SVP Zones SM ICT

- Indicatori

- Damian Blaha

- Versione: 2.98

- Aggiornato: 23 febbraio 2026

- Attivazioni: 10

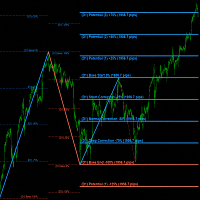

SVP Zones SM ICT is a professional indicator that transforms the logic of a complex manual strategy into a precise mathematical algorithm. It identifies key accumulation and distribution zones based on an in-depth analysis of market structure, Fibonacci levels, and volume. The indicator's creation draws on years of experience studying how volume influences market structure. It is a comprehensive analytical tool for finding reliable entry points.

When the pattern search conditions are met, the indicator forms an accumulation zone and displays it on the chart. The next step and signal to enter a trade is when the price exits this zone in the right direction. After the price exits such a zone, a strong impulse is highly likely to follow, and the risk of reversal beyond the opposite boundary of the zone is minimal. The algorithm works perfectly on both real exchange volumes and standard tick data after a little optimization. In historical data, the indicator displays a signal after the breakout candle closes, and in real time, it displays the signal instantly, at the moment the level is touched (on the current tick). I recommend using H1 and sometimes M30.

New updates include built-in statistics (WinRate): The new update adds an information panel to the chart. It automatically calculates the performance of the last 100 patterns in history, showing the percentage of price hits to targets (TP1, TP2, TP3) and the probability of Stop Loss triggering.

A table with a win rate scale by time has also been added, giving an understanding of the probability of profit at what time of day. Taking this into account, trading only during the most profitable times can yield better results than the statistics for all patterns.

The SVP Zones advisor, which fully automates trading using this algorithm, is also available in my profile.

If you have any questions or need help choosing custom settings, please contact me.

Merece 5 estrelas!