate en masse with the economic cycle.

Invest Like Price: Growth Stock Fund, launched in 1950, and New Horizons, which dates from 1960, are two of the oldest T. Rowe Price funds that still employ the founder’s core growth strategy. Over the past decade both have trounced the S&P 500.

15. George Soros

Age: 83

Founder, Quantum Fund

Indispensable Wisdom: Discount the obvious, bet on the unexpected

Influenced By: Karl Popper

Crystal Ball Cred: Massively shorted the British pound just before it collapsed after withdrawing from the European Exchange Rate Mechanism in 1992.

Fundamentals: The Hungarian hedge fund legend and global macro pioneer has made a career by anticipating currency crises. His bet against the Japanese yen helped make him the highest-earning hedge fund manager in 2013, with a personal windfall of $4 billion. Bases his bets on his home-brewed "reflexivity" social theory, which postulates feedback loops in the market when investors chase higher prices, causing bubbles.

Invest Like Soros: His biggest recent bet is on Israeli pharmaceutical giant Teva. He also is siding with Carl Icahn--and against Bill Ackman--by going long on Herbalife.

16. William Sharpe

Age: 80

Cofounder, Financial Engines

Indispensable Wisdom: Understand risk

Stockholm Calling: Shared the 1990 Nobel Prize in economics with mentor Harry Markowitz and Chicago's Merton Miller for his capital asset pricing model

Money Quote: "Some investments do have higher expected returns than others. By and large they're the ones that will do the worst in bad times."

Fundamentals: His best-known academic work illustrates the relationship between risk and expected returns. The famous "Sharpe ratio" gauges whether portfolio gains are the result of a manager's investment skill or excessive risk-taking. Pro tip: There isn't a lot of "skill" out there.

Invest Like Sharpe: Model your expected returns to your risk tolerance using probabilistic Monte Carlo simulations. If you don't have the math chops for that, use Vanguard's simple retirement-nest-egg calculator (vanguard.com/nesteggcalculator) to gauge asset allocation choices, and buy low-cost diversified index funds and ETFs.

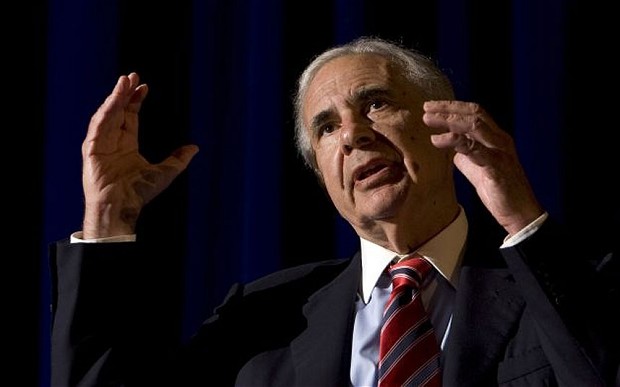

17. Carl Icahn

Age: 78

Founder, Icahn Enterprises

Indispensible Wisdom: Complain loudly

Inspiration For: Gordon Gekko's line from Wall Street "If you need a friend, get a dog."

Fundamentals: Icahn rose to prominence as a corporate raider in the 1980s, taking hostile control of underperforming companies and ruthlessly cashing in. Now he's been reincarnated as an activist investor, but underneath, the leopard has the same spots. His current MO: Take a minority stake in a listed company, demand board seats and aggressively agitate in the interest of shareholders. Management is often not amused, but the stock usually pops.

Invest Like Icahn: If you want Carl in your corner--and you probably do--you can buy shares in his publicly traded holding company, Icahn Enterprises, which has trounced the S&P 500 since 2000 (22% versus 4%). Among its largest holdings are Apple and Chesapeake Energy, the natural gas producer whose CEO, Aubrey McClendon, Icahn helped push out of the company.

18. Jeremy Grantham

Age: 75

Co-Founder, Grantham Mayo van Otterloo

Indispensable Wisdom: Over time asset prices and profit margins revert to long-term averages

Crystal Ball Cred: His quarterly shareholder letter warned of inflating bubbles in the Japanese stock market in the 1980s, the first dot-com craze in the 1990s and the housing crisis in the 2000s.

Fundamentals: Unless you are a genius on the order of Warren Buffett or Peter Lynch, picking individual winners is next to impossible. So Grantham focuses on Broader Slices Of The Market: He had massive success with small caps in the 1970s and international value stocks in the 1980s. Lesson? Stop trying to be a stock picker, and look for value on a grander scale.

Invest Like Grantham: Think farmland. He has been forecasting a global food crisis for several years and actually thinks that buying a farm is the best move. But short of donning overalls, you could just invest in publicly traded food companies like Monsanto or Tyson Foods.

19. Alicia Munnell

Age: 71

Economist

Indispensable Wisdom: Make savings automatic

Influenced By: Robert Ball, commissioner of Social Security under three different presidents

Money Quote: "[The 401(k)] was supposed to be money that you could use to go to Paris. Instead, it's become our basic system."

Bestseller: Managing Your Money in Retirement (2010)

Fundamentals: A 20-year veteran of the Boston Fed and a former member of the President's Council of Economic Advisers who now teaches at Boston College, Munnell sounded the alarm early that Americans weren't saving enough for retirement. A longtime advocate of pushing people to save through automatic enrollment in 401(k) plans, she recently has become concerned that overly spooked retirees won't spend enough to maximize their well-being.

Plan Like Munnell: Run your retirement numbers--most investors have no clue how much they should save or spend. The online calculator at basic.esplanner.com can help you.

20. Jeffrey Gundlach

Age: 54

Founder, Doubleline Capital

Indispensible Wisdom: Discipline beats emotion

Nickname: The King of Bonds

Crystal Ball Cred: Publicly called the mortgage-securities crash in 2007

Money Quote: "When you're in a major market downturn, the beta eats the alpha."

Fundamentals: After being unceremoniously fired from the $12 billion TCW Total Return Bond Fund in 2009, Gundlach got his revenge by founding Double Line Capital, which is now more than four times bigger than his old fund, with $50 billion in assets. A Dartmouth philosophy and math major, Gundlach is a big thinker with a bloodless, contrarian approach who doesn't fall in love with his positions: "You have to be able to abandon your old friends."

Invest Like Gundlach: Buy his DoubleLine Core Fixed Income Fund or Emerging Markets Fixed Income Fund. He's also bullish on the U.S. dollar, which you can play using PowerShares DB US Dollar Index ETF.