Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 14058

- Derecelendirme:

- Yayınlandı:

- Güncellendi:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

Originally this was first made by KimIV (for MetaTrader 4).

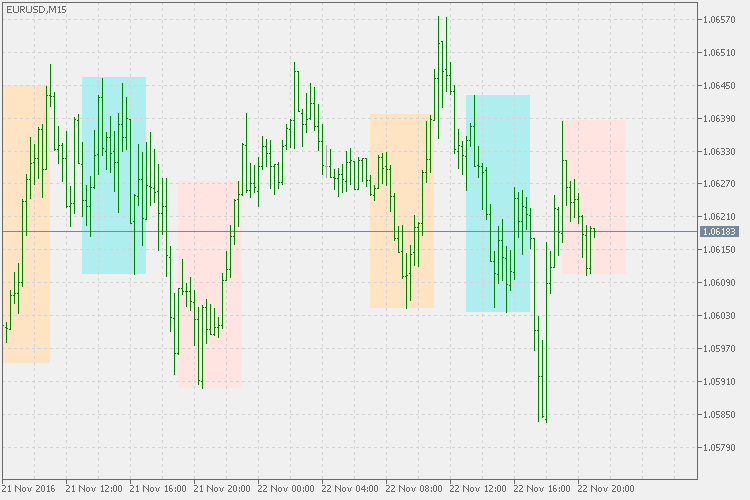

There is already a MetaTrader 5 version, but this version is different. This version is not a conversion, but it is written to be as much MetaTrader 5 code as it can. No substitutes for MetaTrader 4 functions were used. The result is faster, and by all means, a much shorter code.

Number of sessions is increased to 3. Sessions can overlap and sessions can cross day boundaries (the indicator recognizes those cases). It will work for all time frames below daily time frame. Also, this version allows multiple instances of the same indicator on the same chart. For cases like that, unique ID of each new instance has to be set to some unique value. That way those 3 sessions can be extended indefinitely, and by combining multiple instances of the indicator, and number of sessions can be displayed. This indicator display the high/low rectangle for the chose session — it does not display vertical line like rectangles simply in order to allow sessions overlapping and multiple instances of the indicator.

DMI stochastic extreme

DMI stochastic extreme

DMI stochastic extreme - extended indicator.

iTrend

iTrend

iTrend indicator for MetaTrader 5

Aroon oscillator - dynamic zones (levels)

Aroon oscillator - dynamic zones (levels)

Aroon oscillator — that is using dynamic levels/zones instead of using fixed levels for overbought and oversold conditions.

Velocity - normalized

Velocity - normalized

Velocity - normalized using ATR, deviation or no-normalization