Market Condition Evaluation based on standard indicators in Metatrader 5 - page 86

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.30 13:55

Gold forecast for the week of March 31, 2014, Technical AnalysisGold markets fell during the week, but have found a bit of support towards the end of the session on Friday. With that being the case, although this market looks bearish, it would not surprise us if the shorter-term charts lead the way here. After all, the $1280 level should be relatively supportive based upon daily charts, so we are bit hesitant to sell here. If we do break down below the $1280 level however, we can fully see how the market could find its way down to the $1200 level given enough time.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.01 07:34

GOLD TECHNICAL ANALYSIS – Prices reversed downward as expected after putting in a Bearish Engulfing candlestick pattern. A break below the 23.6% Fibonacci expansion at 1319.01 has exposed the 38.2% level at 1273.88, with a further move below that eyeing the 50% Fib at 1237.40. Alternatively, a reversal back above 1319.01 aims for trend line support-turned-resistance now at 1352.35.Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.29 18:43

Crude Oil forecast for the week of March 31, 2014, Technical AnalysisThe light sweet crude market rose during the week, breaking well above the $100 level again. The fact that the previous week had formed a hammer was a clue that we could be going higher, but the actual confirmation came once we cleared the top of that candle. It looks as if the market is still somewhat bullish, and as a result we will more than likely head towards the $104.50 level given enough time. We think that this market will be one that can be bought on dips, simply because there’s so much in the way of support below.

With that being said, we believe that the $105 level will continue to be massive resistance, and as a result we feel that the area will more than likely cause a bit of selling. A break above that area of course would be significant in the sense that it would free the market to go much higher, but at the end of the day we still believe that there’s a bit to go before even get to that issue. We are bullish.

Brent

The Brent markets rose during the week as well, but don’t look quite as bullish of the light sweet crude market. Nonetheless, it appears that we are heading towards the $112 level given enough time, although we would expect some choppiness right around the $108.50 level, an area that did in fact cause a bit of resistance this past week.

Any pullback at this point time should end up being a relatively positive thing, as buyers should step into the marketplace. The $105 level offered enough support to push the market higher last time, and we believe that will continue to be the case. So having said all of this, even if we pullback at this point time, we would fully anticipate this market been somewhat supported. With that in mind, we are not interested in selling, and believe that ultimately we will hit the aforementioned $112 level, but it may take quite a bit of chopping around.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.01 07:35

CRUDE OIL TECHNICAL ANALYSIS – Prices are pushing higher as expected after putting in a bullish Morning Star candlestick pattern. A break above resistance at 100.83, the 23.6% Fibonacci expansion, has exposed the 38.2% level at 102.87. Pushing further above that aims for the 50% Fib at 104.52. Alternatively, a move back below 100.83 exposes the 14.6% expansion at 99.57.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.01 11:19

2014-04-01 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Manufacturing Growth Eases To 8-Month Low

The U.K. manufacturing sector growth slowed unexpectedly to an eight-month low in March, survey data from Markit Economics showed Tuesday.

The seasonally adjusted Markit/Chartered Institute of Purchasing & Supply Purchasing Manager's Index fell to 55.3 in March from 56.2 in February, signaling a further cooling of growth from the peaks scaled towards the end of last year.

The score was forecast to rise to 56.7 in March. Nonetheless, the above neutral 50 reading indicates expansion in the sector.

Manufacturers continued to scale up production at a solid clip in March. However, rates of increase for output and new business cooled further from the highs registered during the second half of last year.

Manufacturing employment increased for the eleventh consecutive month in March with the rate of jobs growth staying close to February's near three-year high.

March data signaled a moderation in price pressures. Average input costs fell for the first time in over one-and-a-half years and output charge inflation eased to a seven-month low.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.04.01

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 31 pips price movement by GBPUSD - Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.02 06:48

Technical Analysis for USDCHF (adapted from dailyfx article)

The US Dollar roseas expected against the Swiss Franc but the likely way forward is obscured by conflicting technical cues. In one scenario, a pullback from resistance at 0.8834, the 23.6% Fibonacci retracement, looks like a correction offering a long entry setup in the context of a falling channel breakout. In another, a bearish Evening Star candlestick pattern suggests a reversal lower is in progress.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.08 08:33

2014-04-08 02:50 GMT (or 04:50 MQ MT5 time) | [JPY - Interest Rate]

==========

BoJ Maintains Monetary Stimulus, Upbeat Economic View

The Bank of Japan kept its current monetary stimulus unchanged on Tuesday as it projects upbeat economic outlook even though the first sales tax hike since 1997 is set to oscillate consumer spending.

The Policy Board, governed by Haruhiko Kuroda, unanimously decided to continue to expand the monetary base at an annual pace of about JPY 60-JPY 70 trillion.

The annual pace of purchase of government bonds will remain at about JPY 50 trillion. The central bank launched its large stimulus April last year, when it vowed to end deflation and shore up consumer price inflation to 2 percent in two years time horizon.

The BoJ left its economic assessment unchanged from last month. Japan's economy has continued to recover moderately as a trend, albeit with some fluctuations due to the consumption tax hike, the bank said in a statement.

Further, the bank said business sentiment has continued to improve, although some cautiousness about the outlook has been observed.

"Japan's economy is expected to continue a moderate recovery as a trend, while it will be affected by the subsequent decline in demand following the front-loaded increase prior to the consumption tax hike," the bank added.

The central bank expects consumer prices, excluding the direct impact of the sales tax hike, to increase around 1.25 percent for some time.

The majority of policymakers observed that risks to the outlook include developments in the emerging and commodity-exporting economies, the prospects for the European debt problem, and the pace of recovery in the U.S. economy.

Sayuri Shirai said the pace of improvement in the employment and income situation in Japan should be added to the list of risks.

USDJPY M5 : 23 pips range price movement by JPY - Interest Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.08 11:11

2014-04-08 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing Production]

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Industrial Production Growth Tops Expectations

U.K. industrial production grew more-than-expected in February, driven by strong contribution from oil and gas extraction.

Industrial production grew 0.9 percent in February from month ago, when it remained flat, the Office for National Statistics said Tuesday. The February rate far exceeded the 0.3 percent expected growth.

Manufacturing output climbed 1 percent, which was faster than the 0.3 percent rise seen in January. Economists had forecast output to grow by 0.3 percent again in February.

The annual increase in industrial production slowed marginally to 2.7 percent in February from 2.8 percent in January. But the rate exceeded the 2.2 percent growth forecast by economists.

Meanwhile, manufacturing output grew at a faster pace of 3.8 percent annually after rising 3.2 percent a month ago. The annual growth in output was expected to slow marginally to 3.1 percent.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.04.08

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 59 pips price movement by GBP - Manufacturing Production news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.10 09:47

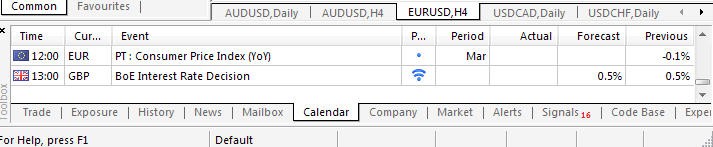

Trading the News: Bank of England (BoE) Interest Rate Decision (based on dailyfx article)

The Bank of England (BoE) interest rate decision may generate fresh highs in the GBP/USD should we see a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather than later.

Why Is This Event Important:

Indeed, BoE Governor Mark Carney argued the first rate hike may come before the general election in May 2015 amid the stronger recovery in the U.K., and a further shift in the policy outlook should continue to heighten the bullish sentiment surrounding the British Pound as the central bank moves away from its easing cycle.

Sticky prices paired with the pickup in household & business activity may push the BoE to adopt a more hawkish tone for monetary policy, and the policy meeting may trigger a bullish reaction in the GBP/USD should the central bank lay out a more detailed exit strategy.

However, the BoE may merely reiterate the policy statement from the March 6 meeting as the central bank continues to assess the margin of slack in the real economy, and the British Pound may face a near-term correction should the MPC meeting drag on interest rate expectations.

How To Trade This Event Risk

Bullish GBP Trade: BoE Sounds More Hawkish/Lays Out Detailed Exit Strategy

- Need green, five-minute candle following the meeting to consider a long British Pound trade

- If market reaction favors a bullish sterling trade, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: MPC Talks Down Interest Rate Expectations- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily Chart

GBP/USD H4 Chart

Bank of England (BoE) Interest Rate Decision March 2014

GBPUSD M5 : 38 pips range price movement by GBP - Interest Rate news event :

The Bank of England interest rate decision came and went once again in its usual fashion. As has become the norm, a quick spike in GBP was followed by an equally fast pullback. As this meeting does not proceed the ECB, we may see greater follow through, especially in the EURGBP cross.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.04.10

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 18 pips price movement by GBP - Interest Rates news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.11 07:38

2014-04-10 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Food Price Index (FPI)]

if actual > forecast/actual = good for currency (for NZD in our case)

==========

New Zealand March Food Prices Dip 0.3%

Food prices in New Zealand eased 0.3 percent on month in March, Statistics New Zealand said on Friday.

That follows the 1.0 percent decline in February and the 1.2 percent gain in January.

On a yearly basis, food prices climbed 1.2 percent after adding 0.2 percent in February and 0.9 percent in January.

The 1.6 percent fall for grocery food was influenced by price falls across most of the subgroups.

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2014.04.11

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 20 pips price movement by NZD - Food Price Index (FPI) news event

Just about the pairs for technical analysis for the next week.

I think - most interesting pairs are GBPUSD and XAUUSD.

GBPUSD D1 - because Chinkou Span line is crossing historical price for correction continuing :

and XAUUSD D1 - because price is going along Sinkou Span A line trying to be reversed from bearish to bullish, and as we know - Sinkou Span A line (the border of Ichimoku cloud) is not strong resistance level.

It was 'most interesting pairs concerning 'technical point of view'

'Fundamental news events points of view' : most intreresting pairs are EURUSD, NZDUSD, AUDUSD and USDCAD (most news events for the next week will be affected on those pairs).

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.04.14 20:25

USD/JPY testing major downside pivot (based on dailyfx article)