Asymmetry999

- Experts

- Kai Wei Luo

- Versione: 1.2

- Aggiornato: 14 dicembre 2025

- Attivazioni: 5

Principle of Asymmetry999 Intelligent Trading System: Three-currency hedging unbalanced arbitrage is an expansion and continuation based on triangular arbitrage. Triangular arbitrage, as a common arbitrage method, has been used by many investors in foreign exchange trading. Triangular arbitrage is realized based on cross exchange rates, which is the foundation of triangular arbitrage. The so-called cross exchange rate refers to the price of one non-US dollar currency expressed in another non-US dollar currency. For example, in a foreign exchange market, USD/JPY = 142.840, EUR/USD = 1.00435, and EUR/JPY = 143.375. When (USD/JPY) × (EUR/USD) is not equal to (EUR/JPY), it provides the possibility for triangular arbitrage. However, strict triangular arbitrage cannot be profitable due to factors such as spreads, slippage, overnight interest, and handling fees. If an imbalance coefficient is added to the above three currency pairs to break this symmetry, there will be a possibility of profit.

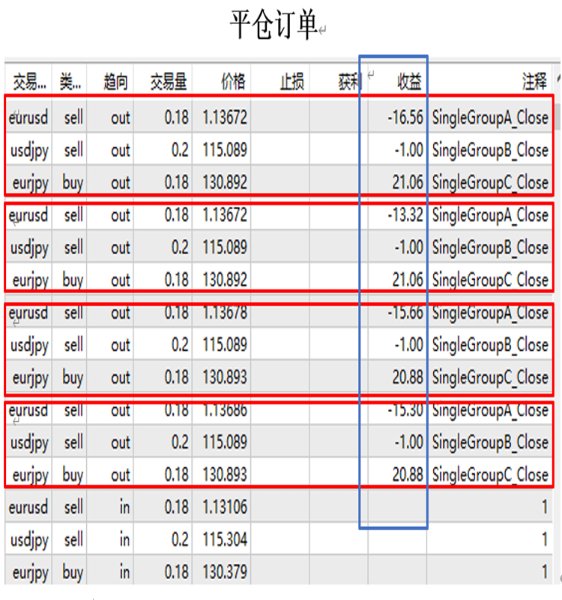

For example: Place orders simultaneously (A lots sell EURUSD) + (B lots sell USDJPY) + (C lots buy EURJPY), where coefficients A, B, and C are obtained through calculation.

If Ask_EURUSD * Ask_USDJPY - Bid_EURJPY < -300, trade the three orders Ask_EURUSD, Ask_USDJPY, and Bid_EURJPY simultaneously;

If Bid_EURUSD * Bid_USDJPY - Ask_EURJPY > +300, trade the three orders Bid_EURUSD, Bid_USDJPY, and Ask_EURJPY simultaneously;

Close the positions when the above three orders are profitable overall, so as to make a profit.

1. Risk control and tips:

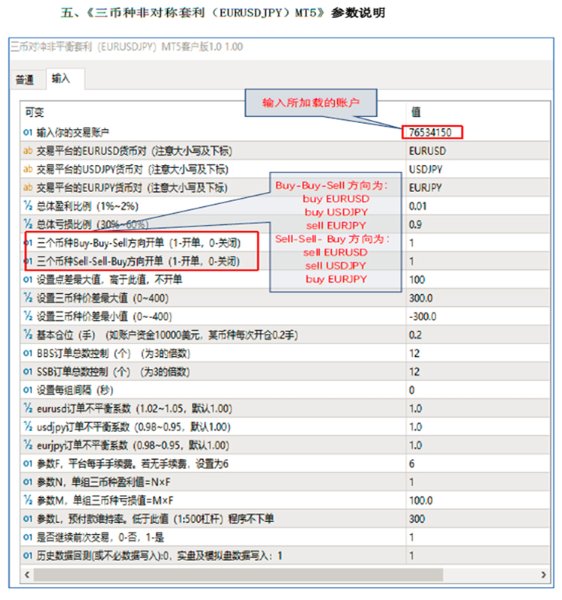

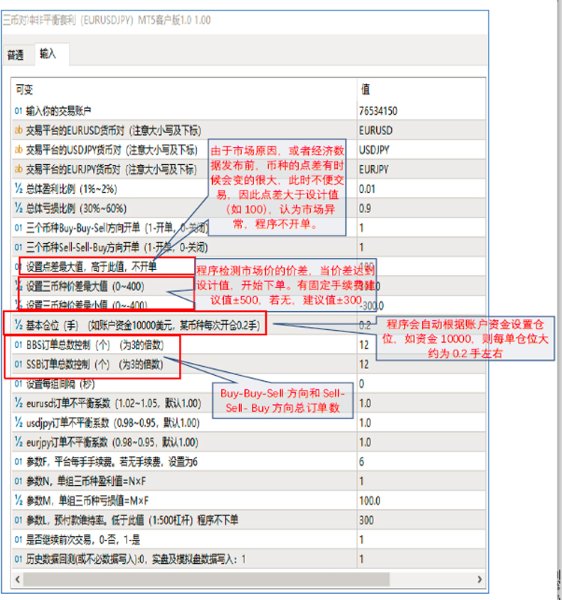

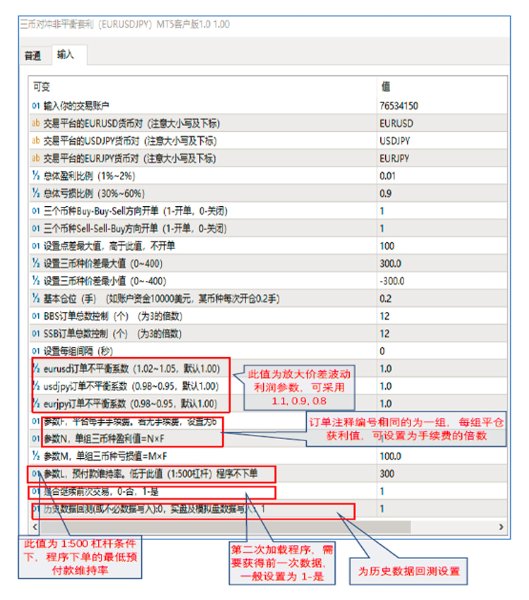

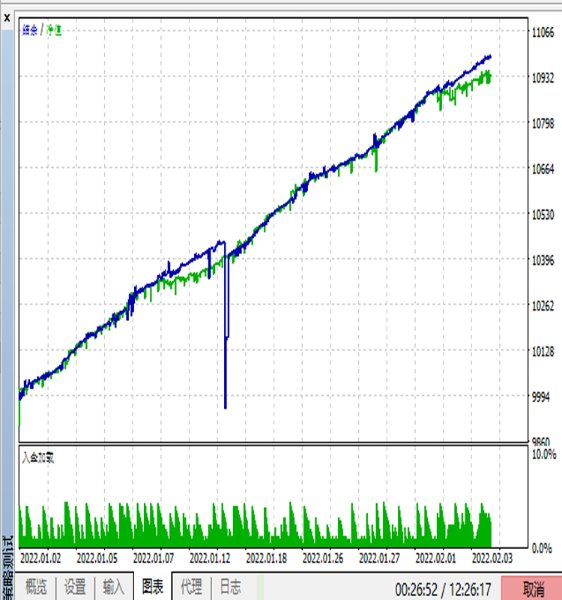

A. The suggested overall profit ratio is 0.01, and the overall loss ratio is 0.6 or a value acceptable to the customer;

B. With a principal of 10,000 USD, it is recommended to set the "basic position" to 0.2 lots, the "BBS order total control" to 12, and the "SSB order total control" to 12.

C. Any trading system has risks, and investment should be prudent.

2. If the following problems occur, it is recommended:

A. If there are no trading orders for a long time, it is recommended to modify the "set the maximum spread of the three currencies" and "set the minimum spread of the three currencies";

B. If the three-currency combination cannot be closed for a long time, it is recommended to modify the "EURUSD order imbalance coefficient", "USDJPY order imbalance coefficient", "EURJPY order imbalance coefficient", and at the same time modify "Parameter F" and "Parameter N" to make them at a reasonable level;

C. After modifying the parameters, it is necessary to reload the EA;

Note:

Please set BBS_open = true and SSB_open = true. If there is no data or no transaction, please check the letter subscripts of the currency pairs in the EA settings;