One key liquidation

- Utilità

- Yue Wen Wang

- Versione: 2.1

- Attivazioni: 5

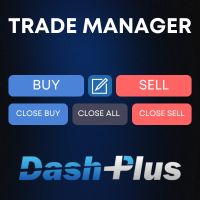

One - click position closing program featuring manual long/short trading and take - profit/stop - loss point settings.

In the rapidly changing environment of financial trading markets, efficient and precise trading operation tools are of utmost importance. This one-click position closing program is specifically designed to meet the diverse needs of traders.

The program's most prominent feature is its convenient "one-click position closing" function. Whether in forex, futures, or stock trading, when market conditions suddenly change, risks intensify, or profit targets are met, traders can quickly close all positions with just one click. This significantly reduces trading time, avoids missing the best timing due to cumbersome operations, and effectively minimizes potential losses or locks in profits in a timely manner. In highly volatile markets, this rapid response capability helps traders gain the upper hand and seize the initiative.

Meanwhile, the program supports manual long and short positions, giving traders full autonomy. Whether you are bullish on the market and choose to go long or predict a decline and prepare to go short, you can achieve this through simple operations, flexibly adapting to various complex and changing market trends. Novice traders can gradually accumulate experience through manual operations, while experienced traders can quickly implement their trading strategies with this function to capture fleeting trading opportunities.

Additionally, the take-profit and stop-loss point setting function serves as a safeguard for trading. Traders can freely set take-profit and stop-loss values according to their own risk tolerance and profit expectations. Once the market price reaches the preset levels, the program will automatically execute trading orders, ensuring timely profit-taking when the market is favorable and prompt stop-loss when the market is unfavorable. This helps traders scientifically manage risks, optimize trading strategies, and enhance the stability and success rate of trading. Whether you are a conservative investor pursuing consistent small gains or an aggressive investor seeking high-risk, high-return trades, reasonable setting of take-profit and stop-loss points can make trading more composed and orderly.