당사 팬 페이지에 가입하십시오

- 게시자:

- Nikolay Kositsin

- 조회수:

- 110

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

실제 저자:

MetaQuotes

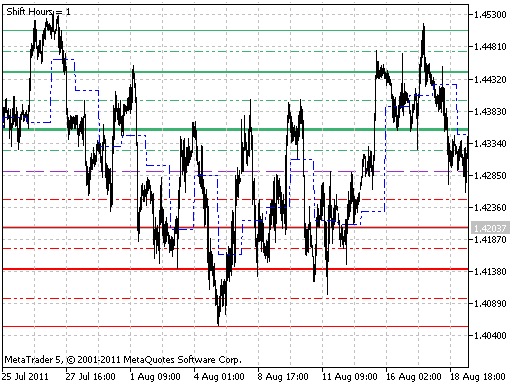

DailyPivot_Shift 인디케이터는 하루의 시작 시점을 기준으로 주요 레벨을 계산할 수 있다는 점에서 일반 DailyPivot 인디케이터와 다릅니다. 따라서 서버 시간이 아닌 현지 시간(예: GMT-8)을 기준으로 레벨을 계산할 수 있습니다. 또한 이 지표는 월요일에 레벨을 만들 때 토요일과 일요일 시세에 대한 정보를 고려하지 않습니다.

피봇 포인트(PP)는 하루 동안 가격이 중력을 받는 수준인 평형점입니다. 전일 고가, 저가, 종가의 세 가지 값이 있으면 피봇 포인트, 저항선 6개, 지지선 6개 등 작은 차트주기에 대해 13개의 레벨을 계산할 수 있습니다. 이러한 레벨을 앵커 포인트라고 합니다.

앵커 포인트를 사용하면 작은 추세의 방향 변화를 쉽게 파악할 수 있습니다. 가장 중요한 세 가지 값은 균형점, 저항1(RES1.0) 및 지지1(SUP1.0)의 수준입니다. 가격이 이 값 사이에서 움직일 때 종종 움직임이 일시 중지되거나 때로는 되돌림을 볼 수 있습니다.

따라서 데일리피벗 인디케이터:

- 가격 변동 범위를 예측합니다;

- 가격이 멈출 수 있는 지점을 보여줍니다;

- 가격 변동 방향의 가능한 변화 지점을 보여줍니다.

당일 시장이 균형점 위에서 열리면 매수 포지션을 오픈하라는 신호입니다. 시장이 균형점 아래에서 열리면 숏 포지션을 개시하기에 유리한 날입니다.

피봇 포인트를 사용하는 기술은 가격이 저항선인 RES1.0 또는 지지선인 SUP1.0과 충돌할 때 반전 또는 붕괴 가능성을 추적하는 것입니다. 가격이 RES2.0, RES3.0 또는 SUP2.0, SUP3.0 수준에 도달하면 시장은 일반적으로 과매수 또는 과매도 상태이므로 이 수준이 대부분 출구 수준으로 사용됩니다.

이 지표는 MQL4에서 처음 만들어져 2006.07. 28에 mql4.com의 코드 베이스에 게시되었습니다.

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/492

Boom Index Spike Pattern

Boom Index Spike Pattern

이 메타트레이더 5(MT5) 사용자 지정 보조지표인 boomSpikeBoxMitigationFinal.mq5는 차트에서 특정 강세 스파이크 패턴을 감지하고 직사각형과 수평선을 사용하여 진입 구간을 표시합니다. 가격이 진입 구간으로 돌아오면("완화") 진입선이 완화 지점까지 짧아집니다.

CBitBuffer Class - Data Serialization in MQL5

CBitBuffer Class - Data Serialization in MQL5

버퍼에서 개별 비트 또는 비트 시퀀스를 읽고 쓰기 위한 클래스입니다.