- European Central Bank (ECB) to Retain Current Policy Ahead of Next T-LTRO in December.

- Will ECB Expand the Scope & Attractiveness of Non-Standard Measures?

The EUR/USD may face another selloff in the days ahead should the

European Central Bank (ECB) adopt a more dovish tone and offer

additional monetary support to prop up the ailing economy.

What’s Expected:

Why Is This Event Important:

The ECB may take a more aggressive approach in expanding its balance-sheet amid the growing threat for deflation, but we may see a relief rally in the EUR/USD should the Governing Council merely make an attempt to buy more time.

Nevertheless, ECB President Mario Draghi may promote a wait-and-see

approach as the central bank continues to assess the impact of the

non-standard measures, and the Euro may face a more meaningful rebound

in the days ahead if we see more of the same from the Governing

Council’s October 2 meeting.

How To Trade This Event Risk

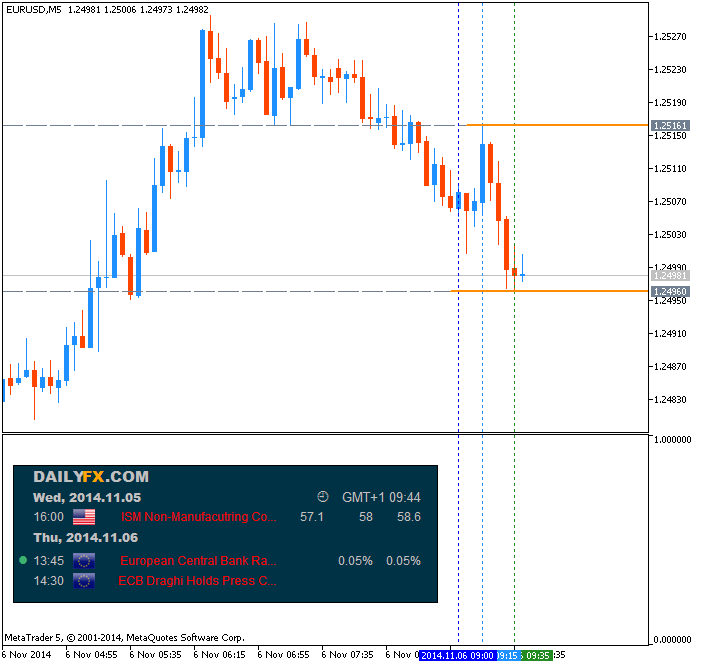

Bearish EUR Trade: Governing Council Shows Greater Willingness to Implement More Easing

- Need red, five-minute candle following the updated forward-guidance to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

EUR/USD Daily Chart

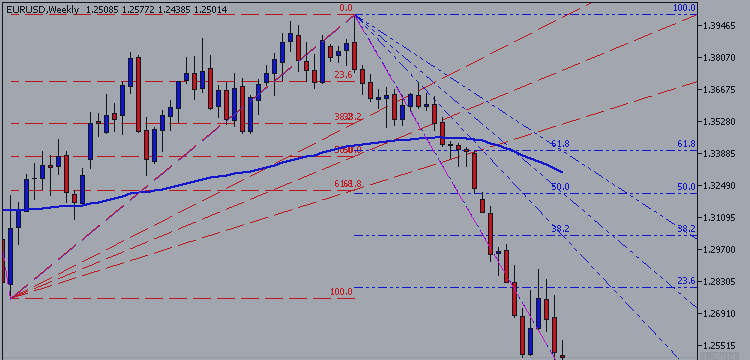

- Despite the range-bound price action in EUR/USD, the long-term outlook remains bearish as the RSI retains the downward momentum carried over from the previous year.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2620 (50.0% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2470 (78.6% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| OCT 2014 | 10/02/2014 11:45 GMT | 0.05% | 0.05% | +5 | +20 |