- Price is considered range bound when it is not trending up or down.

- We can connect swing highs and lows together to create support and resistance levels.

- Entering a trade with a positive Risk:Reward ratio can tip the odds in our favor.

Identifying a Sideways Market

Our first step in range trading is to identify currency pairs that are moving sideways. We want to avoid currency pairs with prices that are sloping up or are sloping down. We can target whatever time frame and currency pair that we like, as long as recent price action has been more or less sideways.

The image below is of 3 different currency pairs and their recent price moves. The 1st chart is a classic uptrend, the 2nd chart is a classic downtrend, and the 3rd chart is an example of a range. We want to find charts that don’t have a clear direction and are mostly moving sideways like chart #3.

After we have found a few an examples of a potential ranging pair, it is

then time to turn to technical analysis to help us find support and

resistance.

Locating Support & Resistance

The terms “support” and “resistance” are trading jargon used to describe

price levels where prices have bounced off of in the past. So anytime

we see price bounce off a low or bounce off a high, that low and high

price can be considered support or resistance.

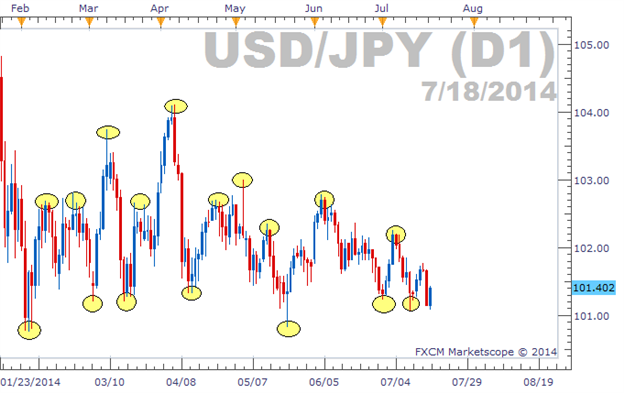

Identifying these highs and lows is very easy in my opinion. I prefer using a yellow ellipse on my Marketscope 2.0 charts to highlight the times where price has “bounced” from either a high or a low.

The chart above shows a USDJPY daily chart with highlighted swing highs

and lows. It looks like a mess at this point, but once we connect some

of the ellipses together using the line tool, potential trading

opportunities can be discovered.

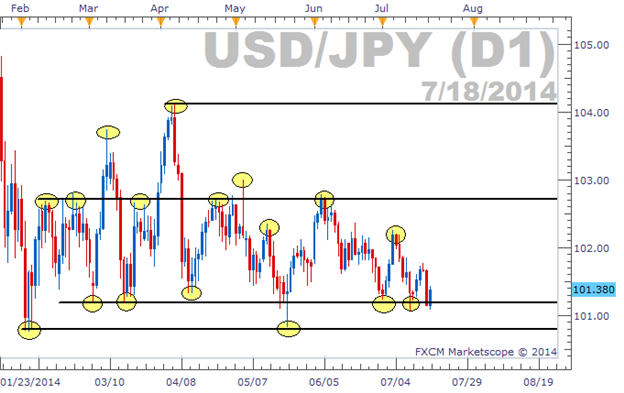

There are differing opinions on how lines should be drawn. I draw lines using a two-step process:

The first step is to identify the highest high price and the lowest low

price, and draw a horizontal line extending from each. The highest and

lowest prices can act as strong support or resistance.

The second step is to identify price levels that touch more than one

ellipse; the more ellipses the better. So in this example, we can see

there were a two main clusters of ellipses that were right around the

same two price levels. We want to draw a horizontal line through both of

those clusters.

The results of these horizontal lines can be seen below.

Trading With a Strong Risk:Reward Ratio

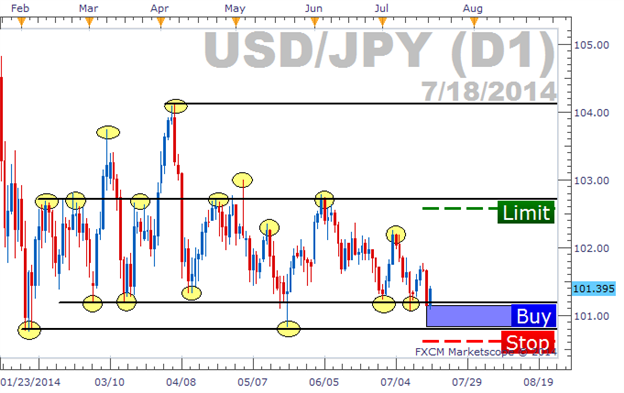

Once our lines are in place, we are now ready to place a trade. Since

these lines caused price to bounce off them in the past, they may cause

price to bounce again in the future. So we want to look to buy when

price is approaching a line from above and look to sell when price is

approaching a line from below.

It turns out that the USDJPY is right at one of the lower lines that we

drew, giving us the possibility of buying at its current level.

Our stop loss should be set beyond the line we are buying at or beyond the lowest low if it is not too far away. Because the lowest low is so close, I’ve opted to set my stop beyond that.

We want our exit strategy to have a positive risk:reward ratio, meaning

we want our profit target (limit) to be further than where we set our

stop. This is a key part of money management that can tip the odds in

our favor.

Keeping that in mind, we also want to try to place our profit target

below the next closest line. This allows price to freely move to our

profit target without being hindered by prior support or resistance

levels.

Revising Strategy for Ranges

Traders that are fortunate enough to create a winning strategy must

never get complacent. Changing market conditions can change your

strategies effectiveness, so we need to be able to adapt. Low volatility

usually leads to more market ranges, so it is good to know how to trade

these types of scenarios.