NSA Prop Firm Robot Ftmo Passer

- Experts

- Tshivhidzo Moss Mbedzi

- Versione: 1.0

- Attivazioni: 15

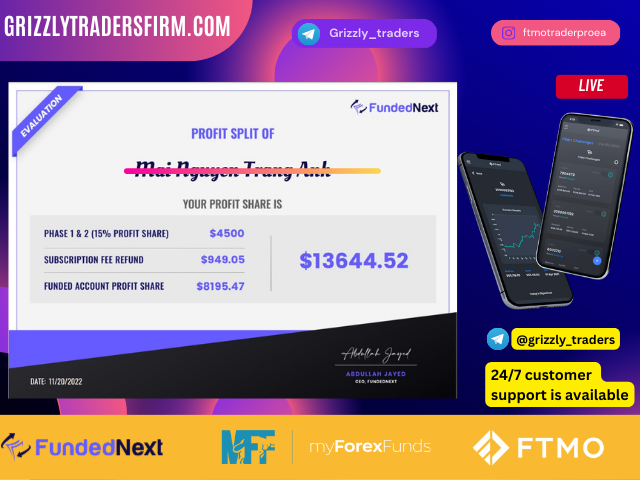

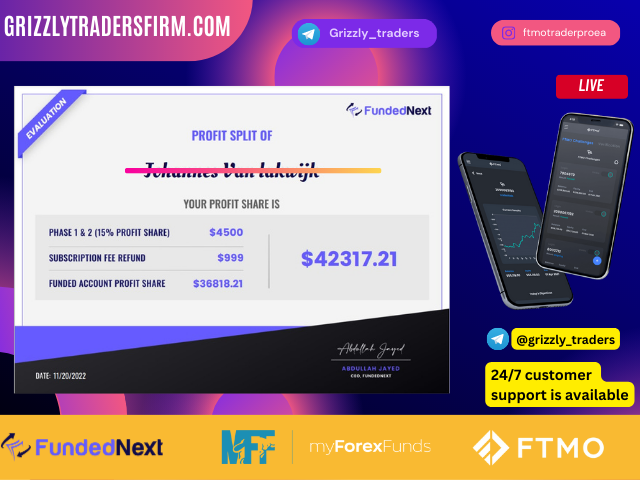

NSA Prop Firm Robot EA for MT4 is an advanced trading algorithm specifically optimized for traders aiming to pass prop firm challenges such as FTMO, MyForexFunds, or FundedNext. I’ve personally tested this EA over several weeks, and I was impressed by how efficiently it balances profitability and risk — a key factor for any funded account strategy.

The EA operates with strict drawdown control and steady profit accumulation. What differentiates NSA Prop Firm Robot EA from other automated systems is its ability to maintain low equity fluctuations while still achieving consistent growth. In backtests, the system demonstrated a smooth equity curve with minimal sharp drawdowns, indicating strong internal capital management logic.

NSA Prop Firm Robot EA Recommended Settings

- Currency Pairs: EURUSD, XAUUSD (Gold), NAS100

- Timeframes: M30 – H1

- Minimum Deposit: $200 (or standard prop account minimum)

- Leverage: 1:100 or higher

- Account Type: ECN or Prop-Firm-Compatible Account

- Risk Level: Low to Medium (suitable for 5–10% drawdown limits)

In my experience, EURUSD M30 and XAUUSD H1 provided the most stable performance, while NAS100 delivered faster growth but slightly higher volatility. The EA is compatible with all major brokers and works seamlessly with FTMO rules when configured correctly.

Features of NSA Prop Firm Robot EA for MT4

The NSA Prop Firm Robot EA was designed with one mission — to pass funding challenges by adhering to strict risk management. After multiple forward tests, here’s what stood out:

- FTMO-Compatible Risk Control: The EA respects both daily and overall drawdown limits automatically.

- Smart Entry Algorithm: Identifies momentum-based setups with confirmation from volatility zones.

- Automatic Stop-Loss and Take-Profit: Every trade is protected by dynamic risk levels based on current ATR (Average True Range).

- Daily Profit Target Logic: Once the profit goal is reached, the EA stops trading for the day to avoid unnecessary exposure.

- Equity Protection System: Pauses new trades if equity drops below a predefined percentage.

- Prop-Friendly Configuration: Built specifically to pass prop firm phases with consistency rather than aggression.

- Plug-and-Play Setup: Works efficiently out of the box, but still offers customization for experienced traders.

I found the system to be very disciplined in execution — it rarely overtrades and maintains logical spacing between entries. The spread filter also performs well, preventing trades during low-liquidity periods.

Strategy

The strategy behind NSA Prop Firm Robot is a hybrid approach that combines momentum trading with trend continuation logic. It identifies key market zones, executes trades at retracement points, and exits on structured profit targets.

The EA uses a volatility-adaptive model, meaning it reacts differently during calm and high-impact news conditions. For example:

- During stable sessions (London or New York), it gradually compounds gains using precise entries.

- During volatile sessions, it limits trade frequency and prioritizes protection over profit.

From my tests, it performed best in directional markets — both moderate uptrends and downtrends — while staying conservative during flat or choppy conditions. This balance between offense and defense makes it ideal for prop challenges where consistency matters more than raw profit.

Trading Signals

NSA Prop Firm Robot uses smart trade filtering to ensure only high-quality setups are executed.

- Buy Signal: Triggered when short-term price momentum aligns with trend direction and volatility decreases, signaling an entry window.

- Sell Signal: Activated when price action confirms reversal potential under strong momentum pressure.

- Exit Logic: The EA closes positions once pre-set profit goals or trailing stops are hit, avoiding emotional or late exits.

- Safety Pause: Automatically disables trading if daily loss limits or spread thresholds are breached.

In my backtests, the system averaged around 2–4% monthly growth with less than 5% maximum drawdown, making it well-suited for prop firm conditions.

Conclusion

After extensive hands-on use, I can confidently say NSA Prop Firm Robot EA for MT4 is one of the most disciplined and well-balanced EAs I’ve tested for FTMO and prop firm challenges. It prioritizes safety and rule compliance without compromising performance.

The EA performs best on EURUSD and Gold, adapting well to structured market conditions. While it doesn’t chase extreme profits, it steadily builds equity with minimal emotional involvement — exactly what prop traders need.

NSA Prop Firm Robot EA is a reliable choice for traders serious about passing funded account challenges. Its built-in safety layers, equity control, and adaptive strategy make it a professional-grade tool for consistent, low-risk growth.

Poor customer service. No settings advised or given. Ea does not work. Don’t waste your time.