QuantumPulse

- Experts

- Abdulrahman Saad

- Versione: 1.0

QuantumPulse– Institutional Gold Trading System (XAUUSD)

QuantumPulse is an advanced institutional-grade automated trading system designed specifically for Gold (XAU/USD).

The robot is built using a multi-layer decision framework that combines higher-timeframe trend validation, micro-momentum detection, liquidity protection, and noise suppression, allowing it to operate efficiently in both trending and volatile gold market conditions.

Unlike traditional retail Expert Advisors,QuantumPulse does not rely on grid, martingale, or recovery strategies. Each trade is independent, protected by a hard stop-loss, and executed only when multiple institutional-grade conditions align.

🧠 Core Trading Logic

QuantumPulse operates using a top-down market analysis approach:

1. Institutional Trend Confirmation

-

Uses H4 EMA structure (Fast vs Slow) to define the dominant market bias.

-

Trades are executed only in the direction of the higher-timeframe trend, reducing exposure to random market noise.

2. Multi-Timeframe Momentum Alignment

-

Confirms momentum using H1 EMA slope, RSI strength, and momentum indicators.

-

Entry timeframe alignment ensures precision timing and avoids premature entries.

3. Micro-Momentum & Noise Filtering

-

Detects short-term price acceleration on the execution timeframe.

-

Filters out sideways and low-quality movements using ATR-based noise suppression.

4. Liquidity & Impulse Protection

-

Avoids entries during liquidity grabs and stop-hunting candles.

-

Prevents trading during abnormal impulse candles or unstable market phases.

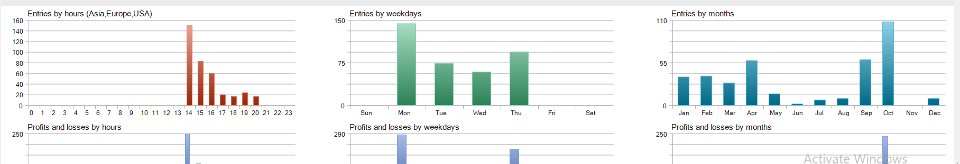

5. Smart Session & Risk Filters

-

Trades only during predefined high-liquidity sessions.

-

Includes spread, margin, and broker stop-level checks to avoid execution issues.

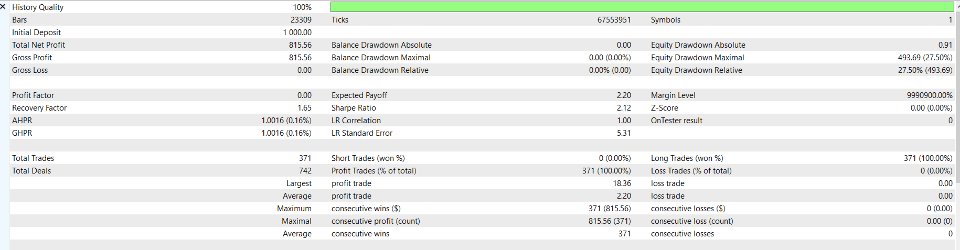

⚙️ Risk & Money Management

-

Dynamic lot sizing based on account margin and selected risk profile.

-

Multiple risk modes available (Low / Medium / High).

-

No averaging, no hedging, no martingale.

-

Each trade is protected by:

-

ATR-based Stop Loss

-

Fixed Take Profit

-

Broker Stop-Level validation

-

Free margin safety buffer

-

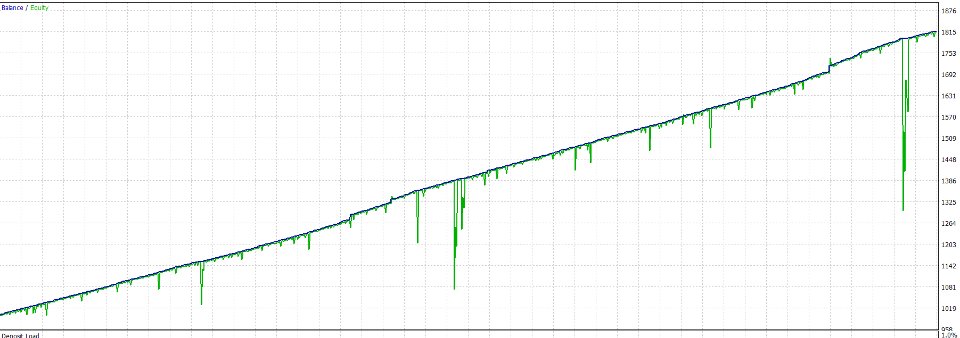

Performance Characteristics

-

Designed for medium- to long-term swing trading.

-

Trade frequency is intentionally selective.

-

Performance is optimized for gold volatility, not scalping.

-

Works best on H1 / M1 execution with higher timeframe confirmation.

⚠️ Important Risk Disclosure (Please Read Carefully)

⚠️ Drawdown Warning

Due to the nature of gold volatility and the strategy’s reliance on higher-timeframe trend continuation, periods of elevated drawdown can occur, especially during:

-

Sudden macroeconomic shocks

-

High-impact news events (CPI, NFP, FOMC)

-

Extended consolidation phases followed by sharp reversals

While the system employs multiple protective filters, no trading system can eliminate drawdown entirely.

👉 This EA is NOT suitable for undercapitalized accounts.

👉 Conservative risk settings are strongly recommended.

👉 Always test on a demo account before live deployment.

Suitable For

✔ Prop Firm Challenges

✔ Funded Accounts

✔ Experienced traders who understand drawdown cycles

✔ Gold-focused portfolios

❌ Not recommended for beginners

❌ Not suitable for ultra-low balance accounts

❌ Not designed for martingale-style equity curves

🛠 Recommended Settings

-

Symbol: XAUUSD

-

Execution Timeframe: M1

-

Trend Confirmation: H4

-

Risk Level: Low or Medium

-

VPS recommended for optimal execution

| ACCOUNT | SIZE LOT |

|---|---|

| 300 USD | 0.01 |

| 600 USD | 0.01 - 0.05 |

| 5000 USD | 0.2 |

| 10,000 USD | 1.0 |