You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Will the EURUSD continue to fall?

Technical Analysis (October 6, 2014). The EURUSD tumbled to support after better than expected Non-Farm Payroll. Will the trend continue in trading this week?

EUR/USD Technical Analysis: Floor Set at 1.25 Threshold?

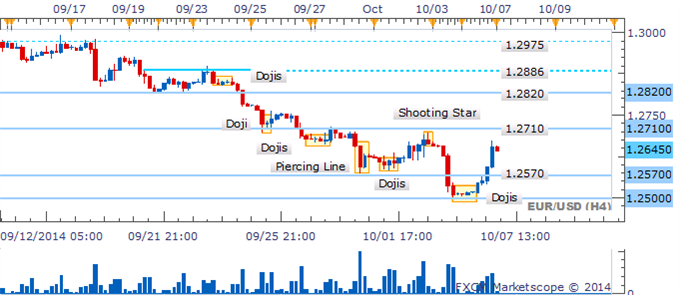

The Euro may be readying a rebound against the US Dollar after prices put in a bullish Piercing Line candlestick pattern. A daily close above support-turned-resistance at 1.2703, the November 2012 bottom, exposes the March 2013 floor at 1.2777. Alternatively, a drop below the 23.6% Fib expansion at 1.2500 clears the way for a challenge of the 38.2% level at 1.2377.

EUR/USD Scope For Recovery May Be Limited In Spite Of A Piercing Line (based on dailyfx article)

EUR/USD’s recent rebound has yielded a Piercing Line formation, yet some skepticism over a recovery is warranted. The pattern requires a successive up-day in order to be validated and to suggest a base may have formed. This may prove a difficult feat given the sustained presence of a downtrend and the sellers still sitting nearby at the 1.2700 handle. Further, the Euro’s path lower over recent months has been littered with reversal signals that have failed to catalyze a recovery.

EUR/USD’s intraday recovery was preceded by a parade of Doji formations. The candlesticks suggested hesitation by the bears to lead the pair lower at the critical 1.2500 barrier. While an absence of reversal signals leaves some doubt over a correction, the context on the daily warns that scope for further gains may be limited.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2014

newdigital, 2014.10.08 06:57

EURUSD and USDJPY - One Risks Correction, The Other Reversal

Normally, the media and market participants are hyping the risk of reversal or volatility. It seems they under-appreciate it today. Both the US Dollar and equity indexes are standing on the edge of important technical levels - a break from the greenbacks three-month trend and the floor of a S&P 500 channel that stretches back to the beginning of 2013. Symbolic breaks for either of these two can tip large fundamental imbalances to trigger deeper trends. What is the potential this pressure represents? Which faces the larger unwind? Why does the USDJPY appeal through more scenarios while the medium-term EURUSD outlook is bearish even if the greenback slips? We discuss these topics in today's Trading Video.

EUR/USD Technical Analysis: Profits Booked on Short Position (based on dailyfx article)

The Euro recovered against US Dollar as expected after putting in a bullish Piercing Line candlestick pattern. A daily close above support-turned-resistance at 1.2777, the March 2013 bottom, exposes the 38.2% Fibonacci retracement at 1.2848. Alternatively, a turn below the 1.2703-15 area marked by the November 2012 floor and the 23.6% Fib clears the way for a challenge of trend line resistance-turned-support at 1.2673.

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - French Trade Balance] = Difference in value between imported and exported goods during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

Trading the News: Canada Net Change in Employment (based on dailyfx article)

The USD/CAD may face a larger pullback going into the end of the week should Canada’s Employment report show a meaningful rebound in job growth and fuel interest rate expectations.

What’s Expected:

Why Is This Event Important:

An upbeat employment print may put increased pressure on the Bank of Canada (BoC) to further normalize monetary policy, but we would need to see a material shift in the forward-guidance to adopt a bullish outlook for the Canadian dollar as Governor Stephen Poloz continues to endorse a period of interest rate stability.

Easing input costs along with the pickup in private sector activity may generate a strong pickup in job growth, and a positive print may threaten the opening monthly range in the USD/CAD as it boosts interest rate expectations.

However, weakening demand at home and abroad may drag on employment, and a dismal development may heighten the bullish sentiment surrounding the USD/CAD as it gives the BoC greater scope to retain its current policy for an extended period of time.

How To Trade This Event Risk

Bullish CAD Trade: Canada Adds 20.0K or More Jobs

- Need red, five-minute candle following the report for a potential short USD/CAD trade

- If market reaction favors a long loonie trade, sell USD/CAD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

Bearish CAD Trade: Employment Report Disappoints- Will favor topside targets as inverse head-and-shoulders remains in play & RSI retains bullish momentum

- Interim Resistance: 1.1300 pivot to 1.1320 (61.8% expansion)

- Interim Support: 1.1050 (61.8% expansion) to 1.1065 (23.6% expansion)

Impact that Canada Employment Change has had on CAD during the last release(1 Hour post event )

(End of Day post event)

The Canada employment report disappointed, with the region shedding 11.0K jobs in August after adding 41.7K the month prior. Despite a downtick in the participation rate to 66.0% from 66.1%, the unemployment rate held steady at an annualized 7.0% for the second consecutive month. As a result, it seems as though the Bank of Canada will retain its neutral tone for monetary policy and keep the benchmark interest rate at 1.00% throughout the remainder of the year in an effort to encourage a more robust recovery. The reaction to the dismal reading was short-lived as the USD/CAD chopped around the 1.0880 level during the North America trade, with the pair closing at 1.0879.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.10.10

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 59 pips range price movement by CAD - Employment Change news event

UK inflation data, Mario Draghi and Janet Yellen’s speeches, US Retail sales, Unemployment and manufacturing data are the major events on our calendar for this week. Here is an outlook on the main market movers coming our way.

Last week, despite continuous positive US data, the FOMC minutes defied expectations for a possible rate hike in the near future, sending the dollar down. The minutes revealed a debate on the necessary normalization period, which the hawks considered too long. Fed minutes also showed that some policymakers feared a stronger dollar will generate downward pressure on inflation and that global economic growth is on a downward trend. Will the dollar continue to decline?

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: Neutral

The Japanese Yen surged versus all major counterparts as the US S&P 500 saw its worst weekly decline in over two years. There’s little economic event risk out of Japan in the week ahead, but we think big things stand on the horizon for JPY pairs.

Traders pushed the Japanese Yen to fresh multi-year lows versus the US Dollar as broader financial markets soared, but a clear flight to safety warns that the JPY may soon regain favor. Typically we would favor the traditional safe-haven in the US Dollar through times of market turmoil.

Yet the clear fact is that speculators remain extremely short the Yen and long the dollar (long USDJPY). This in turn suggests that the Greenback could actually do poorly if we see further stock market tumbles and a broader deleveraging across leveraged assets.

A virtually empty Japanese economic calendar in the week ahead suggests that few expect major JPY moves. Our Senior Technical Strategist nonetheless warns that the USDJPY may be nearing a significant breakdown. And indeed we say this: don’t fall asleep on the Yen. It could very well be that this is a minor S&P 500 correction within a much larger bull trend. Yet we can’t rule out a larger pullback, and we believe the JPY could surge if this is indeed the start of a larger market correction.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: NeutralBritish Pound May Turn Lower as BOE Policy Standstill Continues

The GBP/USD may continue to carve lower-highs & lows in the week ahead should the fundamental developments coming out of the U.K. economy further dampen interest rate expectations.

The U.K. Consumer Price Index (CPI) may mark the lowest print since 2009 as the headline reading is expected to slow to an annualized 1.4%, and the diminishing threat for inflation may heighten the bearish sentiment surrounding the British Pound as the Bank of England (BoE) remains in no rush to normalize monetary policy. It seems as though we will continue to see a 7-2 split within the Monetary Policy Committee (MPC) amid the limited headlines surrounding the October 9 interest rate decision, and we may see Martin Weale and Ian McCafferty continue to serve as the minority throughout 2014 as wage pressures remain largely subdued.

However, the September Jobless Claims report may generate a greater rift within the BoE as Average Weekly Earnings are projected to uptick for the first time since March, and a strong rebound in wage growth may renew bets for higher borrowing costs as the central bank continues to take note of the stronger-than-expected recovery in the labor market. With that said, the inflation outlook is likely to heavily impact the British Pound next week as BoE Governor Mark Carney retains a rather balanced tone for monetary policy, and the central bank may have little choice but to pay closer attention to the recent wave of U.S. dollar strength as the depreciation in the exchange rate raise the risk for imported inflation.

As a result, the GBP/USD remains vulnerable to a further decline, especially as the Relative Strength Index (RSI) retains the bearish momentum carried over from back in July, with the next key downside objective coming in around the 1.5900, the 50.0% Fibonacci expansion from the 2009 lows.