SecModeStoch

- Indicatori

- Kazutaka Okuno

- Versione: 1.0

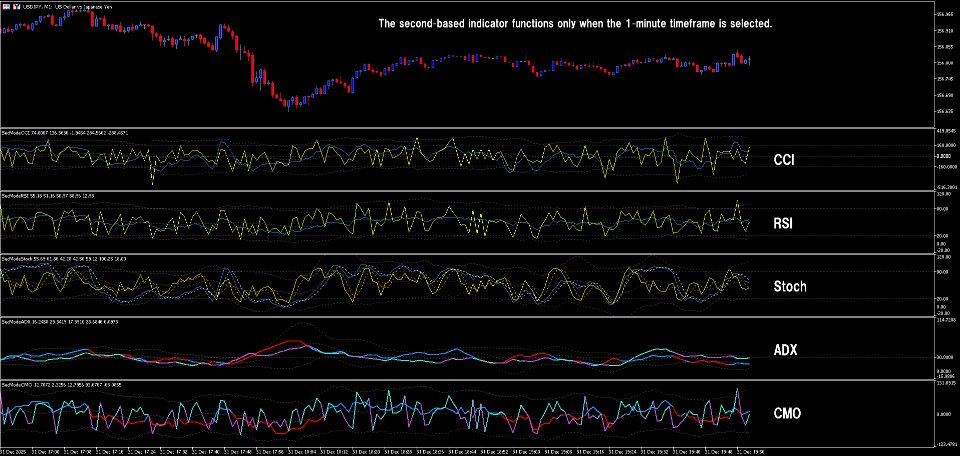

🌍 【SecMode Series】SecModeStoch – High‑Resolution Tick‑Based Stochastic Oscillator

📌 Overview

SecModeStoch is part of the SecMode Series, a next‑generation suite of indicators designed to reveal the micro‑structure of price action at the tick/second level—a level of detail that traditional 1‑minute indicators cannot capture.

While standard Stochastic oscillators refresh only once per minute, SecModeStoch uses a proprietary second‑level engine to:

- Update up to 60 times per minute (or at user‑defined intervals)

- Visualize overbought/oversold conditions in real time

- Highlight divergences between standard timeframe (TF) and second‑level (Sec) Stochastic signals

- Operate without custom symbols, ensuring a clean and lightweight setup

This provides a high‑resolution view of momentum turning points that conventional Stochastic indicators are fundamentally unable to deliver.

🎯 Key Features

① Tick‑Based Engine (No Custom Symbols Required)

Most second‑level indicators rely on:

- Custom symbol creation

- Saving and maintaining second‑level data

- Regenerating data when files become corrupted

- Heavy MT5 resource consumption

SecModeStoch avoids all of these issues.

It generates second‑level data internally from tick streams, offering:

- Fast and simple setup

- Clean chart integration

- Lightweight MT5 performance

- Stable operation even on VPS environments

② Dual‑Line Structure (TF × Sec)

By plotting both TF (standard timeframe) and Sec (second‑level) Stochastic lines:

- The Sec Stoch reacts first to micro‑reversals

- The TF Stoch follows afterward

This makes early turning points visually obvious, giving traders an edge in timing reversals, pullbacks, and breakout failures.

③ High‑Precision Overbought/Oversold Detection

SecModeStoch enhances the classic Stochastic logic with second‑level precision:

- 80/20 zones become significantly more accurate

- Micro‑spikes and micro‑dips become visible

- Sec‑level “false breaks” reveal early exhaustion

- TF confirmation becomes easier and more reliable

This allows traders to detect:

- Early reversal signals

- Momentum compression

- Failed breakouts

- Second‑level divergences

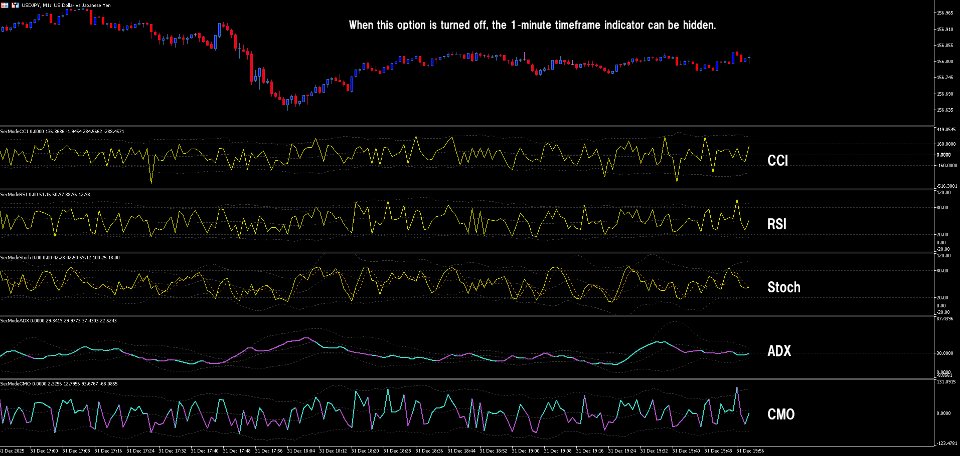

④ Clean Waveform Logic (No Color Changes)

Unlike ADX and CMO, which use directional color logic,

Stochastic conveys information through waveform behavior alone.

This keeps the display clean and focused on:

- Crossovers

- Overbought/oversold touches

- Sec‑level early reversals

- TF/Sec timing differences

⑤ No Repainting (Final Values Stay Final)

SecModeStoch draws second‑level values directly from tick data:

- Closed bars never change (no repainting)

- Open bars update rapidly in real time

This mirrors natural candlestick behavior and ensures transparent, trustworthy signals.

⑥ Unified UI Across the Entire Series

All SecMode indicators share the same interface and design philosophy:

- CCI (Sec)

- RSI (Sec)

- Stochastic (Sec)

- ADX (Sec, with color logic)

- CMO (Sec, with color logic)

This consistency makes multi‑indicator setups intuitive and seamless.

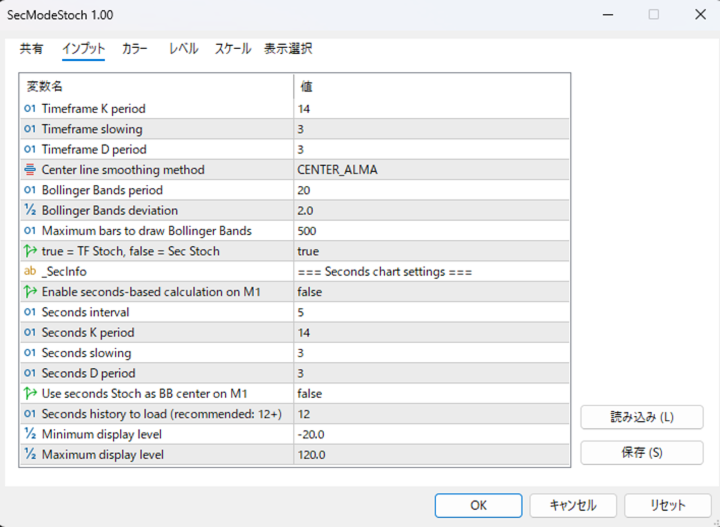

⑦ Three Selectable CenterLine Engines (Optional BB Layer)

Although Stochastic does not traditionally use a centerline,

SecModeStoch includes an optional Bollinger Band layer for enhanced visualization:

1. ALMA – Sniper Mode

- Ultra‑low latency

- Fastest response

- Ideal for scalpers detecting micro‑reversals

2. TMA – Cycle Mode

- Smoothest curve

- Highlights rhythm and cycle structure

- Excellent for environment analysis

- Note: TMA naturally “follows” price until bar close

3. SMA – Benchmark Mode

- Most widely recognized average

- Clean, standard BB behavior

- Adds second‑level nuance to classic Stoch setups

🎁 About the Free Version

This free edition provides full access to the core second‑level engine and high‑resolution Stochastic visualization.

To keep the design streamlined, the following features are intentionally excluded:

- Signal generation

- Alert notifications

- Auto‑drawing tools

- Advanced filters

All essential functions—tick engine, TF/Sec divergence, overbought/oversold behavior—are fully available.

Use this streamlined core edition to experience how dramatically different the second‑level market truly is.

🧠 Usage Examples

- Sec Stoch crosses first → early reversal signal

- Sec Stoch spikes above 80/20 → momentum exhaustion

- TF/Sec divergence → reversal anticipation

- Sec micro‑dip → early pullback detection

🚀 Summary

- Tick‑based second‑level engine (no custom symbols)

- TF/Sec divergence becomes actionable entry logic

- High‑precision overbought/oversold detection

- Clean waveform‑only logic (no color changes)

- No repainting (TMA naturally follows price until close)

- Unified UI across the SecMode Series

- Free access to a radically different market perspective

Experience a level of reversal clarity that traditional Stochastic indicators are fundamentally unable to deliver.