This Week Again: A Political Market

Nervous trading driven by renewed Trump tariffs and Japan’s general election outlook

This week’s market has once again started with politics as the main driver.

There are two major factors:

- President Trump

- Prime Minister Takaichi

◆ Japan Side: Prime Minister Takaichi and the Dissolution Election

Regarding Prime Minister Takaichi,

it is reported that she is expected to officially announce the dissolution of the Diet and a general election today at 18:00 JST.

Elections are inherently unpredictable, and

it remains uncertain whether they will proceed in line with prior approval ratings or market expectations.

However, at this moment, the market sentiment is:

“Expectations for the continuation of the Takaichi administration are dominant.”

As a result, markets are caught between:

- The “Takaichi trade” (weaker yen, stronger equities)

- A corrective adjustment against that move

Today’s opening shows a slightly corrective tone:

- Nikkei Average: lower

- FX market: yen buying dominant

◆ U.S. Side: The Revival of Trump Tariffs

President Trump continues to be a major source of market volatility.

This year, attention has shifted through:

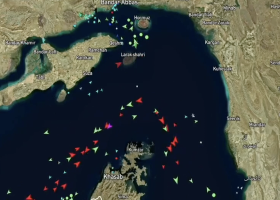

- Venezuela

- Iran

and now has turned to:

Growing tensions with Europe over the Greenland issue.

President Trump stated:

“A 10% tariff will be imposed on European countries starting February 1.”

As usual, this is seen as part of his typical TACO strategy (Threaten And Chicken Out),

but the market has once again been pulled back into an unstable environment.

At the start of the week:

- Dollar selling dominates

- A “sell U.S.” type flow is noticeable

◆ Market Psychology: Fear Made Visible

With political risks spreading simultaneously,

- Gold and precious metals are hitting record highs

- Safe-haven buying and dollar weakness are accelerating

This clearly reflects rising market anxiety.

The market is in a highly sensitive and fragile state.

◆ Today’s Market Environment: U.S. Holiday

Today is:

Martin Luther King Jr. Day (MLK Day)

Therefore:

- U.S. equity markets: closed

- U.S. bond markets: closed

Position-squaring is likely to intensify during the European and London morning session,

and overall liquidity is expected to be limited.

◆ Upcoming Economic Indicators and Events

Economic Data

- Eurozone CPI (HICP, final) for December

- Canada CPI for December

Other Events

- IMF release of the World Economic Outlook

※ U.S. monetary policymakers are currently in the blackout period.

◆ Early London Session Moves

FX started with mild yen weakness:

- USD/JPY: briefly rose into the 158 range, reaching 158.15

- EUR/JPY: 183.85

- GBP/JPY: 211.81

Cross-yen pairs are firm.

On the other hand, European equities are sharply lower:

- Germany DAX: -1.5%

- France CAC: -1.7%

Following Trump’s comment about “a 10% tariff on Europe,”

Europe is reportedly considering retaliatory measures.

◆ Summary

- This week is completely a “political market” again

- Japan: the dissolution election is a crucial test for the Takaichi trade

- U.S.: Trump tariffs are bringing back instability

- Gold at record highs symbolizes rising market fear

- With low liquidity, price swings are likely to be volatile

This week is likely to be defined by:

“Trump × Takaichi.”The actions of these two leaders may drive currencies, equities, and gold all at once.