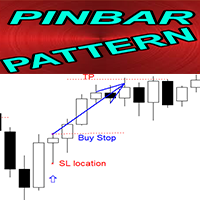

True PinBars

- Indicatori

- Timothy Lee Armstrong

- Versione: 1.15

- Attivazioni: 10

True PinBars — precise and robust

Spot the real pin bars—the ones that actually precede rotation. No chasing every cute wick. This uses strict geometry + market-aware sizing making it the most dynamic on the market.

Features

-

Range Size Filter (optional) :

More robust to outliers and regime shifts.

→ If median = 100 pts and you set PercentOfMedian = 125, today’s bar must be ≥ 125 pts. Clean. Scalable. -

Dual-EMA Trend Filter (optional):

Require price to be on the correct side of EMA 50 and EMA 100 (customizable). Keeps you trading with the tape, not against it. -

Swing Filter (optional):

Demand location. Bull pins form at the lowest low of the last 'number of bars'; bear pins at the highest high. Cuts the mid-range noise. -

Sharper geometry:

-

TailToBodyRatio controls how dominant the tail must be.

-

OppWickMaxOfRange caps the opposite wick as a fraction of the entire candle range (not just the main wick).

Translation: obvious rejection > decorative shadows.

-

-

Non-repainting by design:

Bar-close lock. Signals print only on closed bars. What you see is what the logic validated.

Why it filters better

Layered rules focus on decisive rejection + meaningful size + right context. That means fewer tiny, cosmetic “pins” and more candles that actually matter.

Sensible defaults (fully editable)

-

TailToBodyRatio: 2.0×

-

OppWickMaxOfRange: 15%

-

Trend Filter: off by default; EMAs = 50 & 100

-

Swing Filter: on, SwingLookback = 5

-

Range Size Filter (Median): on, MedianLookback = 25, PercentOfMedian = 125%

Dial PercentOfMedian or TailToBodyRatio down for more signals; up for sniper-level strictness.

EA-friendly

Clear, stable buffers. Closed-bar logic. Built to slot into automation without “ghost” triggers.

Disclaimer: Not investment advice. Validate with your playbook, risk rules, and forward tests before going live.