Lattice Command

- Experts

- Andrew Boggie

- Versione: 1.10

- Attivazioni: 5

LATTICE COMMAND™

Automated Order-Network Execution & Risk Control System for MetaTrader 5

Lattice Command™ is a professional automated execution and risk-control system for MetaTrader 5.

It manages structured order placement, aggregation, and lifecycle control using predefined parameters, with emphasis on capital protection, operational stability, and execution consistency.

The software operates strictly within user-defined limits and does not provide predictive signals or discretionary advice.

---

OVERVIEW

Lattice Command™ is designed to automate order-network management and exposure control under clearly defined rules.

It provides:

- Structured placement of multiple price-interaction levels across a configurable order network

- Controlled aggregation of positions into managed baskets

- Ghosting Technology™ — a proprietary trigger-filtering system that tracks early price interactions without executing, filtering noise before capital is committed

- Automated lifecycle handling from entry to closure

- Continuous monitoring of drawdown, margin, and execution state

- Robust multi-layer safeguards against abnormal market or account conditions

- Dual distance mode: fixed-pip or ATR-adaptive level spacing

- Production-hardened persistent state that survives terminal crashes, VPS restarts, and power interruptions

Its role is execution and control — not signal generation or decision-making.

---

INTENDED USE

Appropriate for:

- Traders requiring repeatable, rule-based execution behaviour

- Risk-focused users automating predefined order-network strategies

- Prop-firm environments with strict loss constraints

- Developers seeking a stable, hardened execution layer

- Users who have validated parameters through backtesting, analysis tools, or their own research

Not intended for signal generation, predictive or discretionary trading, or guaranteed outcomes.

Users are expected to supply and validate all parameters independently.

---

GHOSTING TECHNOLOGY™ — PROPRIETARY TRIGGER FILTERING

Ghosting Technology™ is the defining innovation of Lattice Command™. It solves a fundamental problem with order-network systems: the initial price interactions when entering a lattice are often noise — premature triggers during unstable conditions before price has committed to a direction. Traditional systems execute on every crossing indiscriminately, building early exposure that can drag the entire basket into an unfavourable state.

Ghosting Technology™ defines a configurable threshold of initial interactions that are tracked but not executed. These "ghost" triggers count toward the basket lifecycle and appear on the chart as distinct visual markers, but no order is placed. Only after the ghost threshold is exceeded do subsequent interactions trigger real execution.

The result is an intelligent positioning phase that filters out noise and lets your order network engage when price has demonstrated real commitment. The ghost count is fully configurable — from zero (standard behaviour) to as many initial interactions as you want to filter.

This is not a simple delay. It is a structural filter that fundamentally changes how and when capital is committed to the market.

---

CORE CAPABILITIES

Structured Order-Network Execution

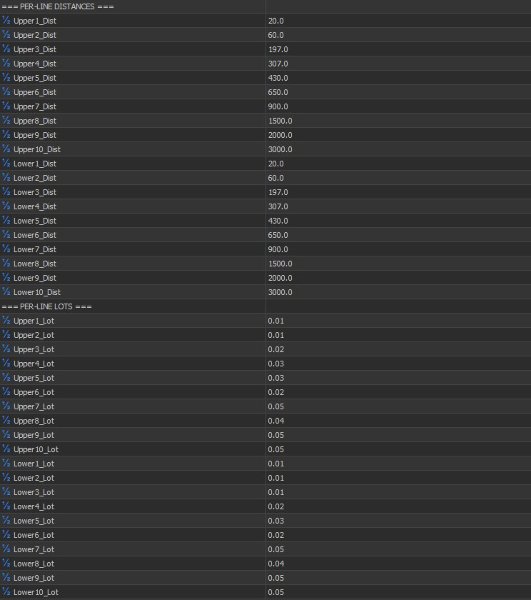

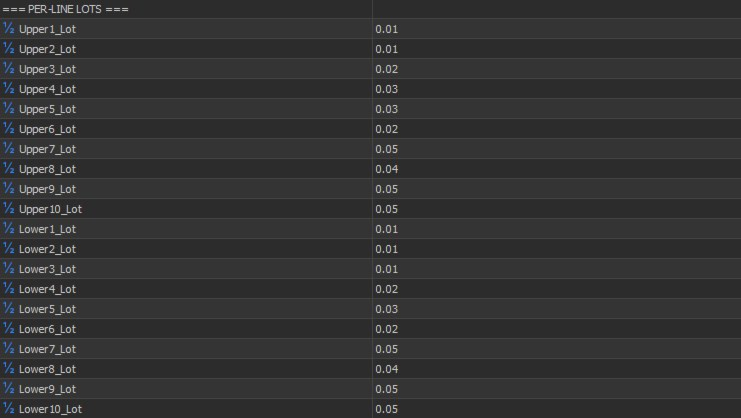

Executes a configurable set of price-based order levels. Supports up to 20 predefined interaction levels — 10 upper (sell) and 10 lower (buy) — with independent spacing and independent lot sizing per level. Build uniform, progressive, regressive, or fully asymmetric order-network configurations. Optional structural locking while aggregation is active. Periodic recalibration based on reference calculations keeps the network aligned with current price structure.

ATR Adaptive Mode

Switches level spacing from fixed pips to ATR-based multiples. In ATR mode, the order network automatically adapts to current market volatility: levels widen in volatile conditions and tighten in calm markets. The ATR period is configurable. Basket TP can also be expressed in ATR multiples, with the effective dollar value calculated at each anchor point. Both distance modes are available via a single parameter toggle.

Basket Lifecycle Management

Aggregates multiple positions into a single managed cycle. Automatic closure when a defined aggregate threshold is reached. Real-time monitoring of basket state and exposure. Historical tracking of completed cycles. One basket active at a time — clean, controlled lifecycle management.

---

RISK CONTROL ARCHITECTURE

Lattice Command™ features a multi-layer risk control system designed for traders who prioritise capital protection.

All stop loss values are expressed in account currency units.

Equity-Based Safeguard (Soft Stop)

Continuously monitors account equity against a configurable drawdown threshold. Liquidates all positions when the limit is reached. Resets internal state automatically. Temporarily suspends execution until recovery conditions are met. This is your automated circuit breaker — it acts when you can't.

Broker-Level Safeguard (Hard Stop)

Applies broker-side stop logic across all active positions. Calculates a unified stop level based on aggregate loss limits. On trigger, execution halts completely until manual intervention. Provides protection even if the EA loses connectivity, the terminal crashes, or the VPS goes down.

Both safeguards are configurable and optional. They can be used independently or in combination.

---

EXECUTION MODES

Consolidated Execution

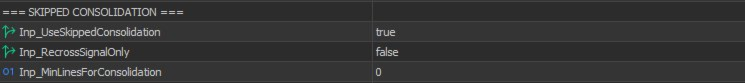

When multiple interaction levels are crossed rapidly between ticks, execution can be consolidated into fewer, larger orders. Reduces position count while maintaining proportional exposure. Configurable thresholds determine when consolidation occurs.

Confirmation-Based Execution (Recross)

Execution can be delayed until price re-interacts with a triggered level. Instead of executing immediately when price crosses a line, the system waits for price to come back and confirm the level. Filters out fast spikes that touch a level once and never return. Can be combined with consolidation and Ghosting Technology™ for highly refined trigger behaviour.

Direction Inversion

Optional inversion of execution direction. Upper crossings execute buy orders, lower crossings execute sell orders. Intended for contrarian order-network workflows. Applied cleanly at the execution layer without changing the underlying lattice logic.

---

PRODUCTION HARDENING

Persistent State Recovery

The software's full operational state is preserved continuously: active order-network positions, basket cycle data, trigger states, ghost progress, chart annotations, session statistics, and execution history. Terminal crash, VPS restart, or power failure — Command resumes exactly where it left off. No orphaned positions. No duplicate orders. No confused state.

Adaptive Broker Compatibility

Automatically detects broker execution modes (instant, market, exchange), fill policies (FOK, IOC, return), and lot constraints (minimum, maximum, step). Normalises all volumes to broker requirements without manual configuration. Tested across ECN, STP, and market-maker environments. Works out of the box.

Intelligent Retry Handling

When orders fail, Command differentiates between temporary failures (requotes, price changes, timeouts) that warrant retries and permanent failures (market closed, invalid parameters) that don't. Configurable retry count and delay. Every failure is logged with the specific reason.

Connection Health Monitoring

Continuous monitoring of connection state and quote freshness. Stale-quote detection prevents execution on outdated prices. Automatic reconnection handling ensures the EA recovers gracefully from network interruptions.

---

PARALLEL CLOSE

Optionally closes all active positions simultaneously rather than sequentially. In a basket with multiple positions, sequential closing means each position waits for the previous one to confirm before the next request is sent — and that delay can cost significant slippage as price moves against you during the closure process. Parallel close eliminates that problem. Sequential closure mode remains available if preferred. Configurable per-instance.

---

SCHEDULING & SESSION CONTROL

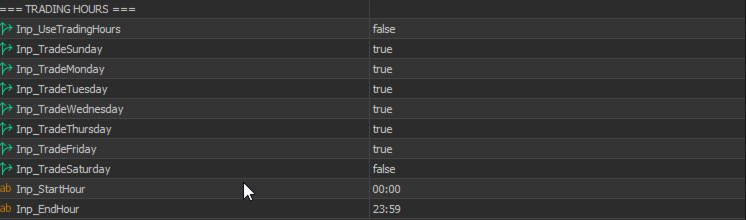

Per-day enable/disable controls (Monday through Sunday) with precise session start and end times. Supports overnight sessions that span midnight. Active aggregation cycles are allowed to complete outside scheduled sessions — the scheduler controls when new interactions can occur, not when existing positions must close.

---

OPERATIONAL SAFEGUARDS

- Maximum open position limit — hard cap on total positions regardless of how many levels are triggered

- Spread threshold filtering — orders blocked when spread exceeds your configured maximum

- Pre-execution margin validation — every order checked against available free margin before submission

- Continuous connection health checks and stale-quote detection

---

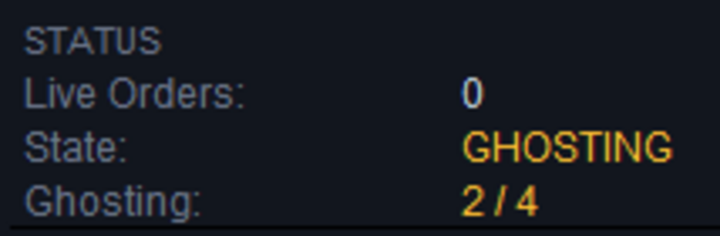

ON-CHART STATUS INTERFACE

Real-time display of: aggregate basket PnL (colour-coded), cumulative session profit, maximum observed drawdown, peak margin usage, active position count, current distance mode, ghost progress indicator, and execution state.

Execution states are clearly labelled:

- IDLE — awaiting interaction

- FILTERING — Ghosting Technology™ phase active

- ACTIVE — executing positions

- SUSPENDED — soft safeguard engaged

- HALTED — hard safeguard engaged

Bloomberg-inspired terminal aesthetic designed for extended monitoring. No ambiguity about what's happening at any time.

---

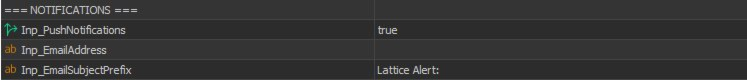

NOTIFICATIONS & ALERTING

Mobile push notifications for: safeguard activation, execution suspension and resumption, and basket cycle completion.

Email notifications for: execution events, state changes, safeguard triggers, error conditions, and lattice recalibration events.

All notification types are independently configurable.

---

CONFIGURATION INPUTS

Core: Reference calculation parameters, structural reset interval, direction handling, aggregate threshold values, Ghosting Technology™ count, execution identifier (magic number), and distance mode (PIPS or ATR with configurable ATR period).

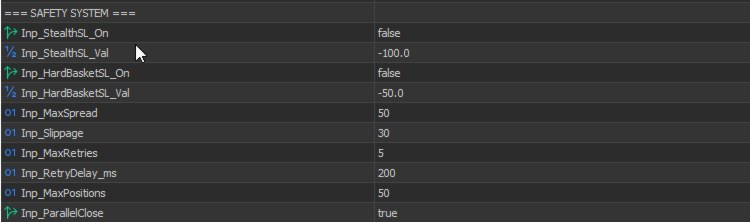

Risk: Equity safeguard enable and threshold, broker-level safeguard enable and threshold, spread limits, slippage tolerance, retry behaviour, maximum position limit, and parallel closure option.

Scheduling: Per-day operation toggles, session start and end times.

Structure: Independent upper and lower level spacing, independent per-level lot sizing — complete asymmetric control over all 20 levels.

Notifications: Mobile push alerts and email configuration with customisable subject prefix.

---

COMPATIBILITY NOTE

Lattice Command™ is a complete, standalone execution system. All features, safeguards, and capabilities described above are fully available without any additional software.

For users who also use Lattice Vision™ (available separately), parameter structures are compatible between the two products. This is a convenience, not a requirement — Lattice Command™ accepts parameters from any source including manual configuration, your own analysis, or third-party tools.

---

DEPLOYMENT RECOMMENDATIONS

1. Begin with the MetaTrader 5 strategy tester — run tick-by-tick backtests with the full execution engine

2. Forward test on a demo account to observe real-time behaviour and broker interaction

3. Start with conservative limits when deploying with real capital

4. Monitor behaviour during initial operation

5. Adjust parameters incrementally

6. Prioritise operational stability over returns

---

SYSTEM REQUIREMENTS

MetaTrader 5 (build 2000+), any compatible broker, stable internet connectivity. VPS recommended for continuous unattended operation.

---

RISK & USAGE NOTICE

This software automates execution based solely on user-defined parameters. It does not generate trading signals, provide financial advice, or guarantee any outcome.

The software cannot account for all possible market or technical conditions including but not limited to: liquidity constraints, slippage variability, latency effects, extreme volatility, broker-specific behaviour, or extraordinary market events.

All responsibility for configuration, deployment, and outcomes remains with the user. Users should thoroughly test all configurations in a risk-free environment before deploying with real capital.

Trading forex and CFDs involves substantial risk of loss and is not suitable for all investors. Past performance — whether demonstrated through backtesting, forward testing, or any other method — is not indicative of future results. You should only trade with capital you can afford to lose.

---

TRADEMARKS & LEGAL

Lattice Command™, Lattice Vision™, and Ghosting Technology™ are common law trademarks of Cave and Fire Group Pty Ltd.

© 2025–2026 Cave and Fire Group Pty Ltd. All rights reserved.

Cave & Fire Lab is a trading name of Cave and Fire Group Pty Ltd., a software development company. We are not a financial services provider, broker, fund manager, or advisory firm.

MetaTrader 5 and MQL5 are registered trademarks of MetaQuotes Ltd. This product is not affiliated with, endorsed by, or sponsored by MetaQuotes Ltd.

All other trademarks are the property of their respective owners.