MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

MQL5 Wizard Techniques you should know (Part 81): Using Patterns of Ichimoku and the ADX-Wilder with Beta VAE Inference Learning

This piece follows up ‘Part-80’, where we examined the pairing of Ichimoku and the ADX under a Reinforcement Learning framework. We now shift focus to Inference Learning. Ichimoku and ADX are complimentary as already covered, however we are going to revisit the conclusions of the last article related to pipeline use. For our inference learning, we are using the Beta algorithm of a Variational Auto Encoder. We also stick with the implementation of a custom signal class designed for integration with the MQL5 Wizard.

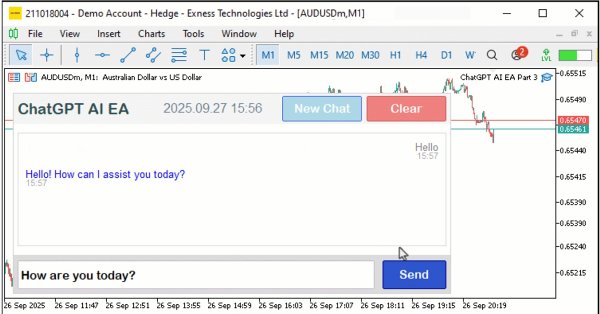

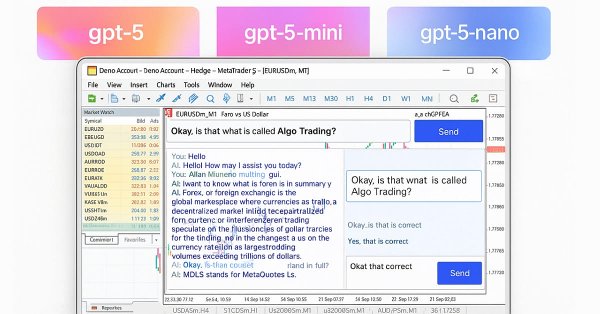

Building AI-Powered Trading Systems in MQL5 (Part 3): Upgrading to a Scrollable Single Chat-Oriented UI

In this article, we upgrade the ChatGPT-integrated program in MQL5 to a scrollable single chat-oriented UI, enhancing conversation history display with timestamps and dynamic scrolling. The system builds on JSON parsing to manage multi-turn messages, supporting customizable scrollbar modes and hover effects for improved user interaction.

From Novice to Expert: Backend Operations Monitor using MQL5

Using a ready-made solution in trading without concerning yourself with the internal workings of the system may sound comforting, but this is not always the case for developers. Eventually, an upgrade, misperformance, or unexpected error will arise, and it becomes essential to trace exactly where the issue originates to diagnose and resolve it quickly. Today’s discussion focuses on uncovering what normally happens behind the scenes of a trading Expert Advisor, and on developing a custom dedicated class for displaying and logging backend processes using MQL5. This gives both developers and traders the ability to quickly locate errors, monitor behavior, and access diagnostic information specific to each EA.

MQL5 Wizard Techniques you should know (Part 80): Using Patterns of Ichimoku and the ADX-Wilder with TD3 Reinforcement Learning

This article follows up ‘Part-74’, where we examined the pairing of Ichimoku and the ADX under a Supervised Learning framework, by moving our focus to Reinforcement Learning. Ichimoku and ADX form a complementary combination of support/resistance mapping and trend strength spotting. In this installment, we indulge in how the Twin Delayed Deep Deterministic Policy Gradient (TD3) algorithm can be used with this indicator set. As with earlier parts of the series, the implementation is carried out in a custom signal class designed for integration with the MQL5 Wizard, which facilitates seamless Expert Advisor assembly.

The MQL5 Standard Library Explorer (Part 1): Introduction with CTrade, CiMA, and CiATR

The MQL5 Standard Library plays a vital role in developing trading algorithms for MetaTrader 5. In this discussion series, our goal is to master its application to simplify the creation of efficient trading tools for MetaTrader 5. These tools include custom Expert Advisors, indicators, and other utilities. We begin today by developing a trend-following Expert Advisor using the CTrade, CiMA, and CiATR classes. This is an especially important topic for everyone—whether you are a beginner or an experienced developer. Join this discussion to discover more.

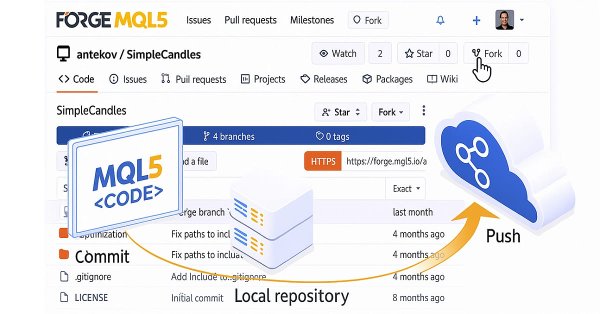

Moving to MQL5 Algo Forge (Part 3): Using External Repositories in Your Own Projects

Let's explore how you can start integrating external code from any repository in the MQL5 Algo Forge storage into your own project. In this article, we finally turn to this promising, yet more complex, task: how to practically connect and use libraries from third-party repositories within MQL5 Algo Forge.

Building AI-Powered Trading Systems in MQL5 (Part 2): Developing a ChatGPT-Integrated Program with User Interface

In this article, we develop a ChatGPT-integrated program in MQL5 with a user interface, leveraging the JSON parsing framework from Part 1 to send prompts to OpenAI’s API and display responses on a MetaTrader 5 chart. We implement a dashboard with an input field, submit button, and response display, handling API communication and text wrapping for user interaction.

Simplifying Databases in MQL5 (Part 2): Using metaprogramming to create entities

We explored the advanced use of #define for metaprogramming in MQL5, creating entities that represent tables and column metadata (type, primary key, auto-increment, nullability, etc.). We centralized these definitions in TickORM.mqh, automating the generation of metadata classes and paving the way for efficient data manipulation by the ORM, without having to write SQL manually.

From Novice to Expert: Animated News Headline Using MQL5 (XI)—Correlation in News Trading

In this discussion, we will explore how the concept of Financial Correlation can be applied to improve decision-making efficiency when trading multiple symbols during major economic events announcement. The focus is on addressing the challenge of heightened risk exposure caused by increased volatility during news releases.

Building AI-Powered Trading Systems in MQL5 (Part 1): Implementing JSON Handling for AI APIs

In this article, we develop a JSON parsing framework in MQL5 to handle data exchange for AI API integration, focusing on a JSON class for processing JSON structures. We implement methods to serialize and deserialize JSON data, supporting various data types like strings, numbers, and objects, essential for communicating with AI services like ChatGPT, enabling future AI-driven trading systems by ensuring accurate data handling and manipulation.

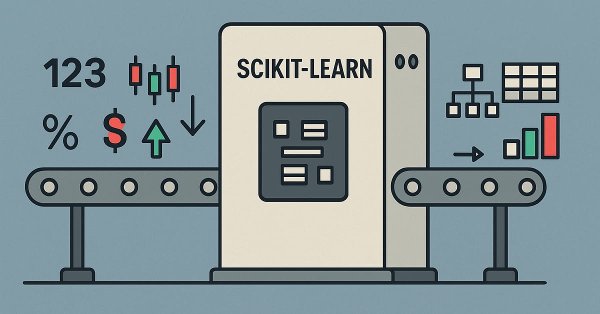

Pipelines in MQL5

In this piece, we look at a key data preparation step for machine learning that is gaining rapid significance. Data Preprocessing Pipelines. These in essence are a streamlined sequence of data transformation steps that prepare raw data before it is fed to a model. As uninteresting as this may initially seem to the uninducted, this ‘data standardization’ not only saves on training time and execution costs, but it goes a long way in ensuring better generalization. In this article we are focusing on some SCIKIT-LEARN preprocessing functions, and while we are not exploiting the MQL5 Wizard, we will return to it in coming articles.

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?

Moving to MQL5 Algo Forge (Part 2): Working with Multiple Repositories

In this article, we are considering one of the possible approaches to organizing the storage of the project's source code in a public repository. We will distribute the code across different branches to establish clear and convenient rules for the project development.

Moving to MQL5 Algo Forge (Part 1): Creating the Main Repository

When working on projects in MetaEditor, developers often face the need to manage code versions. MetaQuotes recently announced migration to GIT and the launch of MQL5 Algo Forge with code versioning and collaboration capabilities. In this article, we will discuss how to use the new and previously existing tools more efficiently.

From Novice to Expert: Animated News Headline Using MQL5 (X)—Multiple Symbol Chart View for News Trading

Today we will develop a multi-chart view system using chart objects. The goal is to enhance news trading by applying MQL5 algorithms that help reduce trader reaction time during periods of high volatility, such as major news releases. In this case, we provide traders with an integrated way to monitor multiple major symbols within a single all-in-one news trading tool. Our work is continuously advancing with the News Headline EA, which now features a growing set of functions that add real value both for traders using fully automated systems and for those who prefer manual trading assisted by algorithms. Explore more knowledge, insights, and practical ideas by clicking through and joining this discussion.

Trend strength and direction indicator on 3D bars

We will consider a new approach to market trend analysis based on three-dimensional visualization and tensor analysis of the market microstructure.

Black Hole Algorithm (BHA)

The Black Hole Algorithm (BHA) uses the principles of black hole gravity to optimize solutions. In this article, we will look at how BHA attracts the best solutions while avoiding local extremes, and why this algorithm has become a powerful tool for solving complex problems. Learn how simple ideas can lead to impressive results in the world of optimization.

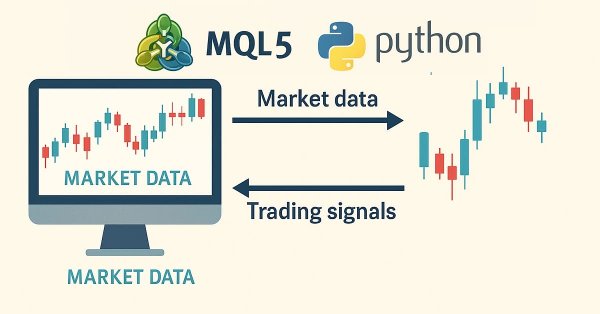

Multi-module trading robot in Python and MQL5 (Part I): Creating basic architecture and first modules

We are going to develop a modular trading system that combines Python for data analysis with MQL5 for trade execution. Four independent modules monitor different market aspects in parallel: volumes, arbitrage, economics and risks, and use RandomForest with 400 trees for analysis. Particular emphasis is placed on risk management, since even the most advanced trading algorithms are useless without proper risk management.

MetaTrader Meets Google Sheets with Pythonanywhere: A Guide to Secure Data Flow

This article demonstrates a secure way to export MetaTrader data to Google Sheets. Google Sheet is the most valuable solution as it is cloud based and the data saved in there can be accessed anytime and from anywhere. So traders can access trading and related data exported to google sheet and do further analysis for future trading anytime and wherever they are at the moment.

From Novice to Expert: Mastering Detailed Trading Reports with Reporting EA

In this article, we delve into enhancing the details of trading reports and delivering the final document via email in PDF format. This marks a progression from our previous work, as we continue exploring how to harness the power of MQL5 and Python to generate and schedule trading reports in the most convenient and professional formats. Join us in this discussion to learn more about optimizing trading report generation within the MQL5 ecosystem.

Simplifying Databases in MQL5 (Part 1): Introduction to Databases and SQL

We explore how to manipulate databases in MQL5 using the language's native functions. We cover everything from table creation, insertion, updating, and deletion to data import and export, all with sample code. The content serves as a solid foundation for understanding the internal mechanics of data access, paving the way for the discussion of ORM, where we'll build one in MQL5.

Getting Started with MQL5 Algo Forge

We are introducing MQL5 Algo Forge — a dedicated portal for algorithmic trading developers. It combines the power of Git with an intuitive interface for managing and organizing projects within the MQL5 ecosystem. Here, you can follow interesting authors, form teams, and collaborate on algorithmic trading projects.

Analyzing binary code of prices on the exchange (Part II): Converting to BIP39 and writing GPT model

Continuing tries to decipher price movements... What about linguistic analysis of the "market dictionary" that we get by converting the binary price code to BIP39? In this article, we will delve into an innovative approach to exchange data analysis and consider how modern natural language processing techniques can be applied to the market language.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

MQL5 Wizard Techniques you should know (Part 79): Using Gator Oscillator and Accumulation/Distribution Oscillator with Supervised Learning

In the last piece, we concluded our look at the pairing of the gator oscillator and the accumulation/distribution oscillator when used in their typical setting of the raw signals they generate. These two indicators are complimentary as trend and volume indicators, respectively. We now follow up that piece, by examining the effect that supervised learning can have on enhancing some of the feature patterns we had reviewed. Our supervised learning approach is a CNN that engages with kernel regression and dot product similarity to size its kernels and channels. As always, we do this in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

CRUD Operations in Firebase using MQL

This article offers a step-by-step guide to mastering CRUD (Create, Read, Update, Delete) operations in Firebase, focusing on its Realtime Database and Firestore. Discover how to use Firebase SDK methods to efficiently manage data in web and mobile apps, from adding new records to querying, modifying, and deleting entries. Explore practical code examples and best practices for structuring and handling data in real-time, empowering developers to build dynamic, scalable applications with Firebase’s flexible NoSQL architecture.

Integrating MQL5 with data processing packages (Part 5): Adaptive Learning and Flexibility

This part focuses on building a flexible, adaptive trading model trained on historical XAUUSD data, preparing it for ONNX export and potential integration into live trading systems.

Python-MetaTrader 5 Strategy Tester (Part 01): Trade Simulator

The MetaTrader 5 module offered in Python provides a convenient way of opening trades in the MetaTrader 5 app using Python, but it has a huge problem, it doesn't have the strategy tester capability present in the MetaTrader 5 app, In this article series, we will build a framework for back testing your trading strategies in Python environments.

From Novice to Expert: Animated News Headline Using MQL5 (VIII) — Quick Trade Buttons for News Trading

While algorithmic trading systems manage automated operations, many news traders and scalpers prefer active control during high-impact news events and fast-paced market conditions, requiring rapid order execution and management. This underscores the need for intuitive front-end tools that integrate real-time news feeds, economic calendar data, indicator insights, AI-driven analytics, and responsive trading controls.

Price Action Analysis Toolkit Development (Part 35): Training and Deploying Predictive Models

Historical data is far from “trash”—it’s the foundation of any robust market analysis. In this article, we’ll take you step‑by‑step from collecting that history to using it to train a predictive model, and finally deploying that model for live price forecasts. Read on to learn how!

Portfolio optimization in Forex: Synthesis of VaR and Markowitz theory

How does portfolio trading work on Forex? How can Markowitz portfolio theory for portfolio proportion optimization and VaR model for portfolio risk optimization be synthesized? We create a code based on portfolio theory, where, on the one hand, we will get low risk, and on the other, acceptable long-term profitability.

Algorithmic trading based on 3D reversal patterns

Discovering a new world of automated trading on 3D bars. What does a trading robot look like on multidimensional price bars? Are "yellow" clusters of 3D bars able to predict trend reversals? What does multidimensional trading look like?

Price Action Analysis Toolkit Development (Part 34): Turning Raw Market Data into Predictive Models Using an Advanced Ingestion Pipeline

Have you ever missed a sudden market spike or been caught off‑guard when one occurred? The best way to anticipate live events is to learn from historical patterns. Intending to train an ML model, this article begins by showing you how to create a script in MetaTrader 5 that ingests historical data and sends it to Python for storage—laying the foundation for your spike‑detection system. Read on to see each step in action.

From Novice to Expert: Reporting EA — Setting up the work flow

Brokerages often provide trading account reports at regular intervals, based on a predefined schedule. These firms, through their API technologies, have access to your account activity and trading history, allowing them to generate performance reports on your behalf. Similarly, the MetaTrader 5 terminal stores detailed records of your trading activity, which can be leveraged using MQL5 to create fully customized reports and define personalized delivery methods.

MetaTrader tick info access from MQL5 services to Python application using sockets

Sometimes everything is not programmable in the MQL5 language. And even if it is possible to convert existing advanced libraries in MQL5, it would be time-consuming. This article tries to show that we can bypass Windows OS dependency by transporting tick information such as bid, ask and time with MetaTrader services to a Python application using sockets.

From Novice to Expert: Animated News Headline Using MQL5 (VII) — Post Impact Strategy for News Trading

The risk of whipsaw is extremely high during the first minute following a high-impact economic news release. In that brief window, price movements can be erratic and volatile, often triggering both sides of pending orders. Shortly after the release—typically within a minute—the market tends to stabilize, resuming or correcting the prevailing trend with more typical volatility. In this section, we’ll explore an alternative approach to news trading, aiming to assess its effectiveness as a valuable addition to a trader’s toolkit. Continue reading for more insights and details in this discussion.

Population ADAM (Adaptive Moment Estimation)

The article presents the transformation of the well-known and popular ADAM gradient optimization method into a population algorithm and its modification with the introduction of hybrid individuals. The new approach allows creating agents that combine elements of successful decisions using probability distribution. The key innovation is the formation of hybrid population individuals that adaptively accumulate information from the most promising solutions, increasing the efficiency of search in complex multidimensional spaces.