You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast = good for currency (for EUR in our case)

[EUR - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

Eurozone Trade Surplus Rises Unexpectedly In JuneEurozone's trade surplus increased unexpectedly in June, data showed Monday.

The trade surplus rose to EUR 16.8 billion in June from EUR 15.4 billion in May, Eurostat reported. Economists had expected the trade surplus to decrease to EUR 15.1 billion.

Exports increased 3 percent year-over-year and imports grew 2 percent in June.

On a seasonally adjusted basis, the trade surplus fell to EUR 13.8 billion in June from EUR 15.2 billion in May.

John O'Donnell and special guest Jim Puplava discuss the beauty and simplicity of Online Trading Academy's patented supply and demand strategy. Jim also gives his views on the bond markets and shares a story about a silver trade he made with the help of Online Trading Academy.

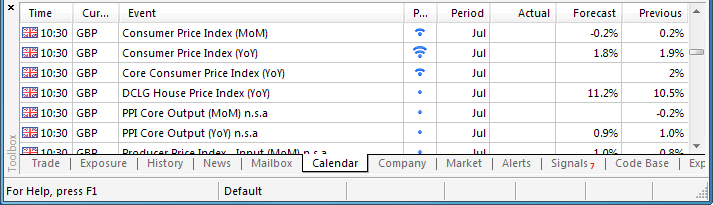

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

A slowdown in the U.K.’s Consumer Price Index (CPI) may help to close the weekly opening gap in the GBP/USD should the inflation report drag on interest rate expectations.

What’s Expected:

Why Is This Event Important:

The Bank of England (BoE) may continue to soften its hawkish tone for monetary policy as the central bank cuts its outlook for U.K. wage growth, and a weaker-than-expected CPI print is likely to trigger a bearish reaction in the GBP/USD as market participants scale back bets of seeing a rate hike in 2014.

U.K. firms may conduct heavy discounting amid weak wage growth paired with the slowdown in private sector consumption, and a dismal CPI reading may instill a more bearish outlook for the GBP/USD as it reduces the BoE’s scope to normalize monetary policy sooner rather than later.

The pickup in private sector lending along with expectations for a faster recovery may generate another stronger-than-expected inflation print, and the pound-dollar may continue to push off of the 200-Day SMA (1.6662) should the data print boost rate expectations.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Slips to 1.8% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Headline Reading for Inflation Tops Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily

- Break of Bearish RSI Momentum Raises Risk for Bottoming Process

- Interim Resistance: 1.6960 (50.0% retracement) to 1.6970 (23.6% retracement)

- Interim Support: 1.6630 (50.0% expansion) to 1.6660 (200-Day SMA)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

June 2014 U.K. Consumer Price Index

GBPUSD M5 : 64 pips price movement by GBP - CPI news event

The U.K.’s Consumer Price Index (CPI) expanded sharply at an annualized rate of 1.9% in June, beating the average estimate of 1.6%. The core CPI also exceeded market forecast to reach 2.0% from 1.6% the month prior. The print was mostly pushed up by clothing & footwear and food & beverage. The larger-than-expected figure boosted the pound, with the GBP/USD climbing to a high of 1.7190 during the North American trade. However, the GBP/USD consolidated going the close, with the pair ending the day at 1.7146.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.08.19

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 46 pips price movement by GBP - CPI news event

if actual > forecast = good for currency (for EUR in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

U.S. Consumer Prices Inch Up Just 0.1% In JulyConsumer prices saw only a modest increase in the month of July, according to a report released by the Labor Department on Tuesday, with higher prices for shelter and food offset by decreases in prices for energy and airline fares.

The Labor Department said its consumer price index ticked up by 0.1 percent in July after rising by 0.3 percent in June. The modest increase by the index matched economist estimates.

The uptick in consumer prices was partly due to higher food prices, which climbed by 0.4 percent in July after inching up by 0.1 percent in June.

The other food at home index increased by 0.7 percent, its largest increase since August of 2011, while the index for non-alcoholic beverages rose by 0.5 percent.

Meanwhile, the report showed that the energy index pulled back by 0.3 percent in July after surging up by 1.6 percent in the previous month.

Strategy Video: EURUSD Breaks Support to Extend Fundamental, Technical Trend

EURUSD has cleared support and further progressed a four-month reversal into a fully developed bear trend. However, does this most recent push promise momentum? The medium and long-term fundamental and technical picture paint a very appealing view. The turn off resistance from a decade-long wedge pattern has aligned itself to a larger change in underlying fundamentals: through growth, rate speculation and perhaps eventually risk trends and capital flows. The opportunity is significant, but the market's momentum behind the theme is still lacking. What should we look for in an active trade? How quickly should we expect a setup to play out under these circumstances? We focus on the EURUSD in today's Strategy Video.

[GBP - Bank of England Minutes] = The BOE's MPC meeting minutes contain the interest rate vote for each MPC member during the most recent meeting. The breakdown of votes provides insight into which members are changing their stance on interest rates and how close the committee is to enacting a rate change in the future.

==========

BoE Split On Rates For First Time In More Than 3 Years

Bank of England policymakers split on rate decision this month, for the first time in more than three years as two members said the current economic situation warrant an immediate rate hike from a historic-low.

At the August Monetary Policy Committee meeting, Ian McCafferty and Martin Weale sought a quarter-point hike in the bank rate to 0.75 percent, while all other seven members voted to keep the rate unchanged at 0.50 percent.

Members were unanimous on holding the rate at 0.50 percent since July 2011.

Regarding the stock of purchased assets, the nine-member board unanimously voted to leave the the programme unchanged at GBP 375 billion.

External members McCafferty and Weale said economic circumstances were sufficient to justify an immediate rise in the Bank Rate. Their arguments sparked market expectations for an action this year itself.

EURUSD touched multi-month low (based on dailyfx article)

- EUR/USD has come under further pressure to touch its lowest level since late September

- Our near-term trend bias is lower in the euro while below 1.3430

- The

6th square root relationship of the year’s high at 1.3280 is a key

pivot with a daily close below needed to confirm that a new leg lower is

underway

- A cycle turn window is eyed on Thursday

- A move over 1.3430 would turn us positive on the euro

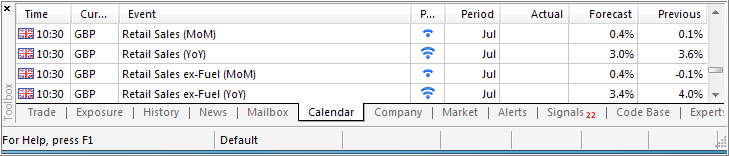

EUR/USD Strategy: Holding only reduced short positions while below 1.3430.Trading the News: U.K. Retail Sales (based on dailyfx article)

A pickup in U.K. Retail Sales may spur a more meaningful rebound in the GBP/USD as it raises the prospects for a stronger recovery in the second-half of 2014.

What’s Expected:

Why Is This Event Important:

The growing dissent within the Bank of England (BoE) should continue to prop up interest rate expectations as a the central bank sees less spare capacity in the U.K. economy, and we may see a greater rift at the next meeting on September 4 should the fundamental developments coming out of the region raise the outlook for growth and inflation.

Easing price pressures along with the ongoing improvement in the labor market may generate a better-than-expected sales report, and a marked pickup in household spending may spur a meaningful rebound in the GBP/USD as it puts increased pressure on the BoE to normalize monetary policy sooner rather than later.

However, subdued wage growth paired with the ongoing slack in the real economy may drag on private consumption, and a dismal print is likely to spur a further decline in the British Pound as market participants scale back bets for an early rate hike.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Retail Sales Climbs 0.4% or Greater

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors long sterling trade, buy GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Household Spending Disappoints- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

- Watching RSI as it struggles to hold above 26 along with the April low (1.6549)

- Interim Resistance: 1.6850-60 (78.6% expansion)

- Interim Support: 1.6560 (38.2% expansion) to 1.6570 (61.8% expansion)

Impact that the U.K. Retail Sales report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

The U.K retail sales report showed a slight increase of 0.1% after contracting 0.5% in May. An decline in demand for textile, clothing and footwear contributed to the weaker-than-expected data. The lackluster print dragged on the pound, with GBP/USD sliding below the 1.7000 handle. The bearish reaction continued throughout the North American trade, with the pair ending the day at 1.6988.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.08.21

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 23 pips price movement by GBP - Retail Sales news event

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

German Private Sector Growth Slows In August

Germany's private sector growth slowed in August as contraction in manufacturing deepened further, flash data from Markit Economics showed Thursday.

The composite output index dropped to 54.9 in August from 55.7 in July. The current sequence of continuous activity growth now stretches to 16 months.

The service sector remained the driving force behind the overall expansion in August. Although the services Purchasing Managers' Index fell to 56.4 from 56.7 in July, it remained above the expected score of 55.5.

Meanwhile, the manufacturing PMI dropped to 52 in August from 52.4 a month ago. The index was expected to fall more sharply to 51.5.

"The PMI data available for the third quarter so far point to a swift recovery in GDP from the ground lost during the second quarter," Oliver Kolodseike, an economist at Markit, said.