+3,252 USD Profit! Key Focus on Post-FOMC Employment Data and BOE Rate Cut Possibility – Forex Outlook for the Week of F

+3,252 USD Profit! Key Focus on Post-FOMC Employment Data and BOE Rate Cut Possibility – Forex Outlook for the Week of February 3, 2025

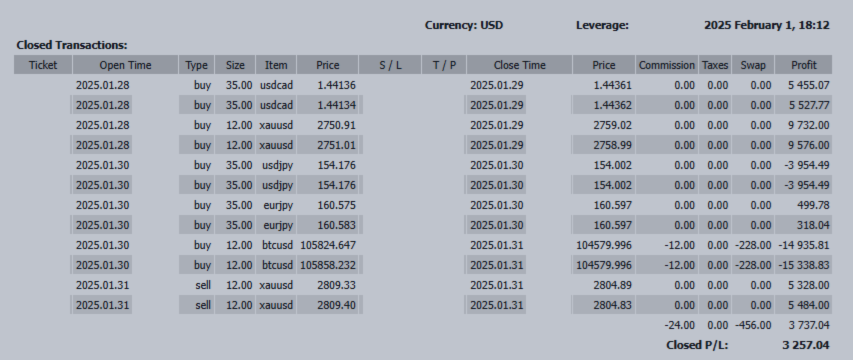

■ Trading Results for January 27 – January 31

📊 Weekly Profit: +3,252 USD

📉 Key Trades:

- Bitcoin Buy → Major Stop-Loss

- Gold Buy → Strong Performance as a Safe Haven Asset

This week, market volatility was heightened by President Trump’s tariff policies. The flow of funds between Gold and Bitcoin tends to be a seesaw effect, and this time, Gold took the lead. Unfortunately, I was unable to fully capitalize on this shift.

Meanwhile, the forex market was volatile, but I managed to read the general flow of major currency pairs, resulting in a break-even performance overall.

■ Forex Outlook for the Week of February 3 – Key Focus Areas

① USD/JPY

📌 Outlook: Neutral

📌 Key Factors:

- U.S. January Employment Report (Friday, Feb 7) – Strong data could delay Fed rate cuts, boosting the dollar; weak data could trigger dollar selling.

- ISM Manufacturing PMI (Monday, Feb 3) & ADP Employment Report (Wednesday, Feb 5) – These will set the tone for market sentiment post-FOMC.

- Trump’s Tariff Policy – New tariffs on Canada and Mexico set to take effect on February 1, though there’s a chance they might be retracted.

② EUR/USD

📌 Outlook: Bearish

📌 Key Factors:

- ECB Rate Cut Expectations – President Lagarde hasn’t ruled out further rate cuts, which could accelerate euro selling.

- French, German & Eurozone GDP Preliminary Data – If weak, the euro may test lower levels.

③ GBP/JPY

📌 Outlook: Neutral

📌 Key Factors:

- BOE Monetary Policy Meeting (Thursday, Feb 6) – Market expects a rate cut from 4.75% to 4.50%.

- MPC Voting Pattern – In December, three members supported a rate cut. How will they vote this time?

- Monetary Policy Report – Inflation outlook will determine the pace of future rate cuts.

④ CAD/JPY

📌 Outlook: Bearish

📌 Key Factors:

- BOC Rate Cut Decision (3.25% → 3.00%) – Downgraded growth outlook & Trump tariffs could fuel further CAD selling.

- Early Week Volatility in the Oceania Market – Expect fluctuations in CAD/JPY.

⑤ AUD/JPY

📌 Outlook: Bearish

📌 Key Factors:

- Growing RBA Rate Cut Expectations – Over 90% probability of a rate cut at the February 17-18 meeting.

- Diminishing Interest Rate Advantage – U.S. rate outlook is stabilizing, reducing AUD’s yield appeal.

⑥ ZAR/JPY (South African Rand/JPY)

📌 Outlook: Neutral

📌 Key Factors:

- SARB’s Interest Rate Strategy – The South African Reserve Bank is closely monitoring Trump’s tariffs.

- South African Political Stability – ZAR is a highly volatile currency, requiring caution.

■ Key Economic Events This Week

📌 Monday, Feb 3: U.S. ISM Manufacturing PMI

📌 Tuesday, Feb 4: U.S. December JOLTS Job Openings

📌 Wednesday, Feb 5: U.S. ADP Employment Report, ISM Non-Manufacturing PMI

📌 Thursday, Feb 6: BOE Interest Rate Decision (Major Impact on GBP)

📌 Friday, Feb 7: U.S. January Employment Report (Biggest Event of the Week!)

■ Trading Strategy This Week

✅ USD/JPY: Stay on the sidelines until NFP release, then trade based on direction.

✅ EUR/USD: Look for sell opportunities as ECB rate cut expectations persist.

✅ GBP: Watch for position adjustments before the BOE meeting and trade based on post-announcement moves.

✅ CAD: Maintain a bearish outlook (BOC rate cut & Trump tariffs in focus).

✅ AUD: Look for sell opportunities on rebounds, given RBA rate cut expectations.

✅ ZAR: Short-term trading only, given its high volatility.

■ Summary

The U.S. January Employment Report is the biggest event of the week!

It will likely set the direction of the dollar post-FOMC.

Other key market movers include:

- BOE’s monetary policy decision

- Trump’s tariff policies

- Concerns over European economic slowdown

Given these uncertainties, I’ll approach this week cautiously while staying flexible for trading opportunities.

Let’s stay calm, calculated, and seize the best opportunities! 💹🔥

Trader’s Health: The Importance of Heart Health and Diet

Successful trading demands sharp decision-making and sustained concentration. However, heart health is often overlooked.

Why Heart Health Matters for Traders

The heart pumps oxygen-rich blood to the brain, maintaining mental clarity and stress resilience – both critical for trading.

Top Vegetables for a Healthy Heart

✅ Leafy Greens (Spinach, Kale, Romaine Lettuce)

➡ Rich in Vitamin K & Folate, improving vascular flexibility.

✅ Garlic & Onions

➡ Enhances blood circulation and stabilizes blood pressure.

✅ Broccoli & Cauliflower (Cruciferous Vegetables)

➡ Antioxidant properties help reduce heart strain.

✅ Beets & Carrots

➡ Improves circulation & strengthens blood vessels.

✅ Avocado & Olive Oil

➡ Healthy fats reduce heart stress and regulate cholesterol levels.

Simple Ways to Incorporate More Vegetables into Your Diet

❗ "I know vegetables are good, but I struggle to eat them daily…"

Here are practical tips for busy traders:

1️⃣ Use Smoothies

➡ Blend spinach + banana + yogurt + almond milk for a quick, nutrient-packed breakfast.

2️⃣ Replace Junk Snacks

➡ Swap chips for celery + avocado dip or nuts + dried fruits.

3️⃣ Stock Up on Frozen & Pre-Cut Vegetables

➡ Keep frozen spinach & broccoli handy for quick meals.

4️⃣ Make Vegetables Visible

➡ Store veggies where you can see them in your fridge to avoid waste.

5️⃣ Create a Simple Daily Routine

➡ Add a mini salad, or mix spinach into soups to build a habit.

Both Trading and Health Require Consistency

Like trading, health is about small, consistent improvements.

Try making this week a "vegetable-focused" week, and you’ll likely feel better concentration and mental stability in your trading.

Let’s make smart trades and smart health choices for another profitable week!

🔥 Wishing you a successful trading week! 🚀