MTF indicators as the technical analysis tool

Most of traders agree that the current market state analysis starts with the evaluation of higher chart timeframes. The analysis is performed downwards to lower timeframes until the one, at which deals are performed. This analysis method seems to be a mandatory part of professional approach for successful trading. In this article, we will discuss multi-timeframe indicators and their creation ways, as well as we will provide MQL5 code examples. In addition to the general evaluation of advantages and disadvantages, we will propose a new indicator approach using the MTF mode.

DiNapoli trading system

The article describes the Fibo levels-based trading system developed by Joe DiNapoli. The idea behind the system and the main concepts are explained, as well as a simple indicator is provided as an example for more clarity.

A Step-by-Step Guide on Trading the Break of Structure (BoS) Strategy

A comprehensive guide to developing an automated trading algorithm based on the Break of Structure (BoS) strategy. Detailed information on all aspects of creating an advisor in MQL5 and testing it in MetaTrader 5 — from analyzing price support and resistance to risk management

Creating an assistant in manual trading

The number of trading robots used on the currency markets has significantly increased recently. They employ various concepts and strategies, however, none of them has yet succeeded to create a win-win sample of artificial intelligence. Therefore, many traders remain committed to manual trading. But even for such specialists, robotic assistants or, so called, trading panels, are created. This article is yet another example of creating a trading panel from scratch.

Comparative analysis of 10 flat trading strategies

The article explores the advantages and disadvantages of trading in flat periods. The ten strategies created and tested within this article are based on the tracking of price movements inside a channel. Each strategy is provided with a filtering mechanism, which is aimed at avoiding false market entry signals.

How to Develop an Expert Advisor using UML Tools

This article discusses creation of Expert Advisors using the UML graphical language, which is used for visual modeling of object-oriented software systems. The main advantage of this approach is the visualization of the modeling process. The article contains an example that shows modeling of the structure and properties of an Expert Advisor using the Software Ideas Modeler.

Websockets for MetaTrader 5

Before the introduction of the network functionality provided with the updated MQL5 API, MetaTrader programs have been limited in their ability to connect and interface with websocket based services. But of course this has all changed, in this article we will explore the implementation of a websocket library in pure MQL5. A brief description of the websocket protocol will be given along with a step by step guide on how to use the resulting library.

Creating Active Control Panels in MQL5 for Trading

The article covers the problem of development of active control panels in MQL5. Interface elements are managed by the event handling mechanism. Besides, the option of a flexible setup of control elements properties is available. The active control panel allows working with positions, as well setting, modifying and deleting market and pending orders.

Genetic Algorithms - It's Easy!

In this article the author talks about evolutionary calculations with the use of a personally developed genetic algorithm. He demonstrates the functioning of the algorithm, using examples, and provides practical recommendations for its usage.

Creating a Multi-Currency Indicator, Using a Number of Intermediate Indicator Buffers

There has been a recent rise of interest in the cluster analyses of the FOREX market. MQL5 opens up new possibilities of researching the trends of the movement of currency pairs. A key feature of MQL5, differentiating it from MQL4, is the possibility of using an unlimited amount of indicator buffers. This article describes an example of the creation of a multi-currency indicator.

Evaluation of Trade Systems - the Effectiveness of Entering, Exiting and Trades in General

There are a lot of measures that allow determining the effectiveness and profitability of a trade system. However, traders are always ready to put any system to a new crash test. The article tells how the statistics based on measures of effectiveness can be used for the MetaTrader 5 platform. It includes the class for transformation of the interpretation of statistics by deals to the one that doesn't contradict the description given in the "Statistika dlya traderov" ("Statistics for Traders") book by S.V. Bulashev. It also includes an example of custom function for optimization.

MQL5 Cookbook: Implementing Your Own Depth of Market

This article demonstrates how to utilize Depth of Market (DOM) programmatically and describes the operation principle of CMarketBook class, that can expand the Standard Library of MQL5 classes and offer convenient methods of using DOM.

Creating Tick Indicators in MQL5

In this article, we will consider the creation of two indicators: the tick indicator, which plots the tick chart of the price and tick candle indicator, which plot candles with the specified number of ticks. Each of the indicators writes the incoming prices into a file, and uses the saved data after the restart of the indicator (these data also can be used by the other programs)

Learn how to design different Moving Average systems

There are many strategies that can be used to filter generated signals based on any strategy, even by using the moving average itself which is the subject of this article. So, the objective of this article is to share with you some of Moving Average Strategies and how to design an algorithmic trading system.

Library for easy and quick development of MetaTrader programs (part XXVIII): Closure, removal and modification of pending trading requests

This is the third article about the concept of pending requests. We are going to complete the tests of pending trading requests by creating the methods for closing positions, removing pending orders and modifying position and pending order parameters.

Creating Neural Network EAs Using MQL5 Wizard and Hlaiman EA Generator

The article describes a method of automated creation of neural network EAs using MQL5 Wizard and Hlaiman EA Generator. It shows you how you can easily start working with neural networks, without having to learn the entire body of theoretical information and writing your own code.

Advanced Adaptive Indicators Theory and Implementation in MQL5

This article will describe advanced adaptive indicators and their implementation in MQL5: Adaptive Cyber Cycle, Adaptive Center of Gravity and Adaptive RVI. All indicators were originally presented in "Cybernetic Analysis for Stocks and Futures" by John F. Ehlers.

Forecasting Time Series (Part 1): Empirical Mode Decomposition (EMD) Method

This article deals with the theory and practical use of the algorithm for forecasting time series, based on the empirical decomposition mode. It proposes the MQL implementation of this method and presents test indicators and Expert Advisors.

Learn how to design a trading system by Fibonacci

In this article, we will continue our series of creating a trading system based on the most popular technical indicator. Here is a new technical tool which is the Fibonacci and we will learn how to design a trading system based on this technical indicator.

Graphical Interfaces X: Updates for Easy And Fast Library (Build 3)

The next version of the Easy And Fast library (version 3) is presented in this article. Fixed certain flaws and added new features. More details further in the article.

Auto detection of extreme points based on a specified price variation

Automation of trading strategies involving graphical patterns requires the ability to search for extreme points on the charts for further processing and interpretation. Existing tools do not always provide such an ability. The algorithms described in the article allow finding all extreme points on charts. The tools discussed here are equally efficient both during trends and flat movements. The obtained results are not strongly affected by a selected timeframe and are only defined by a specified scale.

Library for easy and quick development of MetaTrader programs (part XXXIV): Pending trading requests - removing and modifying orders and positions under certain conditions

In this article, we will complete the description of the pending request trading concept and create the functionality for removing pending orders, as well as modifying orders and positions under certain conditions. Thus, we are going to have the entire functionality enabling us to develop simple custom strategies, or rather EA behavior logic activated upon user-defined conditions.

Developing graphical interfaces for Expert Advisors and indicators based on .Net Framework and C#

The article presents a simple and fast method of creating graphical windows using Visual Studio with subsequent integration into the Expert Advisor's MQL code. The article is meant for non-specialist audiences and does not require any knowledge of C# and .Net technology.

The Basics of Object-Oriented Programming

You don't need to know what are polymorphism, encapsulation, etc. all about in to use object-oriented programming (OOP)... you may simply use these features. This article covers the basics of OOP with hands-on examples.

Developing a self-adapting algorithm (Part II): Improving efficiency

In this article, I will continue the development of the topic by improving the flexibility of the previously created algorithm. The algorithm became more stable with an increase in the number of candles in the analysis window or with an increase in the threshold percentage of the overweight of falling or growing candles. I had to make a compromise and set a larger sample size for analysis or a larger percentage of the prevailing candle excess.

Indicator for Constructing a Three Line Break Chart

This article is dedicated to the Three Line Break chart, suggested by Steve Nison in his book "Beyond Candlesticks". The greatest advantage of this chart is that it allows filtering minor fluctuations of a price in relation to the previous movement. We are going to discuss the principle of the chart construction, the code of the indicator and some examples of trading strategies based on it.

OpenCL: From Naive Towards More Insightful Programming

This article focuses on some optimization capabilities that open up when at least some consideration is given to the underlying hardware on which the OpenCL kernel is executed. The figures obtained are far from being ceiling values but even they suggest that having the existing resources available here and now (OpenCL API as implemented by the developers of the terminal does not allow to control some parameters important for optimization - particularly, the work group size), the performance gain over the host program execution is very substantial.

Exploring Seasonal Patterns of Financial Time Series with Boxplot

In this article we will view seasonal characteristics of financial time series using Boxplot diagrams. Each separate boxplot (or box-and-whiskey diagram) provides a good visualization of how values are distributed along the dataset. Boxplots should not be confused with the candlestick charts, although they can be visually similar.

Machine Learning: How Support Vector Machines can be used in Trading

Support Vector Machines have long been used in fields such as bioinformatics and applied mathematics to assess complex data sets and extract useful patterns that can be used to classify data. This article looks at what a support vector machine is, how they work and why they can be so useful in extracting complex patterns. We then investigate how they can be applied to the market and potentially used to advise on trades. Using the Support Vector Machine Learning Tool, the article provides worked examples that allow readers to experiment with their own trading.

Graphical Interfaces X: The Standard Chart Control (build 4)

This time we will consider the Standard chart control. It will allow to create arrays of subcharts with the ability to synchronize horizontal scrolling. In addition, we will continue to optimize the library code to reduce the CPU load.

Trading Signal Generator Based on a Custom Indicator

How to create a trading signal generator based on a custom indicator? How to create a custom indicator? How to get access to custom indicator data? Why do we need the IS_PATTERN_USAGE(0) structure and model 0?

Plotting trend lines based on fractals using MQL4 and MQL5

The article describes the automation of trend lines plotting based on the Fractals indicator using MQL4 and MQL5. The article structure provides a comparative view of the solution for two languages. Trend lines are plotted using two last known fractals.

How to quickly develop and debug a trading strategy in MetaTrader 5

Scalping automatic systems are rightfully regarded the pinnacle of algorithmic trading, but at the same time their code is the most difficult to write. In this article we will show how to build strategies based on analysis of incoming ticks using the built-in debugging tools and visual testing. Developing rules for entry and exit often require years of manual trading. But with the help of MetaTrader 5, you can quickly test any such strategy on real history.

Using limit orders instead of Take Profit without changing the EA's original code

Using limit orders instead of conventional take profits has long been a topic of discussions on the forum. What is the advantage of this approach and how can it be implemented in your trading? In this article, I want to offer you my vision of this topic.

Auto-Generated Documentation for MQL5 Code

Most Java coders will be familiar with the auto-generated documentation that can be created with JavaDocs. The idea is to add comments into the code in a semi-structured way that can then be extracted into an easy to navigate help file. The C++ world also has a number of documentation auto-generators, with Microsoft's SandCastle and Doxygen being two leaders. The article describes the use of Doxygen to create HTML help file from structured comments in MQL5 code. The experiment worked very well and I believe the help documentation that Doxygen produces from MQL5 code will add a great deal of value.

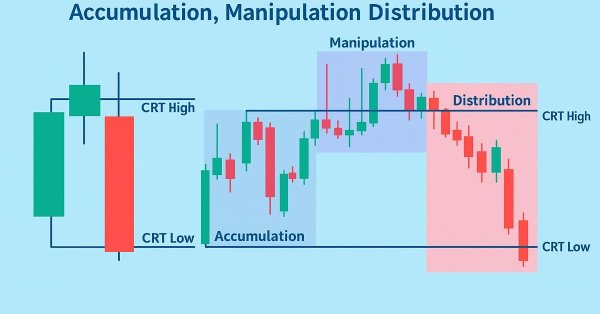

Automating Trading Strategies in MQL5 (Part 41): Candle Range Theory (CRT) – Accumulation, Manipulation, Distribution (AMD)

In this article, we develop a Candle Range Theory (CRT) trading system in MQL5 that identifies accumulation ranges on a specified timeframe, detects breaches with manipulation depth filtering, and confirms reversals for entry trades in the distribution phase. The system supports dynamic or static stop-loss and take-profit calculations based on risk-reward ratios, optional trailing stops, and limits on positions per direction for controlled risk management.

Interview with Dr. Alexander Elder: "I want to be a psychiatrist in the market"

I think financial markets are like manic-depressive patients. Sell when they have mania, and buy when they have depression. The envelope helps me determine where these levels of depression and mania are. There is a joke: "A neurotic is a man who builds castles in the skies, psychotic is the one who lives in them, and a psychiatrist is a person who collects the rent." I want to be a psychiatrist in the market. I want to collect the rent from the madness of the crowd.

Tips from a professional programmer (Part II): Storing and exchanging parameters between an Expert Advisor, scripts and external programs

These are some tips from a professional programmer about methods, techniques and auxiliary tools which can make programming easier. We will discuss parameters which can be restored after terminal restart (shutdown). All examples are real working code segments from my Cayman project.

MetaTrader 5: Publishing trading forecasts and live trading statements via e-mail on blogs, social networks and dedicated websites

This article aims to present ready-made solutions for publishing forecasts using MetaTrader 5. It covers a range of ideas: from using dedicated websites for publishing MetaTrader statements, through setting up one's own website with virtually no web programming experience needed and finally integration with a social network microblogging service that allows many readers to join and follow the forecasts. All solutions presented here are 100% free and possible to setup by anyone with a basic knowledge of e-mail and ftp services. There are no obstacles to use the same techniques for professional hosting and commercial trading forecast services.

Secrets of MetaTrader 4 Client Terminal

21 way to ease the life: Latent features in MetaTrader 4 Client Terminal.

Full screen; hot keys; Fast Navigation bar; minimizing windows; favorites; traffic reduction; disabling of news; symbol sets; Market Watch; templates for testing and independent charts; profiles; crosshair; electronic ruler; barwise chart paging; account history in the chart; types of pending orders; modifying of StopLoss and TakeProfit; undo deletion; chart print.