Axis Trend Grid EA

- Experts

- Yeoh Kian Hui

- Versione: 2.2

- Aggiornato: 20 gennaio 2026

- Attivazioni: 5

6-Month Gold+NASDAQ Live Signal: https://www.mql5.com/en/signals/2352008

The Strategy

Axis Trend Grid Strategy is a fully automated Expert Advisor (EA) designed for high-precision trend-following on volatile instruments like XAUUSD (Gold) and NAS100 (Nasdaq). The system uses a unique "Ladder Entry" mechanism that capitalizes on market momentum by placing pending orders at calculated price levels only when a primary trend is confirmed. It does not simply deploy grids blindly like many other grid EAs out there.

The EA identifies the primary trend using a proprietary alignment system. Once the trend is confirmed, it deploys a grid-like ladder of Buy Stops to catch the breakout as it happens, ensuring you are always positioned in the direction of the strongest price move.

Key Features

-

Proprietary Alignment System that works: Once the trend is confirmed, it deploys a grid-like ladder of Buy Stops to catch the breakout as it happens.

-

Easy-to-use: No complicated settings or configurations. Perfect for all levels of traders including beginners.

-

Auto Buy Stops cleanup: When bearish trends are identified, it will automatically delete the pending orders to avoid buying into a falling knife.

-

Percentage-Based Risk: Every trade is automatically protected by a Hard Percentage Stop Loss calculated from the entry price.

-

Crash Protection: Includes a global safety filter that halts all trading and clears pending orders if the market price drops significantly from your highest peak.

-

Advanced Dashboard: Real-time visual monitoring of account balance, equity, floating PnL, and drawdown percentage directly on the chart.

-

Market Compliant: No DLLs used, passes all MQL5 automated validation checks, and works with all MetaTrader 4 brokers.

-

No Martingale: The strategy uses fixed lot sizes and protective stops for every transaction, and will not blindly deploy Grid entries.

-

No External WebRequests: There's no need to configure any external webrequest, ensuring you always have full access to the EA without any interruptions.

How to Use

-

Symbol: Recommended for XAUUSD (Gold), NAS100, and US30.

-

Timeframe: Optimized for the M1 (1-Minute) chart.

-

Account Type: ECN, Raw Spread, Standard, Micro oraccounts with low spreads are preferred.

-

Min Deposit: Recommended starting balance of $1,000 depending on the broker's leverage.

-

Default Settings: The EA comes with optimized default settings. Ready to start directly without complicated configurations.

Main Settings

-

Trade Lot Size: Fixed volume for each trade.

-

Stop Loss %: Protective exit percentage (e.g., 5.0 for a 5% stop).

-

TP Point: Individual TP. The profit target (in $) for each single trade. If hit, only that specific trade closes.

-

Cluster Profit: Basket Target. If the total net profit of all open trades hits this $ amount ALL trades close instantly to secure profits.

-

Max Orders/Positions: Cap on total active and pending trades.

-

Crash Price %: Safety threshold to prevent trading during extreme market drops.

-

Ladder / Grip Step: Spacing Filter. The minimum distance required between trades. Prevents placing orders too close to each other.

Operating Notes

-

Most Grid-based strategies may temporarily hold multiple open positions during extended price movement. However, Axis Trend Grid will avoid placing orders during market downtrend to prevent catching the "falling knife".

-

It is recommended to test the EA on a demo account before live trading.

-

Users should apply appropriate risk and money management settings.

Supports and Updates

-

Support is provided through the MQL5.com messaging system.

-

Updates may include new configuration options and internal logic improvements.

Disclaimer

-

This Expert Advisor does not guarantee trading results.

-

Trading involves financial risk, and each user is responsible for their own decisions.

-

The EA does not use external connections and fully complies with MQL5 Market requirements.

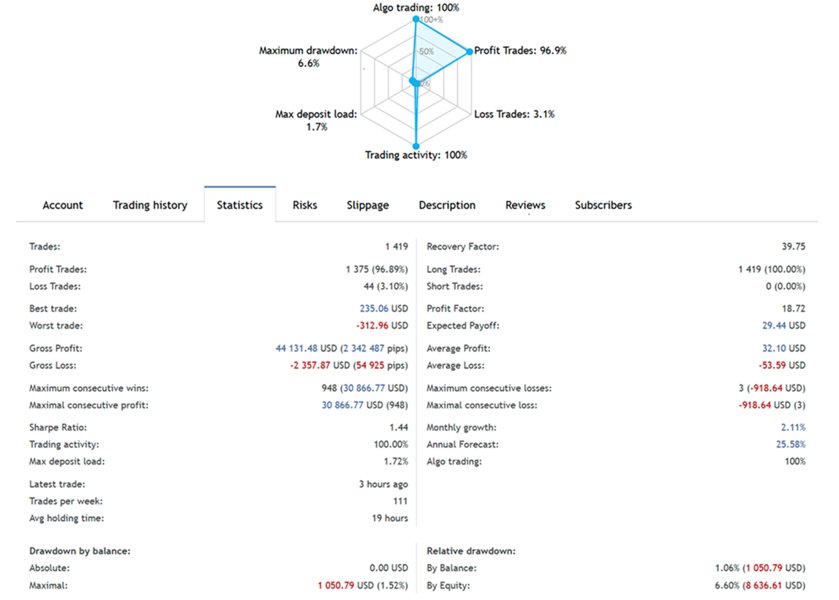

The backtest results are very encouraging, showing stable behavior during trending market conditions. Since the strategy is trend-based, I am optimistic about its performance in live market conditions as well. I will continue monitoring the EA and plan to update this review with live results so other users can get a clearer and more practical understanding of its performance over time.